The service sector supports Apple's revenue reaching a record high for the same period last season, while revenue in China unexpectedly declined, and iPhone sales during the off-season were disappointing, but a double-digit increase is expected this season | Earnings Report Insights

Service revenue has continuously set new quarterly highs over the past three years, with a year-on-year growth accelerating to 15% in the third quarter; iPhone sales increased by over 6% in the third quarter, with growth slowing by more than half compared to the previous quarter. Sales in the Greater China region declined by 3.6%, while analysts expected an increase of over 9%. Tariff-related costs amounted to $1.1 billion, in line with the company's expectations, and were nearly 40% higher than the previous quarter. The CEO stated that the fourth quarter will be Apple's best performance season, with revenue expected to grow by 10%-12%, and the Greater China region is expected to return to growth, with strong and unexpected responses to the iPhone 17. Revenue guidance has reached a new four-year growth high. The CFO stated that iPhone sales in the fourth quarter are also expected to increase by 10%-12%. After hours, Apple initially fell before rising, at one point increasing by over 5%

Despite being in the off-season for smartphone sales and facing the impact of tariffs from the Trump administration, Apple's revenue in the last fiscal quarter still exceeded Wall Street expectations, achieving the best performance for the same period in history. The strong services business became a pillar of growth, offsetting the significant slowdown in iPhone growth.

The financial report shows that in the last fiscal quarter ending September, Apple's iPhone sales growth was less than half of the previous quarter and fell short of analyst expectations. In China, the world's largest smartphone market, Apple's total revenue not only failed to accelerate but also returned to a decline. In contrast, the revenue from the services business maintained double-digit growth, continuing its record-breaking momentum, sharply contrasting with the iPhone.

Although the iPhone performance was poor last quarter, Apple CEO Tim Cook expressed confidence in the iPhone 17 series launched in September, stating that the new series received a strong market response that was "beyond expectations."

Cook stated that Apple expects iPhone sales this quarter to achieve a double-digit year-on-year growth rate, making this quarter the best for Apple's performance, with quarterly revenue expected to grow by 10%-12%. From the financial data, this guidance implies that the revenue growth rate will reach a new high in at least four years. Apple's Chief Financial Officer (CFO) Luca Maestri stated that iPhone revenue this quarter will also see a growth rate of 10%-12%. This growth rate far exceeds the consensus expectation of analysts at 6%.

At the same time, Apple confirmed that the financial pressure from tariffs imposed by the Trump administration on major product manufacturing regions such as India has been increasing quarter by quarter. This Thursday, Apple stated that it incurred $1.1 billion in tariff-related costs in the last fiscal quarter, nearly 40% higher than such tariff costs in the previous quarter.

