Whether the Federal Reserve will cut interest rates in December may depend on "when the U.S. government shutdown ends."

The longer the government shutdown lasts, the more data will be missing, and the Federal Reserve will act more cautiously. Morgan Stanley believes that if the government shutdown continues past Thanksgiving (late November), it is very likely that there will be a pause in interest rate cuts in December. Citigroup, on the other hand, holds a more optimistic view, expecting the government to reopen within the next two weeks, allowing the Federal Reserve to obtain multiple employment reports before the December meeting, thus providing a basis for continuing to cut rates by 25 basis points

The ongoing government shutdown is plunging the Federal Reserve into a "data fog," making its December interest rate decision uncertain.

After the recent monetary policy meeting, Federal Reserve Chairman Jerome Powell's remarks reinforced cautious market expectations. According to reports from the trading desk, Citigroup and Morgan Stanley's latest reports indicate that Powell has shifted from his previous dovish stance, stating firmly that a rate cut in December is "far from a done deal."

He likened the current lack of data to "driving in a fog," and bluntly stated, "If you're driving in fog, what do you do? You slow down." This metaphor has been interpreted by the market as a clear signal: the absence of data may lead the Federal Reserve to act more cautiously.

Due to the government shutdown preventing the timely release of key economic data, the data-dependent Federal Reserve is facing increasing uncertainty.

Currently, Wall Street has differing views on this matter. Morgan Stanley believes that the longer the shutdown lasts, the lower the probability of a rate cut. In contrast, Citigroup is confident that the government shutdown will end within two weeks and expects the Federal Reserve to cut rates as scheduled.

"Driving in the Fog" in a Data Vacuum

Powell's "driving in the fog" analogy highlights the Federal Reserve's policy dilemma in a data vacuum. According to a Morgan Stanley report, Powell emphasized during the press conference that monetary policy "does not have a preset path" and will "increasingly rely on data." This shift in stance, occurring simultaneously with his announcement of a 25 basis point rate cut, appears particularly hawkish.

Citigroup analyst Andrew Hollenhorst's team believes that Powell's hawkish comments may be aimed at seeking consensus within the divided Federal Reserve. Nevertheless, Powell's warning is clear: in a highly uncertain environment, the Federal Reserve tends to "act cautiously."

It is noteworthy that the Federal Reserve also announced it would halt quantitative tightening (QT) starting December 1, a move seen by some market participants as a dovish counterbalance.

