Hawkish Federal Reserve + Dovish Bank of Japan = Yen depreciation?

JP Morgan believes that Powell's press conference demonstrated a hawkish stance, while Ueda Kazuo sent dovish signals, with policy divergence driving the USD/JPY to break above 154, reaching a new high. Currently, "high market trading" dominates the market, with fair value around 154.5, and there is still short-term upside risk. However, when USD/JPY exceeds 155 significantly, the risk of Japanese official intervention will increase sharply, becoming a "ceiling" for the exchange rate's upward movement

The policy divergence between the Federal Reserve and the Bank of Japan is significantly shaking up the foreign exchange market, with the yen likely to be the first to bear the brunt.

On November 3rd, according to news from the Chase Trading Desk, JP Morgan stated in its latest research report that the Federal Reserve unexpectedly displayed a hawkish stance at its October meeting, raising doubts about a rate cut in December, while the Bank of Japan maintained a dovish posture, rejecting the market's expectations for a rate hike. This stark contrast has directly led to a significant weakening of the yen.

The report pointed out that Federal Reserve Chairman Jerome Powell's hawkish remarks after the October FOMC meeting caught the market off guard, and his cautious attitude towards the prospects of a December rate cut reignited expectations for a strong dollar. Meanwhile, the Bank of Japan kept interest rates unchanged at its highly anticipated October monetary policy meeting, defying market expectations for a 25 basis point hike, and Governor Kazuo Ueda's subsequent press conference further released dovish signals.

This policy divergence has directly pushed the USD/JPY to quickly break through 153 from around 152.20 yen, and it subsequently rose above 154, reaching a new high since mid-February. Affected by the policy divergence of the two major central banks, JP Morgan raised its USD/JPY forecast, expecting it to reach 156 in the fourth quarter of 2025, significantly higher than the previous forecast of 142.

(Daily candlestick chart of USD/JPY exchange rate)

The bank noted that the current exchange rate trend reflects the ongoing impact of "high market policy trading," which is a strategy combination of buying Japanese stocks and selling yen. Based on a model of the TOPIX index and the probability of a rate hike by the Bank of Japan in December, the fair value of USD/JPY is around the mid-154 range, indicating that there is still upward risk in the short term, but when USD/JPY significantly exceeds the 155 level, the risk of intervention by Japanese authorities will sharply increase, which could become a "ceiling" for further upward movement in the exchange rate.

The Federal Reserve's "Hawkish Surprise" Leaves Dollar Outlook in a Fog

JP Morgan stated that Federal Reserve Chairman Jerome Powell's "far from dovish" remarks at the press conference following the October FOMC meeting have shaken the market's general expectations for a rate cut in December.

This reflects an earlier tension within the committee between the dual goals of employment and inflation than the consensus and JP Morgan's expectations, especially against the backdrop of a nominal growth rate maintaining a healthy level of around 5%.

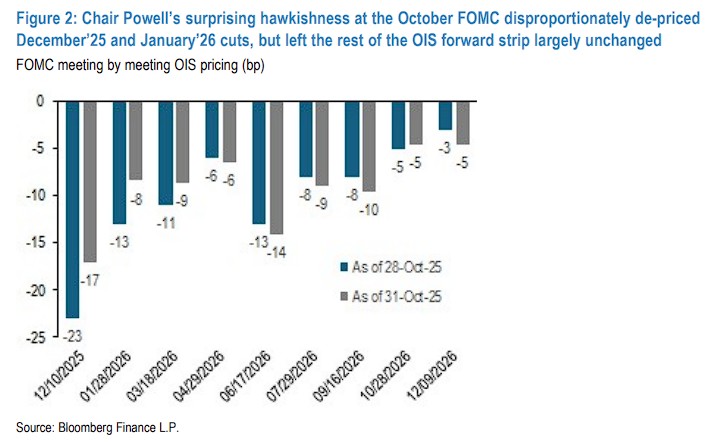

From the reaction of the OIS curve, the market mainly adjusted down its expectations for rate cuts in December and January, but there was limited adjustment to the rate cut expectations for subsequent meetings in 2026.

(Chairman Powell's unexpectedly hawkish stance at the October FOMC meeting led the market to significantly lower its pricing expectations for rate cuts in December 2025 and January 2026, but had little impact on the rest of the OIS forward curve.) JP Morgan believes that this asymmetric reaction indicates that the market is skeptical about the persistence of the Federal Reserve's hawkish shift, especially considering the Fed's long-standing self-identified asymmetric dovish tendency, the possibility of negative non-farm employment data following the end of the government shutdown, and the risk of the Fed's independence issue resurfacing early next year.

The market generally believes that once signs of a weak labor market appear, this hawkish tone will be difficult to maintain, which limits the further upside potential of the dollar.

Notably, JP Morgan emphasizes that although the USD/JPY has surged due to policy divergence, its exchange rate has begun to "overshoot" and is approaching a sensitive area that could trigger intervention. These factors collectively make the short-term outlook for the dollar "more ambiguous," limiting the conditions for a trend-driven dollar bull market.

The Bank of Japan's "dovish" tone leads to significant adjustments in yen forecasts

The research report points out that contrary to widespread market expectations, the Bank of Japan decided to keep its policy interest rate unchanged at 0.50% during the highly anticipated October monetary policy meeting, rather than raising it by 25 basis points as previously expected by JP Morgan. The post-meeting "Outlook Report" also made no revisions to economic growth and inflation forecasts.

Bank of Japan Governor Kazuo Ueda continued the dovish tone in the subsequent press conference, triggering widespread selling of the yen. The USD/JPY exchange rate quickly surged from around 152.20 before the meeting, breaking through the 153 and 154 levels.

JP Morgan economists believe that this decision by the Bank of Japan reflects its respect for the "Takaichi government" pursuing policies of reflation and yen depreciation. Based on this, JP Morgan predicts that the Bank of Japan's next rate hike may be delayed until January next year, and thus significantly raised its USD/JPY exchange rate targets:

Q4 2025: 156 (previously 142)

Q1 2026: 152 (previously 139)

Q2 2026: 151 (previously 139)

Q3 2026: 150 (previously 139)

"Takaichi trades" dominate the market, but intervention risks are accumulating

The report notes that the recent movements of the USD/JPY can no longer be simply explained by the interest rate differential between the US and Japan.

The bank believes that market dynamics have been dominated by the so-called "Takaichi trades"—a trading pattern of "buying Japanese stocks and selling yen" triggered by the cooling expectations of an early rate hike by the Bank of Japan.

JP Morgan points out that a model based on the TOPIX index and the probability of a rate hike in December shows that the fair value of USD/JPY is around 154.5. As long as the "Takaichi trades" continue and the Bank of Japan remains inactive, the short-term risks for USD/JPY still lean towards the upside.

However, the research report also states that the upside potential is not unlimited. JP Morgan emphasizes that when the exchange rate is "far above 155," the risk of policy intervention will significantly increase

Japan's newly appointed Finance Minister, Shunichi Suzuki, has issued a warning that he is "paying close attention to the movements in the foreign exchange market with a sense of urgency," which is seen as a preliminary signal of intervention. Verbal or actual intervention from the Japanese Ministry of Finance, a hawkish shift from the Bank of Japan, or pressure from the United States could all limit further increases in the exchange rate.

Looking ahead, JPMorgan Chase expects that after the Bank of Japan's next interest rate hike in January next year, the USD/JPY will gradually return to a downward trend