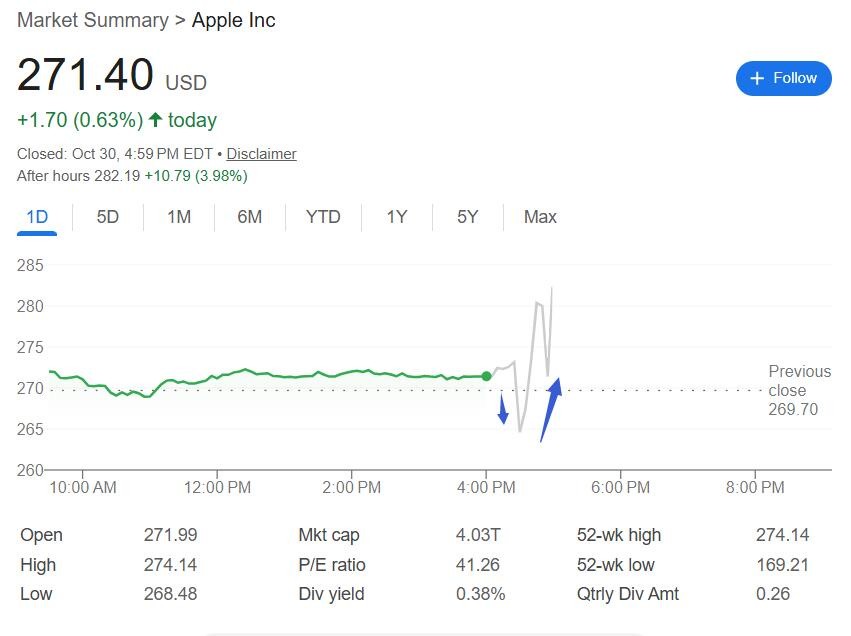

After the financial report was released, Apple's stock price, which had risen about 0.6%, turned to decline in after-hours trading, dropping as much as 3%, but later rebounded to rise, with after-hours gains exceeding 5% driven by strong growth guidance.

On October 30, Eastern Time, Thursday after the U.S. stock market closed, Apple announced the financial data for its fourth fiscal quarter of 2025 (hereinafter referred to as the third quarter) ending September 27, 2025, with the previous fiscal quarter referred to as the second quarter and the current fiscal quarter referred to as the fourth quarter.

