Trading volume hits a new high! Coinbase's revenue surged by 55%, and the CEO stated that details on "stock tokenization and prediction markets" will be showcased in December, continuing the move towards a "universal exchange."

Coinbase's trading volume in the third quarter reached $295 billion, and this strong momentum has continued into the fourth quarter. Q3 net profit soared nearly five times from $75.5 million in the same period last year to $433 million. The company plans to share more details about its stock tokenization and prediction markets at a product showcase on December 17

Thanks to record token prices driving a significant increase in trading volume, Coinbase, the largest cryptocurrency exchange in the United States, exceeded revenue expectations in the third quarter. Its CEO also previewed the company's next steps in stock tokenization and prediction markets, boosting the company's stock price.

According to the financial report released on Thursday, Coinbase's third-quarter revenue grew 55% year-over-year to $1.9 billion, surpassing analysts' estimates of $1.8 billion. Net profit soared nearly fivefold from $75.5 million in the same period last year to $433 million, or $1.50 per share.

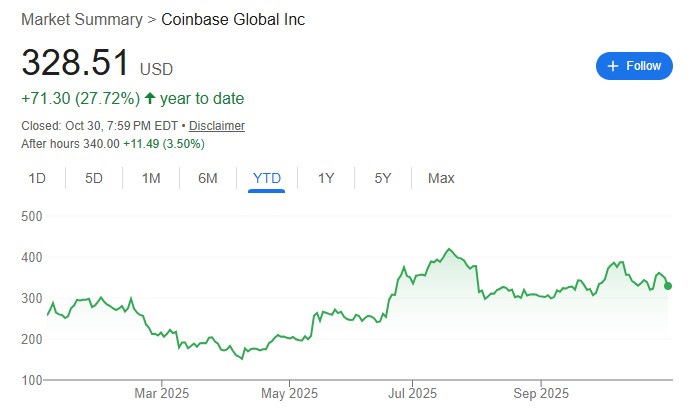

After the earnings report was released, Coinbase's stock price rose by as much as 4% in after-hours trading, with a cumulative increase of 32% year-to-date. The cryptocurrency market has continued to rebound this year, partly due to the Trump administration's positive attitude toward the industry, including the passage of the first stablecoin regulatory bill in the U.S. in July.

Trading Volume Soars, Stablecoins and Derivatives Become New Revenue Engines

In a letter to shareholders on Thursday, Coinbase stated that the company's trading volume reached $295 billion in the third quarter. This strong momentum appears to have continued into the fourth quarter. Data shows that in the first month of the current quarter, despite investors experiencing extreme volatility with record liquidations just days after cryptocurrencies like Bitcoin hit all-time highs, trading revenue still reached $385 million.

In addition to trading operations, stablecoins and derivatives also contributed to revenue growth.

As a shareholder and major distribution channel for USDC stablecoin issuer Circle Internet Group Inc., Coinbase generated $354.7 million in revenue from this segment in the third quarter.

Furthermore, the company reported that the recently acquired options platform Deribit contributed $52 million in revenue this quarter, thanks to "sustained growth in options trading, with notional trading volume hitting an all-time high." During the period, the total notional trading volume of derivatives between Deribit and Coinbase exceeded $840 billion.

Moving Towards "Everything Exchange," Acquisition Plans Remain on the Agenda

During the earnings call, CEO Brian Armstrong stated that the company plans to share more details about its stock tokenization and prediction markets at a product showcase on December 17.

Armstrong said, "We have been working hard to prepare for the next steps," reiterating the company's vision of becoming an "everything app" that provides all the financial functions consumers need.

Coinbase executives also indicated that the company remains interested in acquisitions, particularly in the trading and payment sectors