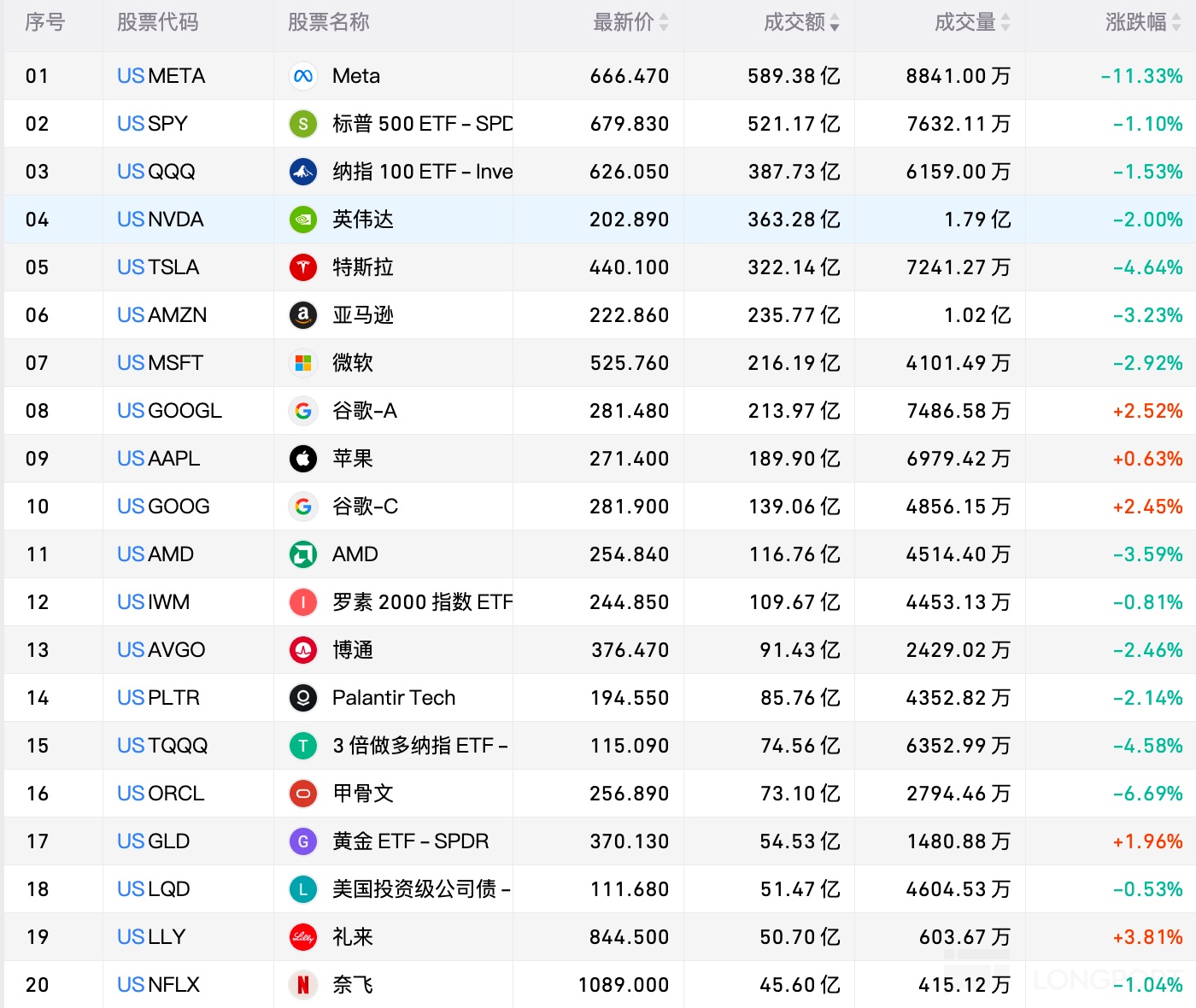

US Stock Information Active List | Most of the Mag7 fell back, with Meta leading the decline by over 11%, and third-quarter tax expenses causing profits to plummet by 80%

On Thursday, the top traded stock in the U.S. market, Meta Platforms, fell over 11%, with a trading volume of $58.938 billion. Despite the company's strong revenue performance in the third quarter, it also forecasted a significant increase in operating expenses and capital expenditures for 2026, and plans to accrue a large one-time tax expense. The latest disclosed financial report shows that the company achieved revenue of $51.24 billion in the third quarter, a year-on-year increase of 26%, but net profit plummeted 83% year-on-year to $2.71 billion, with earnings per share of $1.05, far below the market expectation of $6.68. The core reason for Meta's "cliff-like" drop in earnings is the $15.93 billion one-time non-cash income tax expense resulting from the "One Big Beautiful Bill Act" introduced by U.S. President Trump, which directly raised the company's effective tax rate from 12% in the same period last year to 87%. Additionally, Meta's total costs and expenses in the third quarter were $30.7 billion, a year-on-year increase of 32%, significantly outpacing the 26% revenue growth rate, leading to a contraction in operating profit margin from 43% to 40%. Nvidia, ranked 4th, fell 2%, with a trading volume of $36.328 billion, and its market value dropped below $5 trillion. Driven by the explosive demand for AI chips and new collaborations in supercomputing, 6G, and robotics, Nvidia became the first company to stabilize its market value at the $5 trillion mark yesterday. Tesla, ranked 5th, fell nearly 5%, with a trading volume of $32.214 billion