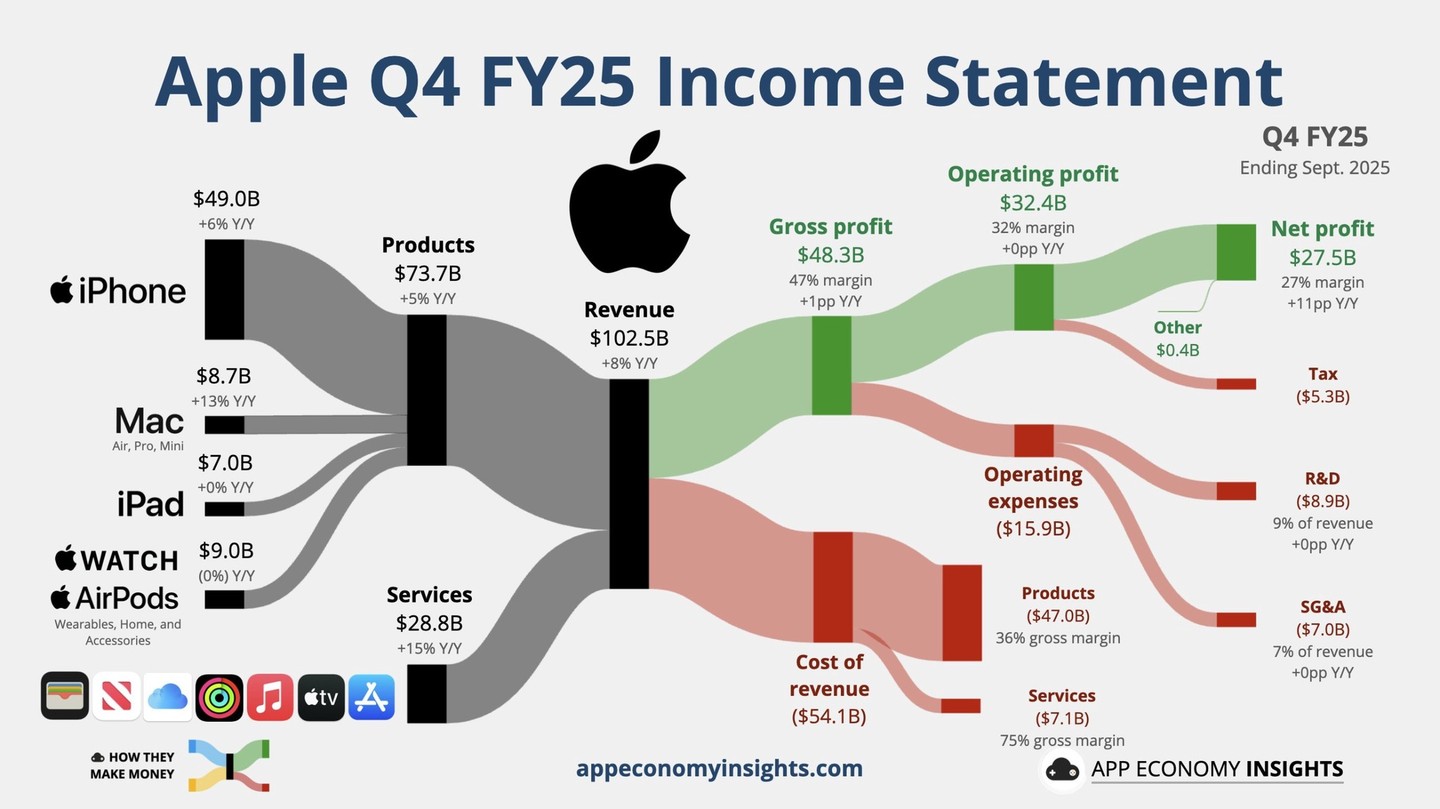

1) Key Financial Data

Revenue: Third quarter net sales were $102.47 billion, a year-on-year increase of 7.9%, with analysts expecting $102.19 billion, and a year-on-year growth of 9.6% in the second quarter.

EPS: The diluted earnings per share (EPS) for the third quarter was $1.85, a year-on-year increase of 90.7%, with analysts expecting $1.77, and a year-on-year growth of 12.1% in the second quarter.

Net Profit: The third quarter net profit was $27.47 billion, a year-on-year increase of 86.4%, with a year-on-year growth of nearly 9.3% in the second quarter.

Operating Expenses: Third quarter operating expenses were $15.91 billion, a year-on-year increase of 11.4%, with a year-on-year growth of 8.3% in the second quarter

Gross Margin: The gross margin for the third quarter was 47.2%, compared to 46.5% in the second quarter; the gross profit for the third quarter was USD 48.34 billion, a year-on-year increase of 10.2%, the same as the second quarter's year-on-year growth of 10.2%.

2) Segment Business Data

Products: Total net sales of mobile phones, computers, wearable devices, and other products in the third quarter reached USD 73.72 billion, a year-on-year increase of 5.4%, compared to analysts' expectations of USD 73.49 billion, with a year-on-year growth of 8.2% in the second quarter.

iPhone: Net sales for the third quarter were USD 49.03 billion, a year-on-year increase of 6.1%, compared to analysts' expectations of USD 49.33 billion, with a year-on-year growth of nearly 13.5% in the second quarter.

Mac: Net sales for the third quarter were USD 8.73 billion, a year-on-year increase of 12.7%, compared to analysts' expectations of USD 8.55 billion, with a year-on-year growth of 14.8% in the second quarter.

iPad: Net sales for the third quarter were USD 6.95 billion, a year-on-year increase of 0.03%, compared to analysts' expectations of USD 6.97 billion, with a year-on-year decline of 8.1% in the second quarter.

Wearable Devices, Home, and Accessories: Net sales for the third quarter were USD 9.01 billion, a year-on-year decrease of 0.3%, compared to analysts' expectations of USD 8.64 billion, with a year-on-year decline of nearly 8.6% in the second quarter.

Services: Net sales for the third quarter were USD 28.75 billion, a year-on-year increase of 15.1%, compared to analysts' expectations of USD 28.18 billion, with a year-on-year growth of nearly 13.3% in the second quarter.

