Undeterred by a market value evaporation of $200 billion, Meta issued a record $25 billion in bonds, even raising U.S. Treasury yields

Despite a single-day market value evaporation of $208 billion due to massive AI spending, Meta still plans to issue $25 billion in bonds to support its AI strategy, which will be one of the largest corporate bond issuances this year and could even trigger a chain reaction in the U.S. bond market. Zuckerberg stated that this is a necessary "upfront investment" to win the "superintelligence" race. However, unlike Google and Microsoft, which have cloud businesses, the return path for Meta's AI investments remains unclear

Despite a market value evaporation of over $200 billion, Meta still chooses to "go all in" on AI and continue to "burn cash."

On October 31, according to a report by the Financial Times citing informed sources, the social media giant has hired Citigroup and Morgan Stanley to prepare for a bond issuance of $25 billion, with maturities ranging from 5 to 40 years.

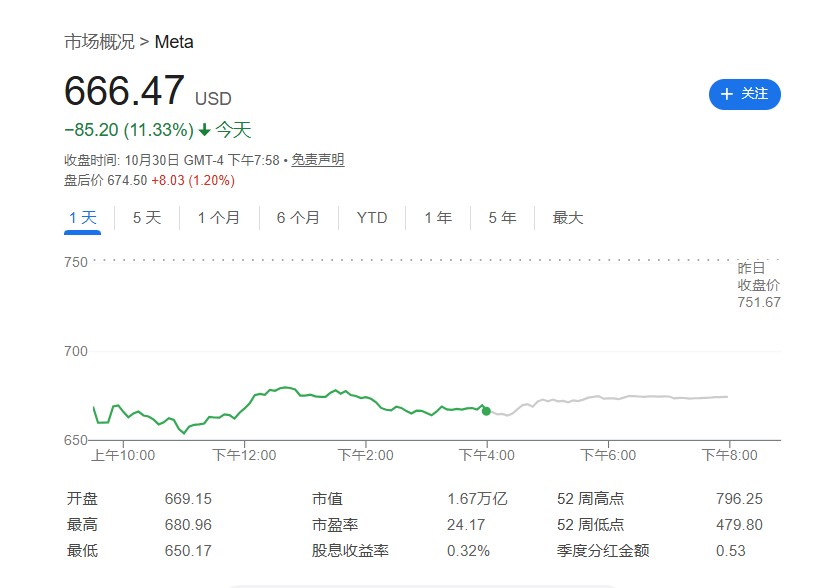

Just a day before this plan was disclosed, Meta's stock price plummeted by 11.3%, with a market value loss of nearly $208 billion, marking its second-largest single-day decline in history. The market panic stems from investors' concerns about its exorbitant capital expenditures.

In the face of market concerns, CEO Mark Zuckerberg remains resolute. On Wednesday, October 29, he told analysts that to gain an edge in the race to build "super artificial intelligence," "actively investing in building capabilities upfront is the right strategy." Meta expects its capital expenditures this year to reach $72 billion, and spending growth in 2026 will be "significantly larger," far exceeding previous forecasts.

This year's largest corporate bond issuance has impacts that extend beyond the company itself. Media analysis indicates that Meta's massive bond issuance plan has reopened the corporate bond supply floodgates and has become one of the factors driving up U.S. Treasury yields. This may indicate that the capital expenditure frenzy of tech giants is not only reshaping the industry landscape but also having a substantial impact on the broader macroeconomy and financial markets.

Betting on the Future of AI, but the Path to Returns is Unclear

Meta's substantial investment in AI faces a unique challenge: its business model is vastly different from its competitors. Analysts note that companies like Microsoft and Google have large cloud computing businesses that can generate direct revenue from driving AI applications, making their investment return paths clear.

In contrast, the vast majority of Meta's revenue still comes from advertising. This raises more questions for investors and analysts about the ultimate return on its AI investments. Nat Schindler, an analyst at Canadian Imperial Bank of Commerce, pointed out in a report that Meta "will need to see a significant amount of new revenue sources to justify the substantial increase in its capital expenditures."

Nevertheless, Zuckerberg believes these investments can feed back into the core business. He revealed that the company's AI recommendation system increased the time users spent on Facebook by 5% in the third quarter. At the same time, Meta has strong cash flow as a backing. According to data from S&P Global Market Intelligence, Meta is one of only five companies in the S&P 500 index with annual operating cash flow exceeding $100 billion.

Record Bond Issuance Supports Exorbitant Spending

To support this gamble, Meta is turning to the debt market. Reports indicate that this $25 billion bond issuance will be one of the largest corporate bond transactions of the year This is not an isolated case. Oracle Corporation sold $18 billion in bonds in September. Data forecasts indicate that large technology companies will invest a total of $400 billion this year in AI infrastructure, such as purchasing chips and building data centers.

Meta's spending scale is particularly astonishing. According to media estimates, its annual capital expenditure of $72 billion will account for 37% of the company's projected revenue, the highest ratio among large tech peers. Mark Zuckerberg has warned that spending growth in 2026 will be "significantly larger," suggesting that future investment amounts will far exceed expectations.

Notably, during a recent dinner with U.S. President Trump, Zuckerberg stated that Meta plans to invest $600 billion in U.S. data centers and AI infrastructure by the end of 2028.

Capital Expenditures of Tech Giants Impact the Bond Market

Meta's massive financing needs have stirred waves in the bond market.

After Federal Reserve Chairman Powell hinted at slowing the pace of interest rate cuts, U.S. Treasury yields have continued to rise, and Meta's move to restart corporate bond issuance has further exacerbated this trend, with yields on U.S. Treasuries reaching their highest levels in over a week.

Currently, the spending frenzy of U.S. tech giants on data center construction and equipment procurement is becoming one of the important driving forces behind U.S. economic growth