Bank Of Communications' third quarterly report: one can see both the "bustle" and the "insights"

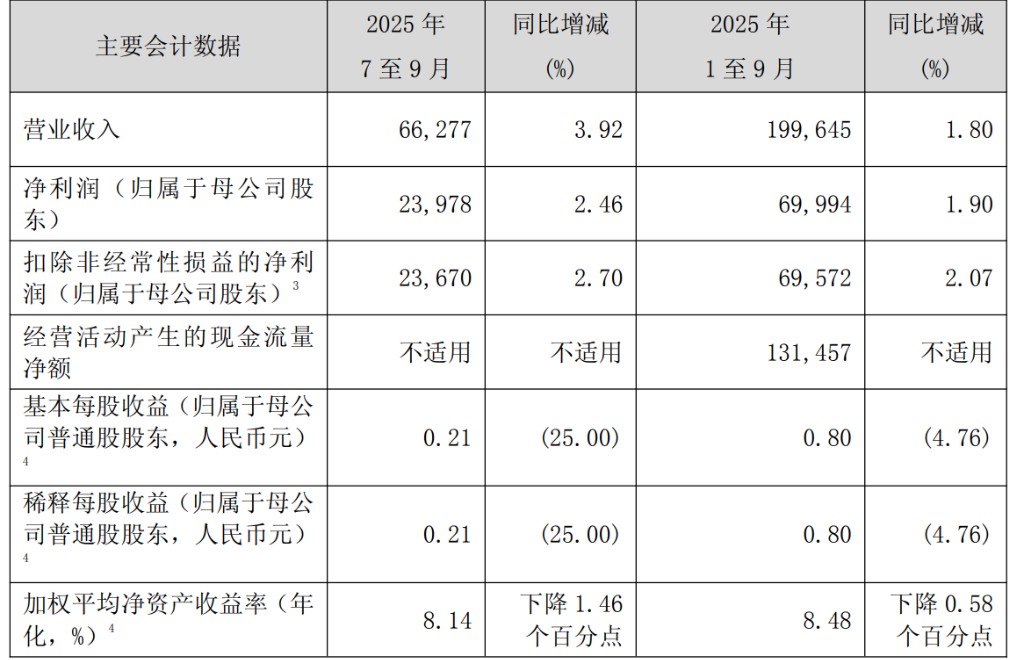

The Bank of Communications' Q3 2025 report shows an operating income of 199.645 billion yuan, a year-on-year increase of 1.80%; net profit of 69.994 billion yuan, a year-on-year increase of 1.90%. The bank's asset quality is stable, with a decrease in the non-performing loan ratio and a provision coverage ratio reaching 209.97%. Net interest income and net fee and commission income have both increased, reflecting good operational capability. Overall operations show a stable and improving development trend, embodying a long-term strategic approach

Among the state-owned major banks, Bank of Communications has always had distinct characteristics. It is both stable, focusing on asset quality and risk control, and innovative, keeping pace with technology and AI applications. Its business layout is orderly, exuding a sense of "long-termism."

On the evening of October 30, Bank of Communications disclosed its third-quarter report for 2025, which, upon careful review, is quite noteworthy.

In terms of overall operations, in the first three quarters of this year, the bank achieved operating income of CNY 199.645 billion, a year-on-year increase of 1.80%; the net profit attributable to shareholders of the parent company reached CNY 69.994 billion, a year-on-year increase of 1.90%. Overall, the operations show a lively and steadily improving development trend.

Upon closer inspection, Bank of Communications has consistently maintained control over asset quality, with stable asset quality at the end of the period. The non-performing loan ratio has decreased compared to the end of last year, while the rates of loans under scrutiny and overdue loans have also declined compared to the end of the previous quarter. The provision coverage ratio reached 209.97%, an increase of 8.03 percentage points from the end of last year.

Results and processes, liveliness and subtleties must be implemented for sustainable development.