3) Segment Market Data

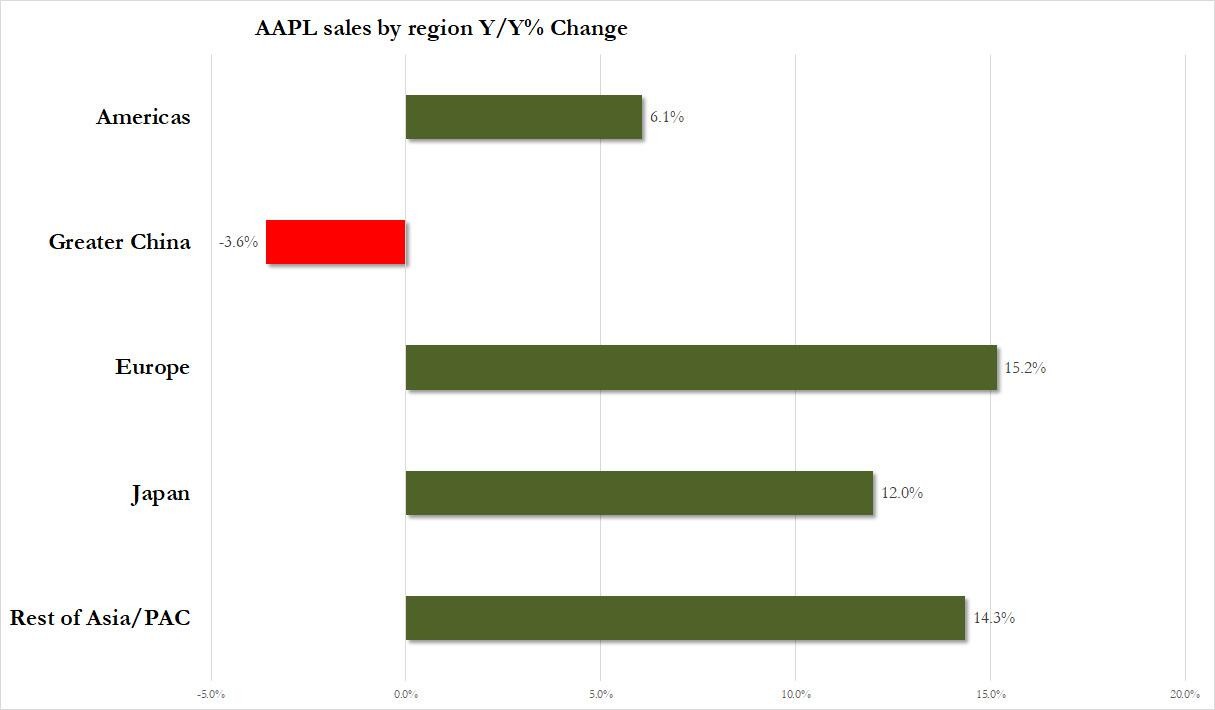

Americas: Net sales in the Americas for the third quarter were USD 44.19 billion, a year-on-year increase of 6.1%, compared to analysts' expectations of USD 44.45 billion, with a year-on-year growth of 9.3% in the second quarter.

Europe: Net sales in Europe for the third quarter were USD 28.7 billion, a year-on-year increase of 15.2%, compared to analysts' expectations of USD 26.36 billion, with a year-on-year growth of 9.7% in the second quarter.

Greater China: Net sales for the third quarter were USD 14.49 billion, a year-on-year decrease of 3.6%, compared to analysts' expectations of USD 16.43 billion, with a year-on-year growth of 4.35% in the second quarter.

Japan: Net sales for the third quarter were USD 6.64 billion, a year-on-year increase of 12%, compared to analysts' expectations of USD 6.41 billion, with a year-on-year decline of 11.5% in the second quarter.

Other Asia-Pacific: Net sales for the third quarter were USD 8.44 billion, a year-on-year increase of 14.3%, compared to analysts' expectations of USD 8.08 billion, with a year-on-year decline of nearly 8.5% in the second quarter.

