$9.7 billion AI cloud deal! Microsoft partners with Dell to support new cloud service provider IREN and jointly build a supercomputing center in Texas

Microsoft has signed an approximately $9.7 billion AI cloud agreement with Australian new cloud service provider IREN, marking its largest external computing power procurement in history. IREN will purchase $5.8 billion worth of GPU equipment from Dell and build a super-large computing power center in Texas. This move highlights Microsoft's urgent need to alleviate the AI computing power shortage and also promotes the rapid rise of "new cloud" service providers like IREN, becoming a new force in AI infrastructure competition

Microsoft has reached a nearly $10 billion cloud service agreement with specialized computing power provider IREN, becoming the largest customer of this Australian company. This deal not only highlights the tech giant's demand for artificial intelligence computing power but also marks the rise of a new wave of "new cloud" service providers focused on AI infrastructure.

According to reports, Microsoft has signed an agreement worth approximately $9.7 billion with Australia-based IREN Ltd. for its artificial intelligence cloud capabilities. This five-year agreement will enable Microsoft to utilize IREN's accelerator systems built on the NVIDIA GB300 architecture located in Texas to support its growing AI workloads.

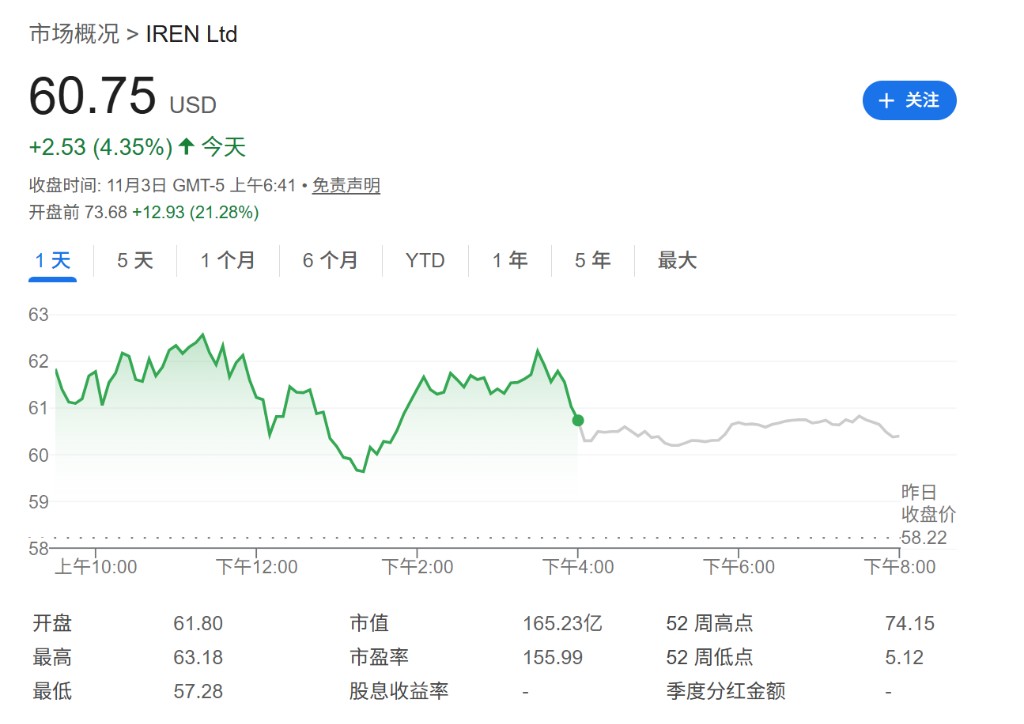

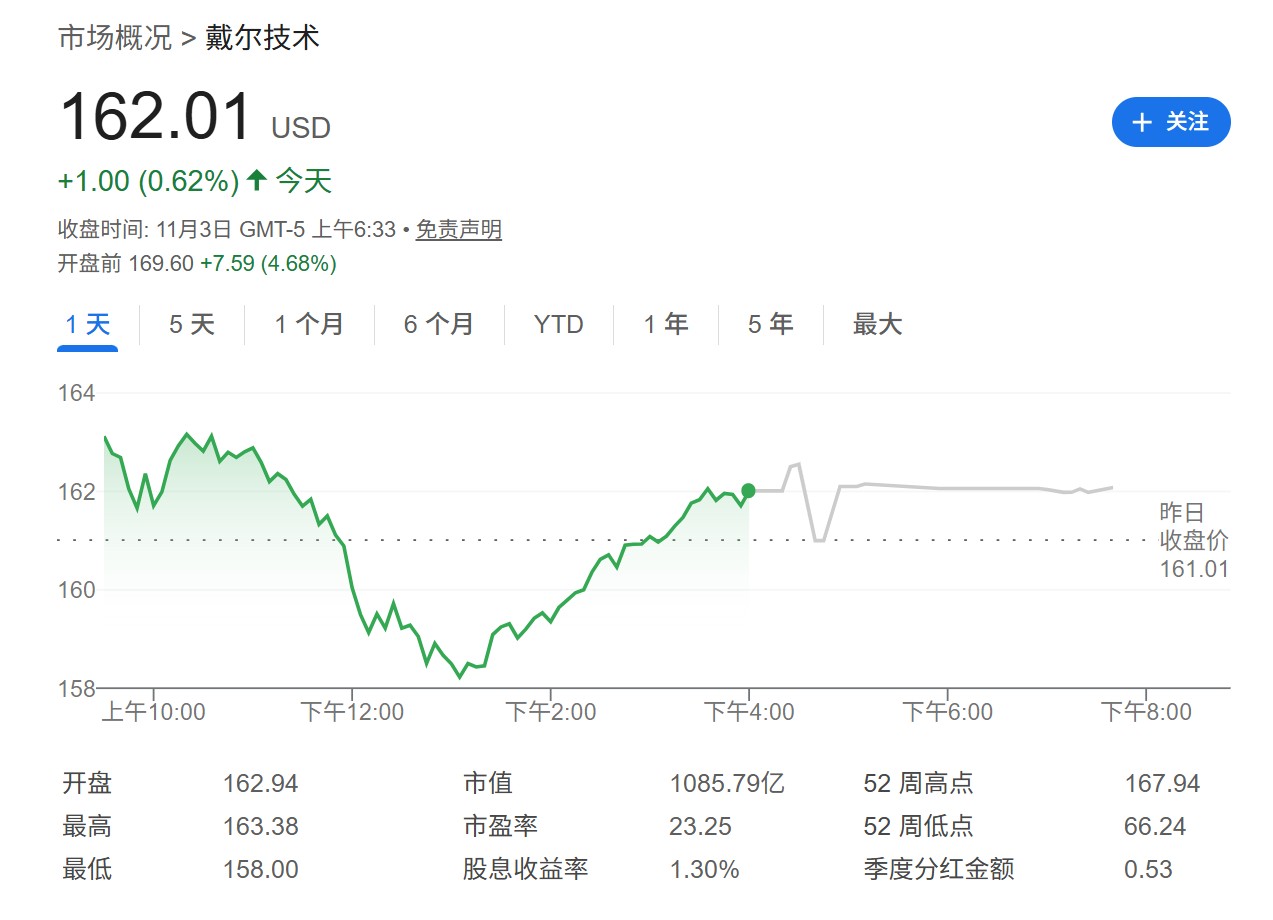

According to a statement released by IREN on Monday, the agreement includes a 20% upfront payment. IREN also announced that it has agreed to procure $5.8 billion worth of essential GPUs and related equipment from Dell Technologies. Following the announcement, IREN's U.S. stock pre-market gains expanded to nearly 30%, while Dell Technologies' U.S. stock pre-market rose over 5%.

This deal is Microsoft's latest significant move to address its computing power bottleneck. With the surge in demand for its Azure cloud services and partner OpenAI, Microsoft is facing immense pressure on data center capacity. Just last week, Microsoft stated in its earnings report that the company is working to secure enough cloud capacity to fully meet customer demand, and collaboration with external suppliers like IREN is a key strategy to tackle this challenge.

