Goldman Sachs traders: The rise of U.S. stocks is "extremely narrow," with the seven giants repeatedly hitting new highs but overall underperforming the global market

Goldman Sachs traders pointed out that the U.S. stock market is showing extreme polarization: the seven tech giants continue to hit new highs, but the number of stocks rising on days when the S&P 500 is up has hit a historic low. More concerning is that the U.S. stock market has underperformed the global market for 18 consecutive months. The strong performance of tech giants is supported by their AI investments, but the weakening dollar and the recovery of European and Asian markets are driving the rise of non-U.S. markets, leading to a more balanced performance across the global market

The U.S. stock market exhibits two major contradictions: tech giants repeatedly hitting new highs are driving the index upward, but market breadth has narrowed to extreme levels, and the overall performance of U.S. stocks has lagged behind global markets for 18 consecutive months.

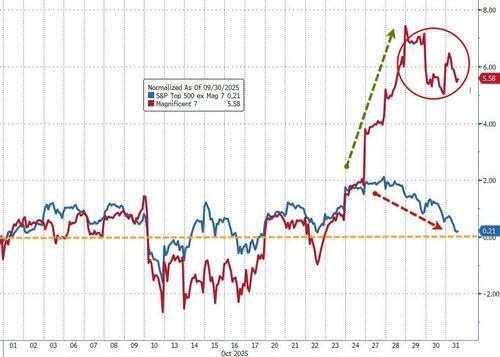

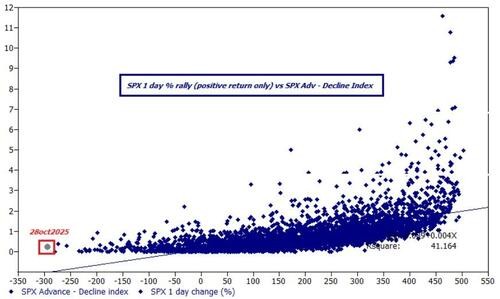

On October 31, Goldman Sachs trader Mark Wilson pointed out that the Nasdaq index recorded a 5% increase for two consecutive months, but market concentration reached a historical extreme. On Tuesday, when the S&P 500 index rose, the ratio of advancing to declining stocks hit the lowest level on record. This indicates that U.S. large-cap tech stocks are dominating, while the other 493 constituent stocks are almost stagnant.

More notably, despite the strong performance of U.S. tech giants, U.S. stocks have underperformed global markets and have failed to generate any excess returns over the past 18 months. This reflects two significant market phenomena in 2025: a weakening dollar and a recovery in non-U.S. markets such as Germany, Southern Europe, Japan, and South Korea, although these trends are not as eye-catching as the topic of artificial intelligence.

Wilson believes that the ongoing narrowing of the U.S. market will bring performance challenges to many investors, but the current global market breadth is impressive and is expected to continue supported by valuations and positions.

Tech Giants Lead the Way, Market Narrowing Reaches Extreme Levels

The article points out that the market data for October clearly shows the concentration of the U.S. stock market's upward trend.

The seven major U.S. tech stocks (Mag-7) significantly outperformed the other 493 constituent stocks of the S&P 500, which remained basically flat for the month. The seven giants have once again broken through to a significant new high relative to the S&P 500 index, continuing their status as the core narrative of the market.

This narrowing trend is becoming increasingly extreme. On the day the S&P 500 index rose on Tuesday, the ratio of advancing to declining stocks reached the lowest recorded reading. Despite the Nasdaq index rising 5% for two consecutive months, market breadth continues to deteriorate.

Goldman Sachs trader Mark Wilson believes that the ongoing AI investments by large tech companies are the core factors supporting their stock price performance. According to a previous article from Wall Street Insight, Amazon and Google are experiencing accelerated growth in their cloud businesses, while Microsoft maintains a growth rate of 39% These companies are unlikely to slow down their spending plans in the short term.

It also pointed out that Meta faces investor skepticism regarding demonstrable return on investment this quarter, but considering the competitive landscape, the company is also unlikely to reduce spending. Its $125 billion bond issuance received record demand, confirming its ability to continue investing. Although the stock price reaction itself may become a constraint mechanism, if Meta's stock price does not significantly decline a week later, this debate will maintain the current pattern.

After the third-quarter earnings report, the capital expenditure plans of the seven giants may be raised by another $60 billion for 2026. In this context, Nvidia rightfully becomes the first company with a market value exceeding $5 trillion.

European market quietly consolidates, global performance breadth supports subsequent trends

Mark Wilson stated that although Asian markets have made headlines this week, substantial changes are occurring in the European market. Airbus, Thales, and Leonardo announced a merger of their satellite businesses to create a pan-European industry leader, a small step that holds significant importance.

The consolidation of the European telecommunications industry continues to advance, with new deal news emerging this week from both the UK and Italy. These may not be "AI winners," but they are precisely the traditional industries that should demonstrate AI efficiency improvements.

Italian utility company ENEL has just begun to respond to the "AI power upgrade" theme, with its valuation bill and earnings momentum driving its stock price to a 12-month relative high. Large European stocks are beginning to shake off the currency drag experienced earlier this year, with Airbus, ASML, and ENEL all reaching new relative highs over the past 12 months.

Goldman Sachs' Asian team believes that the trend of the dollar still supports expectations for earnings per share and broad market performance in Asia, with China's GDP expectations also being revised upward again.

Wilson stated, the current breadth of global market performance is impressive and is expected to continue under the support of position allocation and valuation