iPhone sales forecast! Apple's Q4 performance and guidance exceed expectations, predicting double-digit growth in holiday season sales

Apple Inc. announced its fourth-quarter results for fiscal year 2025, with sales increasing by 7.9% year-on-year to $102.5 billion, exceeding market expectations. Earnings per share were $1.85, and net profit was $27.46 billion. The company predicts a significant increase in sales during the holiday season, benefiting from the launch of the new iPhone. Despite a 3.6% decline in revenue from Greater China, CEO Tim Cook remains optimistic about future growth, believing that the Chinese market will recover

According to Zhitong Finance APP, Apple (AAPL.US) reported better-than-expected results for the fourth quarter of fiscal year 2025 and forecasted a significant increase in holiday season sales following the launch of its new iPhone, helping to reassure investors that its flagship product remains a growth engine. For the fourth fiscal quarter ending September 27, sales increased by 7.9% year-on-year to $102.5 billion, slightly above the previous average expectation of $102.2 billion. Earnings per share rose to $1.85, exceeding the prior average expectation of $1.77.

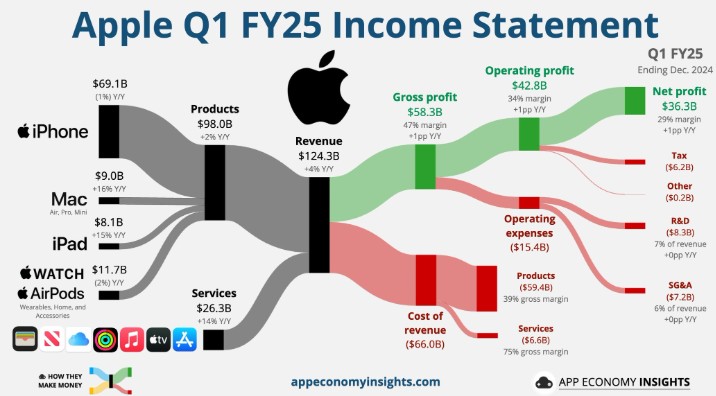

The company's net profit for the fourth quarter was $27.46 billion, compared to $14.29 billion in the same period last year, with the decline attributed to one-time tax expenses. The gross margin was 47.2%, higher than the analyst expectation of 46.4%.

By business segment, Apple released its latest iPhone in September, updating the design and launching a new ultra-thin model called Air. This product line remains Apple's most profitable, accounting for about half of its total revenue. The performance of the Mac and wearables segments also exceeded expectations.

In the last quarter, Apple's revenue in Greater China fell by 3.6% to $14.5 billion, far below the analyst expectation of $16.4 billion. The company faces increasing competition from local smartphone manufacturers and is also struggling with artificial intelligence features. Nevertheless, CEO Tim Cook stated that he believes Apple will return to growth in Greater China this quarter.

Cook noted that delivery delays in the Chinese market were the "main reason" for the decline in sales in China during the fourth fiscal quarter. He mentioned that Apple is still working to resolve some supply constraint issues.

Cook added, "However, we are very confident in the Chinese market. We are pleased with the response to our new products in the Chinese market and expect to achieve growth or a return to growth in the first fiscal quarter. Currently, in the first fiscal quarter, supply for some iPhone 17 models remains tight, and we are doing our utmost to fulfill orders as soon as possible. This is a happy problem."

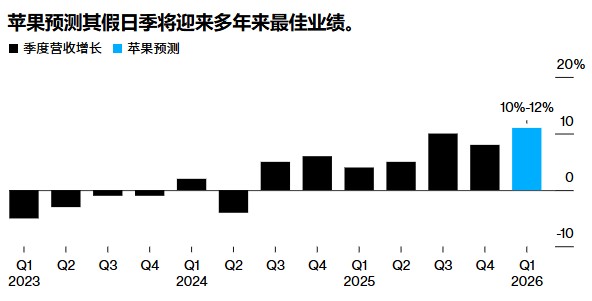

Looking ahead, Chief Financial Officer Kevan Parekh stated during a conference call with analysts on Thursday that revenue for the first fiscal quarter ending in December is expected to grow by 10% to 12%, while the previous average forecast was only 6%. He said, "We expect iPhone revenue to grow by double digits year-on-year, which will be our best-performing quarter ever for iPhone."

LSEG data shows that analysts expect Apple's new fiscal quarter (December quarter) sales to reach $132.31 billion, with earnings per share of $2.53, and the performance guidance provided by Apple exceeds these expectations. If there is an 11% year-on-year growth, then revenue for this quarter will reach $137.97 billion. ** This outlook indicates that Apple Inc. is working to address a range of global challenges, including trade tensions, weakness in its Chinese market, and delays in the development of artificial intelligence capabilities.

Natalie Hwang, founding managing partner of Apeira Capital, stated: "Strong growth is expected during the holiday season, providing Apple with a buffer to consolidate market demand, but it will be very interesting to see whether Apple can effectively translate this momentum into lasting advantages in artificial intelligence and infrastructure."

Additionally, tariffs increased costs by $1.1 billion in the fourth fiscal quarter, in line with Apple's expectations. The company anticipates tariff costs will reach $1.4 billion this fiscal quarter, with operating expenses expected to be between $18.1 billion and $18.5 billion.