Order Details: Five-Year Contract with $10 Billion Revenue Expectation

According to the terms of the agreement, once the deal is fully implemented, it is expected to bring approximately $1.94 billion in annualized revenue to IREN. IREN CEO Daniel Roberts stated via email that it will occupy about 10% of IREN's total capacity, allowing the infrastructure provider room to sign more contracts and generate additional revenue.

To support this massive agreement, IREN also disclosed that it has agreed to purchase the necessary GPUs and related equipment from Dell for $5.8 billion. This hardware procurement is fundamental to ensuring its ability to deliver cutting-edge AI computing power to Microsoft. Daniel Roberts stated:

“We have always viewed major hyperscale cloud service providers as natural partners. As their computing needs and our AI cloud capabilities grow, these conversations are accelerating.”

These newly procured GB300 systems will be deployed in phases at IREN's facility located in Childress, Texas. The facility is planned to have a capacity of 750 megawatts, with deployment work expected to continue until 2026. Additionally, Daniel Roberts mentioned that the company has a larger capacity of up to 2 gigawatts (GW) at its Sweetwater hub near Abilene, Texas, and is seeing "strong interest in large-scale AI infrastructure deployment there."

The Rise of "New Cloud" Service Providers

The success of IREN is a microcosm of a broader industry trend, namely the rise of "new cloud" service providers. These companies are data center operators focused on artificial intelligence, competing to provide the much-needed computing power for large-scale cloud service providers like Meta and top AI companies like OpenAI. Notable companies in this field also include CoreWeave, Nebius Group NV, Crusoe, and Nscale.

It is worth noting that many of these companies, including IREN, originated from Bitcoin mining enterprises, leveraging their experience in building and operating large-scale computing clusters to successfully transition into the more profitable AI sector. Driven by the AI boom, this Australian company listed on NASDAQ has seen its stock price perform remarkably, with a year-to-date increase of 480% as of last Friday's close.