AWS achieves the fastest growth in three years, capital expenditures surge by 55%, Amazon rises nearly 12% after hours | Earnings Report Insights

Amazon's third-quarter performance exceeded market expectations, benefiting from a 20% acceleration in AWS growth, marking the largest increase in three years, which drove the stock price up nearly 11.8% in after-hours trading. The company is fully committed to ramping up AI infrastructure construction, with capital expenditures increasing by 55% year-on-year to $35.1 billion, and strengthening its collaboration with Anthropic through the $11 billion "Rainier Project," as self-developed AI chips are in short supply

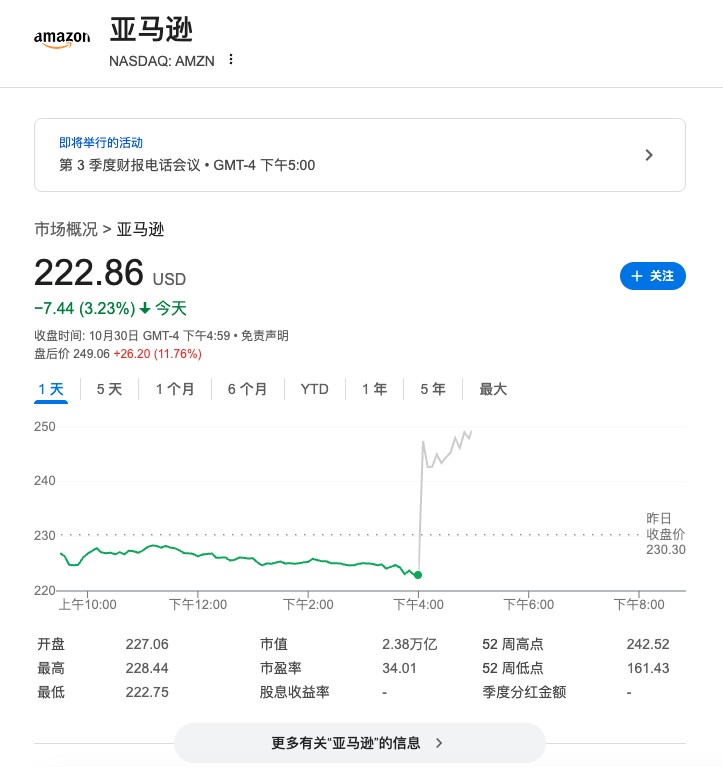

Amazon announced its financial results after the market closed on Wednesday, showing that the company's third-quarter performance exceeded analysts' expectations, with its cloud business achieving the largest growth in three years, driving the company's stock price up nearly 12% in after-hours trading.

Here are the key points from Amazon's third-quarter financial report:

Key Financial Data:

Net Sales: Net sales in the third quarter increased by 13% to $180.2 billion, surpassing $158.9 billion in the third quarter of 2024 and analysts' expectations of $177.82 billion. Excluding the positive impact of $1.5 billion from annual exchange rate fluctuations, the year-over-year growth is 12%.

Operating Income: Operating income for the third quarter was $17.4 billion, unchanged from $17.4 billion in the third quarter of 2024. The operating income for the third quarter of 2025 includes two special expenses—$2.5 billion related to the settlement with the Federal Trade Commission (FTC) and an estimated $1.8 billion severance cost primarily related to planned job cuts. Excluding these expenses, operating income would have reached $21.7 billion.

Net Income: Net income for the third quarter rose to $21.2 billion, with earnings per share of $1.95, exceeding analysts' expectations of $1.58. Net income for the third quarter of 2024 was $15.3 billion, with earnings per share of $1.43.

Cash Flow: For the 12 months ending September 30, 2025, cash flow from operating activities increased by 16% to $130.7 billion. Free cash flow for the 12 months ending September 30, 2025, decreased to $14.8 billion.

Segment Data:

North America Segment: The North America segment's sales increased by 11% year-over-year to $106.3 billion. Operating income was $4.8 billion, down from $5.7 billion in the third quarter of 2024. Excluding the $2.5 billion FTC settlement-related expense, North America operating income would be $7.3 billion.