After the earnings announcement, as of the time of writing, Apple's stock price rose nearly 3% in after-hours trading. As of the close, Apple's stock price has increased by 8.4% year-to-date.

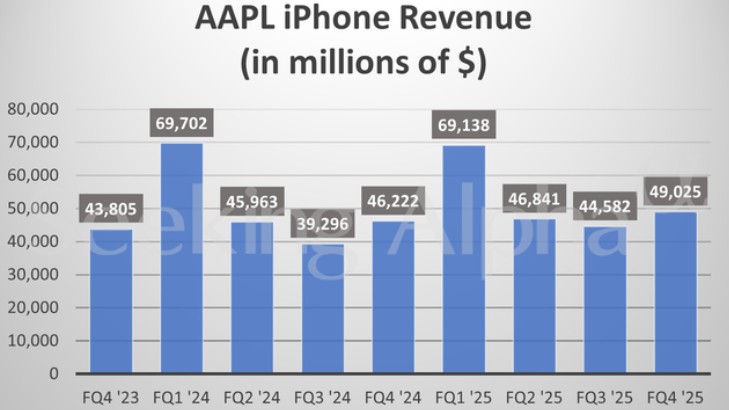

iPhone Business

Driven by new models, Apple's iPhone revenue grew 6.1% year-over-year to $49 billion. However, this figure is slightly below analysts' expectations of $49.3 billion. Apple stated that it is facing supply constraints, which may be the reason for the limited revenue growth.

In the fourth fiscal quarter, the sales period for the iPhone 17 was about two weeks, with strong initial demand leading to sellouts at Apple retail stores and third-party channels. Most buyers opted for the high-end iPhone 17 Pro model, which boosted Apple's average selling price. The $999 iPhone Air (more expensive than its predecessor) also contributed to this.

According to data from Counterpoint Research, the iPhone 17 series saw a 14% increase in sales in the first ten days of its launch in the U.S. and China compared to the previous generation, with the iPhone 17 and iPhone 17 Pro Max being the most in demand. However, the iPhone Air, touted as the thinnest iPhone ever, has seen "lukewarm interest" in the market according to UBS data.

Among the "seven tech giants," Apple's stock price increase this year has lagged behind its competitors, as investors are watching to see if its artificial intelligence capabilities can catch up. The company stated that its biggest update for the virtual assistant Siri will be launched next year, and Cook told the media that Apple is "making good progress" on these upgrades. **

When asked whether the rise of chatbots and artificial intelligence applications would change the way consumers use apps, Cook stated that he sees "opportunities" for artificial intelligence on the App Store. He also mentioned that Apple Intelligence—a set of AI features provided for iPhone and other Apple products—is encouraging people to upgrade their iPhones.

Earlier this year, Apple delayed the update for Siri, which could have brought Siri closer to OpenAI's ChatGPT and Google's Gemini. Meanwhile, competitors like Google, Microsoft, and Samsung continue to invest billions of dollars into their artificial intelligence infrastructure.

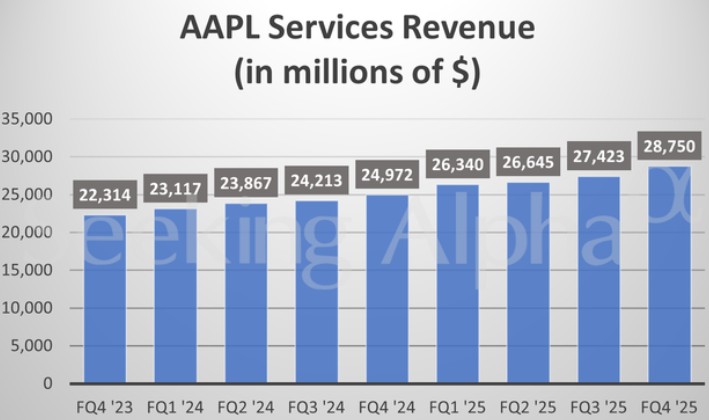

Services Business

In the last quarter, the services business (including online subscription services like iCloud and Apple Music, as well as App Store fees, Google search licensing fees, payment fees, and AppleCare hardware warranty services) remained Apple's fastest-growing segment, with revenue increasing by 15% to $28.8 billion, exceeding analysts' expectations of $28.2 billion. Despite the strong growth momentum in the services business, regulators are still trying to amend App Store policies, which could impact software and subscription revenue, posing challenges for Apple. However, Apple recently achieved a legal victory as a judge ruled that it does not have to terminate its $20 billion annual search business partnership with Alphabet (GOOGL.US) subsidiary Google.

Other Businesses

Mac revenue grew by 13% to $8.73 billion, surpassing the previous average expectation of $8.6 billion. The company updated the MacBook Air and Mac Studio product lines in March and released a new entry-level MacBook Pro earlier this month.

Meanwhile, the iPad business launched new low-end and Air models in March and updated the Pro version earlier this month. Its fourth-quarter revenue was $6.95 billion, flat compared to the same period last year.

Sales in the wearables, home, and accessories segment (including AirPods, smartwatches, set-top boxes, and HomePod smart speakers) declined by less than 1% to $9.01 billion, while analysts had previously expected a significant drop in sales for this segment.