Can global central banks be more accommodative?

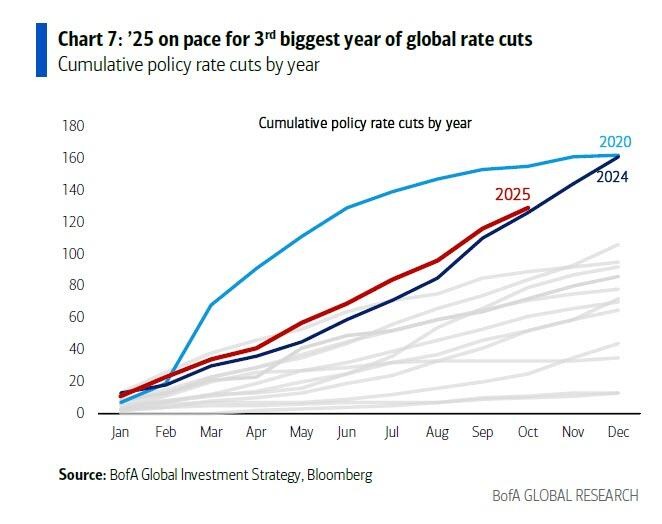

So far this year, central banks around the world have cut interest rates 129 times, which is set to become the third highest number of rate cuts in history. Can liquidity become even more accommodative? Bank of America’s Hartnett believes that factors such as Powell's hawkish stance and record bond issuance for AI infrastructure may affect liquidity trends. He suggests that for investors looking to hedge against an unexpected tightening of financial conditions in the fourth quarter, the best stop-loss trading strategy is to go long on the US dollar

So far this year, central banks around the world have cut interest rates 129 times, which is set to become the third highest number of rate cuts in history.

Can liquidity become even more accommodative?

Bank of America’s Hartnett believes that factors such as Powell's hawkish stance and record bond issuance for AI infrastructure may affect liquidity trends. He suggests that for investors looking to hedge against an unexpected tightening of financial conditions in the fourth quarter, the best stop-loss trading strategy is to go long on the dollar.