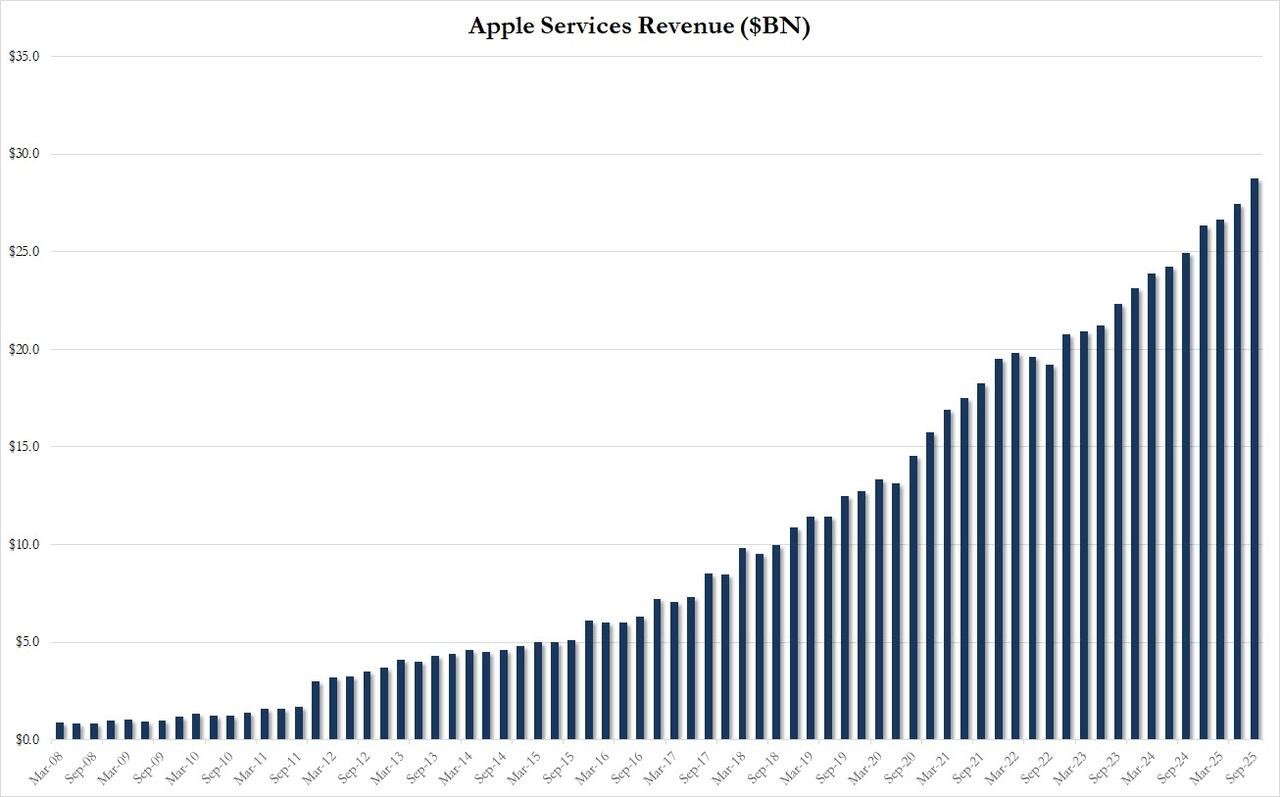

Service Revenue Continues to Set Quarterly Highs for Three Consecutive Years, Revenue Guidance Growth Reaches at Least Four-Year High

The financial report shows that in the third quarter, Apple's total revenue, net profit, and iPhone sales revenue were all at their highest levels in the last three quarters since entering 2025. The revenue growth rate slowed from nearly 10% in the second quarter to nearly 8%, slightly above analysts' expectations. EPS earnings increased by over 90% year-on-year, exceeding analysts' expectations by 4.5% Net profit in the third quarter surged over 86%, more than nine times the growth rate of the second quarter, marking the highest growth rate since the end of June 2021.

Cook stated that Apple's revenue set a record for the highest in the quarter ending in September. CFO Parekh noted that in the third quarter, the active device installations for all of Apple's products reached new highs for each respective quarter, and in all market regions, active device installations also hit new records. As of the end of the third fiscal year, Apple's total revenue reached $416 billion, setting a new annual revenue record.

The services business remains a crucial pillar of Apple's success. This segment continues to grow, helping to alleviate some of the pressure on hardware profit margins caused by tariffs. Thanks to the growth of subscription services like iCloud, AppleCare, and Apple Pay, Apple's service revenue for the third quarter of the fiscal year increased by 13.5% year-over-year to $109.16 billion, outperforming analysts' expectations of just over $108 billion.

Apple's services business has consistently set quarterly records over the past three years, and in the third quarter, it not only maintained double-digit year-over-year growth but also slightly increased its growth rate from about 13% in the second quarter to 15%, contrary to analysts' expectations of a slight slowdown to around 12%.