Duration of the Shutdown Determines Decision Basis

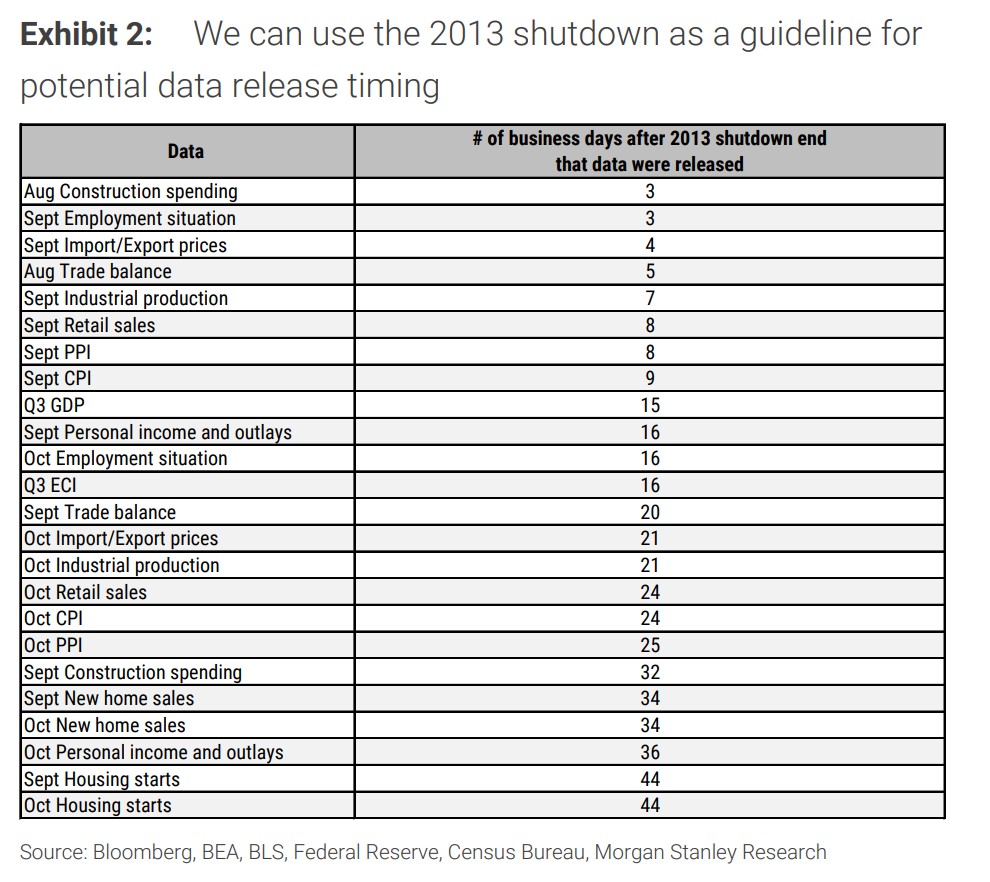

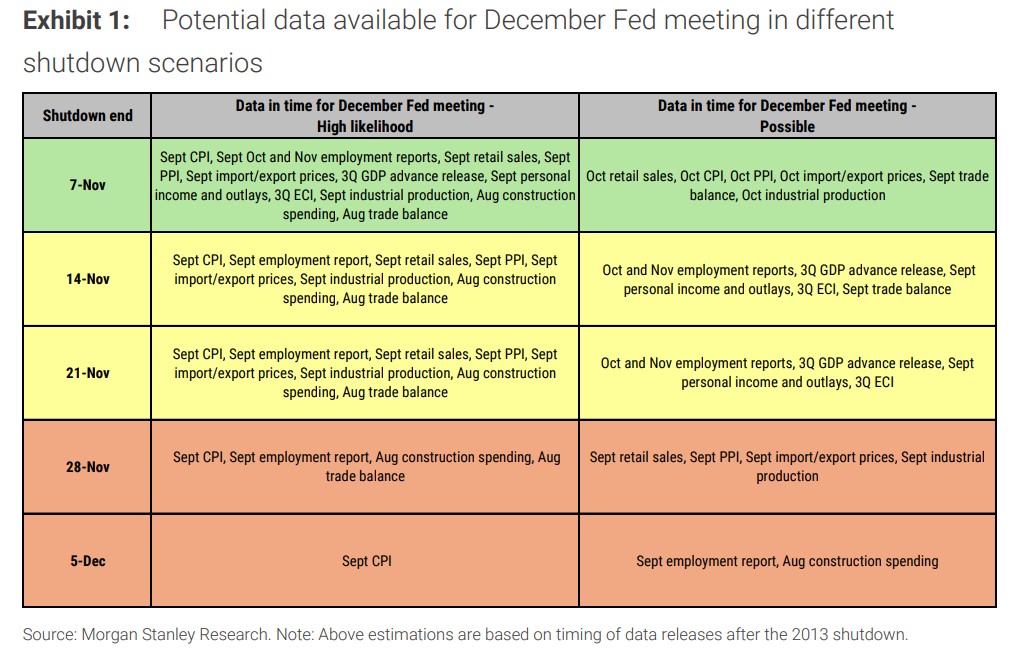

The length of the government shutdown directly determines the data foundation for the Federal Reserve's decisions. Morgan Stanley's research report conducted a scenario analysis, with economist Michael T Gapen's team using the 2013 government shutdown as a reference to predict the data the Federal Reserve might obtain under different shutdown end dates.

-

Scenario 1: Ends next week. If the government quickly reopens, the Federal Reserve is likely to receive three employment reports for September, October, and November, as well as key data such as the September and possibly October CPI and retail sales before the December meeting. Morgan Stanley believes this data would be sufficient to support a rate cut decision.

-

Scenario 2: Ends mid-November. In this case, the data will become "more limited," and the Federal Reserve may only receive employment, retail, and inflation reports for September. However, Morgan Stanley's analysis suggests that state-level unemployment data and private sector indicators may fill some gaps, allowing the Federal Reserve to still potentially proceed with a rate cut

-

Scenario 3: End after Thanksgiving (late November). This is the most pessimistic scenario. By then, the Federal Reserve is likely to only have the CPI and employment report from September, while there is a risk of not obtaining key data such as September retail sales. In this "data vacuum," unless there are strong signals of deterioration from state levels or the private sector, the likelihood of the Federal Reserve pausing interest rate cuts in December will be higher.

In short, the longer the closure lasts, the lower the probability of interest rate cuts.

Citigroup: Closure may end within two weeks

In contrast to Morgan Stanley's caution, Citigroup's report appears more optimistic. Citigroup stated that it is "increasingly confident" that the government shutdown will end within the next two weeks.

The report pointed out several imminent pressure points:

-

Impact on livelihoods is already evident: Benefits from the Supplemental Nutrition Assistance Program (SNAP) ceased on November 1, affecting up to 42 million Americans.

-

Military pay crisis is imminent: Funds for paying military salaries are about to run out.

-

Political opportunity: Upcoming local elections may create new momentum to break the political deadlock.

Citigroup predicts that once the government reopens as scheduled, data releases will quickly resume, and the Federal Reserve "may receive up to three employment reports" before the December meeting. This will provide ample basis for decision-making. Therefore, Citigroup maintains its baseline forecast: the Federal Reserve is expected to cut rates by 25 basis points in December, January, and March.

The above content is from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)