On Thursday, the top traded stock in the U.S. market, Meta Platforms, fell over 11%, with a trading volume of $58.938 billion. Despite the company's strong revenue performance in the third quarter, it forecast a significant increase in operating and capital expenditures for 2026 and plans to accrue substantial one-time tax expenses.

The latest disclosed financial report shows that the company achieved revenue of $51.24 billion in the third quarter, a year-on-year increase of 26%, but net profit plummeted 83% year-on-year to $2.71 billion, with earnings per share of $1.05, far below the market expectation of $6.68.

The core reason for Meta's "cliff-like" drop in profits is the $15.93 billion one-time non-cash income tax expense resulting from the "One Big Beautiful Bill Act" introduced by U.S. President Trump, which directly raised the company's effective tax rate from 12% in the same period last year to 87%. Additionally, Meta's total costs and expenses in the third quarter were $30.7 billion, a year-on-year increase of 32%, significantly outpacing the 26% revenue growth, leading to a contraction in operating profit margin from 43% to 40%.

NVIDIA, ranked 4th, fell 2%, with a trading volume of $36.328 billion, and its market value dropped below $5 trillion. Driven by the explosive demand for AI chips and new collaborations in supercomputing, 6G, and robotics, NVIDIA became the first company to stabilize its market value at the $5 trillion mark yesterday.

Tesla, ranked 5th, fell nearly 5%, with a trading volume of $32.214 billion. According to media reports, Tesla's Cybertruck has been recalled ten times within less than two years of its launch, and this problematic model has not gained widespread acceptance among consumers. The latest recall involves 6,197 Cybertrucks due to potential issues with the installation of off-road light bar components, which may detach and increase the risk of collision.

According to documents submitted to the U.S. National Highway Traffic Safety Administration website, Tesla stated that no accidents, injuries, or deaths related to this situation have been found so far. This is the tenth recall for the Cybertruck, and just a week ago, Tesla initiated a safety recall for 63,619 pickup trucks due to overly bright parking lights. Other issues that led to recalls include loose steel trim pieces, inverter failures, and small font sizes on warning lights.

Amazon, ranked 6th, fell over 3%, with a trading volume of $23.603 billion. Amazon's stock price surged 11% in after-hours trading on Thursday, following the announcement of third-quarter revenue and profits that exceeded expectations.

Microsoft, ranked 7th, fell nearly 3%, with a trading volume of $21.621 billion. Microsoft's first-quarter revenue was $77.673 billion, an 18% increase compared to $65.585 billion in the same period last year, with a year-on-year increase of 17% excluding the impact of exchange rate fluctuations; net profit was $27.747 billion, a 12% increase compared to $24.667 billion in the same period last year, with a year-on-year increase of 11% excluding the impact of exchange rate fluctuations; diluted earnings per share were $3.72, a 13% increase compared to $3.30 in the same period last year, with a year-on-year increase of 11% excluding the impact of exchange rate fluctuations.

Alphabet's Class A shares, ranked 8th, rose 2.52%, with a trading volume of $21.399 billion. Alphabet's total revenue for the third quarter was $102.346 billion, a 16% increase compared to $88.268 billion in the same period last year, with a year-on-year increase of 15% excluding the impact of exchange rate fluctuations;According to U.S. Generally Accepted Accounting Principles, Alphabet's net profit for the third quarter was $34.979 billion, an increase of 33% compared to $26.301 billion in the same period last year; diluted earnings per share were $2.87, up from $2.12 in the same period last year.

Wedbush raised the target stock price for Google's parent company Alphabet from $245 per share to $320 per share.

AMD, ranked 11th, fell 3.59%, with a trading volume of $11.678 billion. The stock hit an all-time high on the previous trading day.

Oracle, ranked 16th, fell nearly 7%, with a trading volume of $7.311 billion. The stock has now declined for four consecutive trading days. Reports yesterday indicated that Oracle's credit default swaps (CDS) surged due to market concerns over its massive AI spending. According to ICE Data Services, the cost of insuring against corporate debt default over the next five years is nearing the highest level since October 2023.

Eli Lilly, ranked 19th, rose nearly 4%, with a trading volume of $5.07 billion. The company's third-quarter revenue reached $17.6 billion, a year-on-year increase of 54%, exceeding industry expectations; net profit reached $5.583 billion, compared to $970 million in the same period last year; earnings per share were $6.21, and adjusted earnings per share calculated on a Non-GAAP basis were $7.02.