Commentary pointed out that the revenue growth rate of the services business exceeded market expectations by 230 basis points, which is a positive sign indicating that the impact of App Store fee adjustments on consumer behavior may not be as significant as previously feared.

After the earnings report was released, Cook revealed that revenue in the fourth quarter is expected to grow by 10%-12%. If Apple's fourth-quarter revenue growth slightly exceeds the lower end of Cook's guidance of 10% or reaches the midpoint of 11%, it will mark the highest quarterly growth rate since the end of 2021. If the fourth-quarter growth exceeds 11.2%, it will represent the highest revenue growth rate since the end of September 2021.

The guidance provided by Cook suggests that in the fourth quarter, which includes the year-end Thanksgiving and Christmas holidays as well as China's "Double 11," Apple will achieve strong results with the iPhone 17 and the MacBook Pro and iPad Pro featuring the M5 chip, which will be released in the fourth quarter.

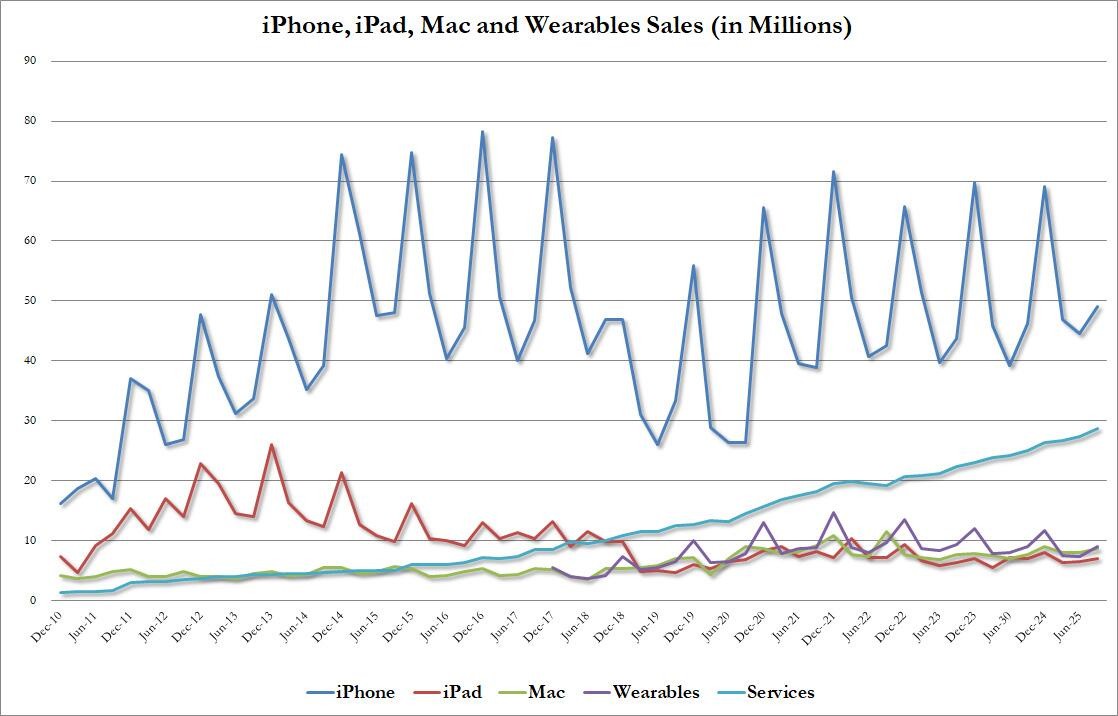

iPhone sales growth rate in the third quarter slowed by more than half, expected to return to double-digit growth in the fourth quarter

Among Apple's main hardware products, only iPhone and iPad sales revenue in the third quarter fell below analysts' expectations.

The iPhone contributed nearly 49% of Apple's revenue in the third quarter. The sales of iPhones in the quarter grew by just over 6% year-over-year, more than halving the growth rate from nearly 13.5% in the second quarter, while analysts had expected growth of nearly 7%.