International Segment: The international segment's sales increased by 14% year-over-year to $40.9 billion; excluding the impact of exchange rate fluctuations, the year-over-year growth is 10%. Operating income was $1.2 billion, down from $1.3 billion in the third quarter of 2024.

Cloud Services: The AWS (Amazon Web Services) segment's sales increased by 20% year-over-year to $33 billion, exceeding analysts' expectations of $32.42 billion and a growth of 18.1%. Operating income was $11.4 billion, up from $10.4 billion in the third quarter of 2024.

Fourth Quarter Performance Guidance:

Net Sales: Net sales are expected to be between $206 billion and $213 billion, representing a year-over-year growth of 10% to 13% compared to the fourth quarter of 2024. This guidance is expected to benefit from a positive impact of approximately 190 basis points from exchange rates.

Operating Income: Operating income is expected to be between $21 billion and $26 billion, compared to $21.2 billion in the fourth quarter of 2024 Driven by strong performance, Amazon's stock price surged 11.8% after hours.

Cloud Business Growth Hits Three-Year High

AWS is the world's largest cloud infrastructure provider but is facing increasing competition from Google and Microsoft, both of which released quarterly results this week. Google's cloud business saw a 34% revenue growth in the third quarter, while Microsoft Azure recorded a 40% increase.

According to the financial report, Amazon Web Services' revenue for this quarter reached $33 billion, a year-on-year increase of 20%, marking the largest year-on-year growth since the end of 2022. Analysts had previously estimated an average growth of 18%. Operating profit for cloud services grew 9% year-on-year to $11.4 billion, also exceeding expectations and accounting for about two-thirds of Amazon's total operating profit.

Before the earnings report was released on Thursday, investor expectations for the cloud business were relatively low, as the company had mentioned limitations on the launch of new data centers in recent quarters. CEO Andy Jassy and other executives expressed optimism about the business, although they did not explicitly predict a re-acceleration of growth.

So far this year, Amazon's stock performance has lagged behind its industry peers, with investors concerned that the gains from the company's artificial intelligence products are not sufficient to support growth. Year-to-date, Amazon's stock has only risen 2.4%, while Microsoft has increased by 24% and Google has surged by 49%. In contrast, both Microsoft and Alphabet's Google have seen cloud computing business growth rates exceeding AWS.

Jassy stated in a statement:

"AWS's growth rate is the fastest since 2022, re-accelerating year-on-year to 20.2%. We continue to see strong demand in artificial intelligence and core infrastructure, and we have been focused on accelerating capacity expansion—adding over 3.8 gigawatts of capacity in the past 12 months."

Increased Investment in AI, Capital Expenditures Soar 55%

Under Jassy's leadership, Amazon has been focused on improving the profitability of its retail business, including increasing automation levels and selling higher-margin advertising and other services to online merchants. However, as investors shift their focus to Amazon's prospects in the artificial intelligence competition, these initiatives have recently become less of a focal point.

Like other large competitors, Amazon has made significant investments in data centers and chips to build and run AI models capable of generating text and images and automating processes. The company stated that its capital expenditures surged 55% this quarter to $35.1 billion, exceeding analyst expectations.

Earlier this week, Amazon announced plans to cut 14,000 jobs from its workforce to reduce costs while increasing investments in AI. Jassy told investors in February that Amazon's capital expenditures would reach approximately $100 billion this year.

Partnering with Anthropic to Build Data Centers, In-house Chips Fully Subscribed

Despite Amazon's desire to build its cloud business into a marketplace encompassing a wide range of AI tools, the company is highly reliant on one key partner for its AI layout: Anthropic.

On Wednesday, Amazon officially launched its $11 billion artificial intelligence data center known as "Project Rainier." The facility, first announced last year, will be used to train and run models developed by Anthropic. Amazon has invested $8 billion in Anthropic and stated that the startup will use its 1 million self-developed Trainium2 chips by the end of 2025, which will bring in billions of dollars in business scale.

Media reports indicate that the new data center helps Amazon address external perceptions that it has missed out on a highly lucrative wave of AI deals related to cloud services. Anthropic deepened its cloud partnership with Google last week by signing a deal worth hundreds of billions of dollars, while Meta has also reached high-value cloud service agreements with both Google and Oracle in recent months