Revenue and Profit Both Increase

The third-quarter report shows that from January to September 2025, Bank of Communications achieved operating income of CNY 199.645 billion, a year-on-year increase of 1.80%; net profit (attributable to shareholders of the parent company) was CNY 69.994 billion, a year-on-year increase of 1.90%. This continues to reflect sustained growth based on a large business scale.

Additionally, the bank's annualized average return on assets and annualized weighted average return on equity were 0.62% and 8.48%, respectively, maintaining overall stability. The profit growth rate exceeded the operating income growth rate, reflecting effective cost control during the reporting period.

Interest, Fees, and Commissions All Increase

How does a well-managed major bank demonstrate its capabilities?

The answer lies in the performance of each category of business.

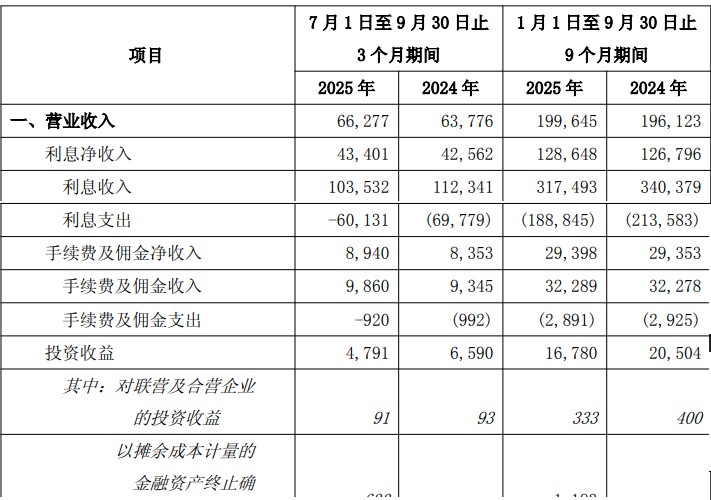

In Bank of Communications' third-quarter report, the net interest income for the first three quarters was CNY 128.648 billion, an increase of CNY 1.852 billion year-on-year, with a growth rate of 1.46%.

During the same period, net income from fees and commissions reached CNY 29.398 billion, also an increase of CNY 0.045 billion year-on-year.

The slight decline in investment income is related to fluctuations in the interbank market during the same period, but the overall investment gains of CNY 16.8 billion from January to September are still at a good level.

Provision Coverage Ratio Continues to "Increase"

In terms of asset quality, the highlights of the third-quarter report are even more pronounced.

At the end of the reporting period, Bank of Communications had a non-performing loan balance of CNY 114.5 billion, with a non-performing loan ratio of 1.26%, a decrease of 0.05 percentage points from the end of last year. Despite significant challenges in the external environment, asset quality continues to improve, bolstering market confidence At the same time, the provision coverage ratio is 209.97%, an increase of 8.03 percentage points from the end of last year; the provision ratio is 2.65%, an increase of 0.01 percentage points from the end of last year. This reflects the prudent and cautious side of Bank of Communications, as the preparations on hand are always quite sufficient, whether for loans or for non-performing assets.

Total Assets Continue to Increase

The third quarterly report also shows that at the end of the reporting period, Bank of Communications had total assets of CNY 15.50 trillion, an increase of 4.02% from the end of last year; total liabilities were CNY 14.21 trillion, an increase of 3.37% from the end of last year. This indicates that during the reporting period, the scale of Bank of Communications' core business of deposits and loans maintained steady growth.

At the end of the reporting period, the balance of customer loans increased by 6.04% compared to the end of last year. Among them, corporate loans increased by 7.46%, significantly faster than the 3.40% increase in personal loans, reflecting the bank's continued efforts in corporate business and support for enterprise development.

With scale enhancement, revenue increase, asset quality improvement, and profit growth, overall, it is still an encouraging third quarterly report.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at their own risk