The third quarter only includes a little over a week of sales data for the iPhone 17 series. CFO Parekh provided guidance for fourth-quarter iPhone sales, which covers the peak season including the major year-end holiday. The expected growth rate of 10%-12% indicates that Apple will record double-digit iPhone sales growth in the second quarter of this year after the fiscal quarter ending in March.

The third quarter only includes a little over a week of sales data for the iPhone 17 series. CFO Parekh provided guidance for fourth-quarter iPhone sales, which covers the peak season including the major year-end holiday. The expected growth rate of 10%-12% indicates that Apple will record double-digit iPhone sales growth in the second quarter of this year after the fiscal quarter ending in March.

Cook stated that Apple has found that consumer response to the new iPhone has been positive so far, with a significant year-on-year increase in foot traffic at company stores, "We are seeing enthusiasm globally."

Data from Counterpoint Research earlier this month showed that in the first 10 days of sales in Apple's two major markets—China and the United States—the sales of the iPhone 17 series increased by 14% compared to the same period of the previous generation iPhone 16. However, analysts have recently expressed differing views on whether the sales momentum of the iPhone 17 can be sustained.

Jefferies analyst Edison Lee pointed out in a report that tracking of various iPhone 17 models and markets shows that delivery times continue to shorten, stating, "The delivery time for the iPhone 17 Pro has almost disappeared, and the delivery time for Air in China has dropped to nearly zero." Shortened delivery times usually indicate that sales are within or below expected ranges.

Lee also mentioned that the resale premium for the iPhone 17 Pro has turned into a discount, and the premium for the 17 Pro Max has basically disappeared. However, he also acknowledged, "Industry research shows that growth in the Chinese market is accelerating, which challenges our negative outlook."

Sales in Greater China Declined 3.6% in Q3, Expected to Recover Positive Growth in Q4

Among Apple's major markets, only the Americas and Greater China saw sales fall short of analyst expectations in the third quarter, with only Greater China experiencing negative sales growth.

Sales in the Americas slowed to about 6% year-on-year growth, down from over 9% in the second quarter, a decline that exceeded analyst expectations. Sales in Europe, Japan, and the Asia-Pacific region outside of Japan all accelerated growth compared to the second quarter, with growth rates exceeding 10%.

Sales in Greater China declined by 3.6% year-on-year, failing to accelerate to 9.3% as analysts had expected from over 4% growth in the second quarter. The performance in the third quarter indicates that after a brief rebound in the second quarter, sales in Greater China have returned to the downward trend seen in the previous two years. In the second quarter, Apple achieved positive sales growth in Greater China for the first time since Q2 2023.

The underperformance of Apple in Greater China in the third quarter may primarily be influenced by the iPhone.

Market research firm IDC reported that in the third quarter, the total shipment of smartphones in the Chinese market was approximately 68.4 million units, a year-on-year decline of 0.6%, continuing the downward trend. The third quarter is traditionally a slow season for mobile phone sales, with fewer new products launched and released. Additionally, in the third quarter of this year, China provided subsidies for certain devices—funding for the "national subsidy" is relatively tight. In this environment, consumer spending has become more rational Comments suggest that discussions about Apple's supply shortages may alleviate concerns regarding the erosion of Apple's market share in Greater China by local smartphone brands.

Third Quarter Tariff Costs Meet Expectations, Increasing Nearly 40% Quarter-on-Quarter

While announcing its financial results, Apple revealed on Thursday that in the third quarter, the company incurred an additional cost of $1.1 billion due to tariffs. This aligns with the estimated tariff cost increase disclosed by Cook during the quarterly report in July.

Compared to the $800 million in the second quarter, the tariff costs in the third quarter increased nearly 38% quarter-on-quarter.

Apple also expects its operating expenses in the fourth quarter to be in the range of $18.1 billion to $18.5 billion, representing a quarter-on-quarter increase of 13.8% to 16.3% and a year-on-year increase of 26.7% to 29.5%.

Cook reiterated his statements from the past few quarters on Thursday, stating that Apple is "expanding its investment in artificial intelligence (AI)." He also mentioned that Apple has made more progress in the development of the new Siri and reaffirmed that the new Siri will be released next year