The valuation of the power generation business has surpassed that of NVIDIA and GE Vernova! Morgan Stanley: Caterpillar is severely overvalued

Morgan Stanley believes that Caterpillar's stock price has been "perfectly priced": the company's power generation business accounts for only about 12% of total sales and is trading at a valuation even more expensive than Nvidia and GE Vernova. "The market is either paying an exorbitant premium to purchase the power generation business or is absurdly revaluing the cyclical business as profit margins continue to shrink."

After Caterpillar's stock price soared to an all-time high due to better-than-expected Q3 performance, Morgan Stanley issued a warning: the market's valuation multiple for the company's power generation business has far exceeded that of AI giant Nvidia and energy leader GE Vernova. This frenzy has pushed the stock price to a state of "perfect pricing," where any slight disturbance could trigger a severe correction.

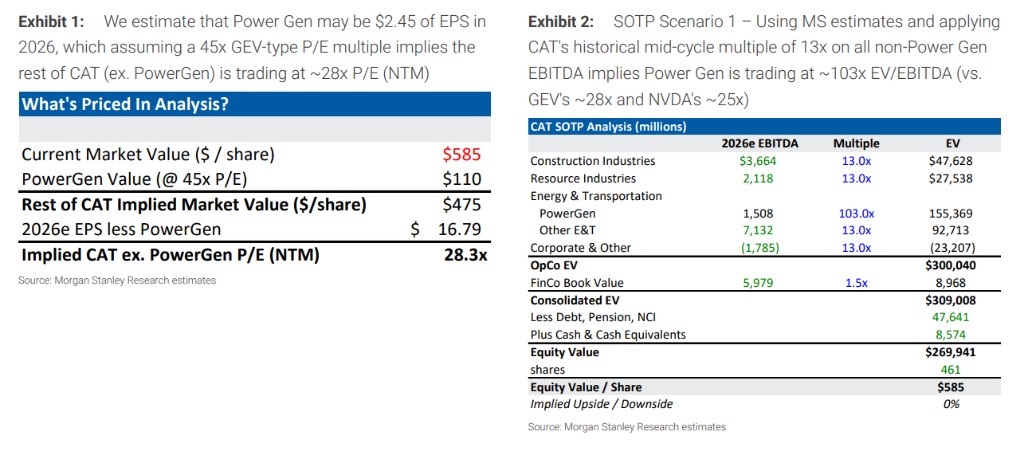

According to Wind Trading Desk, Morgan Stanley analysts stated in a report on October 30 that at the current stock price, the market is assigning an EV/EBITDA (Enterprise Value/Earnings Before Interest, Taxes, Depreciation, and Amortization) multiple for Caterpillar's power generation business between 58 times and 103 times.

What does this mean? In comparison, the valuation multiple for peers in the energy sector, GE Vernova, is about 28 times, while the highly sought-after AI chip giant Nvidia's valuation is only around 25 times. This means the market believes Caterpillar's power generation business is more valuable than the related businesses of the world's top technology and energy companies.

Analysts warn that to justify Caterpillar's current stock price of $585, the market must accept one of two extreme scenarios:

Either Caterpillar's power generation business, which accounts for only about 12% of total sales, is trading at a valuation more expensive than Nvidia and GE Vernova;

Or the valuation of the company's remaining traditional cyclical businesses (such as construction and resource extraction) has been pushed to "absurd levels" far exceeding historical normal ranges.

Even under the most optimistic assumption—assigning a 45 times price-to-earnings ratio to Caterpillar's power generation business (the level of GE Vernova)—the implied valuation for the remaining cyclical businesses (engineering machinery, resource industries, etc.) still reaches a high of 28 times price-to-earnings ratio. And the adjusted operating profit margins for these businesses are shrinking quarter by quarter, with a nearly 100 basis point decline in Q3:

The market is either paying an exorbitant premium for the power generation business or revaluing cyclical businesses to absurdly high levels while profit margins continue to shrink.

Morgan Stanley estimates that even assuming a compound annual growth rate of over 30% for backup generators and over 65% for main power generation solutions, and accounting for a service multiplier effect of 1.5-3 times, it would still be difficult to reach the bullish expectation of $20 billion in power generation sales by 2027. The report suggests:

In the data center theme, Cummins' valuation is more reasonable and carries lower risk.

The report maintains Caterpillar's 2026 EPS expectation at $19.24, with a target price of $380 based on a 20 times price-to-earnings ratio—this is already above the company's historical center of 13-22.5 times, indicating a potential downside of 35% from the current stock price