$27 billion and Zuckerberg's financial skills: spending other people's money to buy one's own computing power

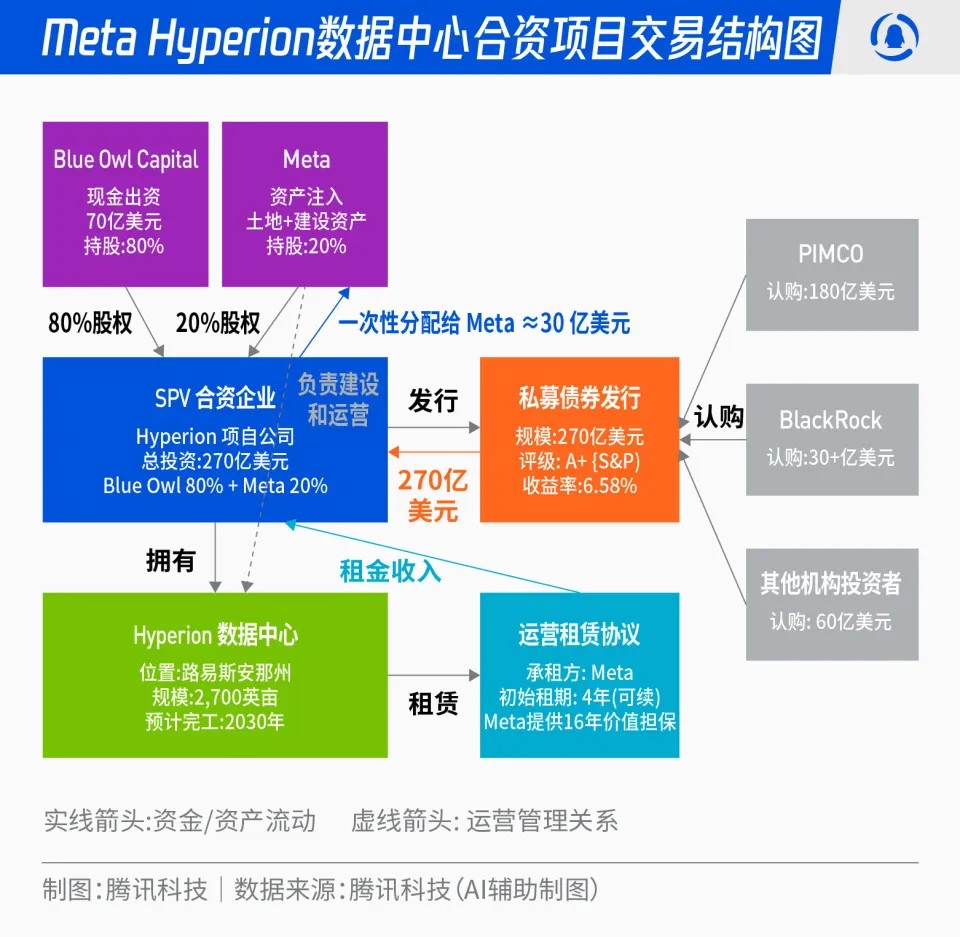

Meta's revenue in the third quarter reached $51.2 billion, a year-on-year increase of 26%, but capital expenditures are expected to rise to $70-72 billion, with higher figures projected for 2026. Due to a one-time tax impact, GAAP earnings per share were only $1.05, and the stock price fell over 13%. Meta announced a $27 billion "Hyperion" data center joint venture project, with Blue Owl contributing 80% and Meta contributing 20%. Bonds will be issued through an SPV, and the assets will not be included in Meta's balance sheet, with the data center being leased back to Meta long-term. This design provides a new financing model for the AI industry

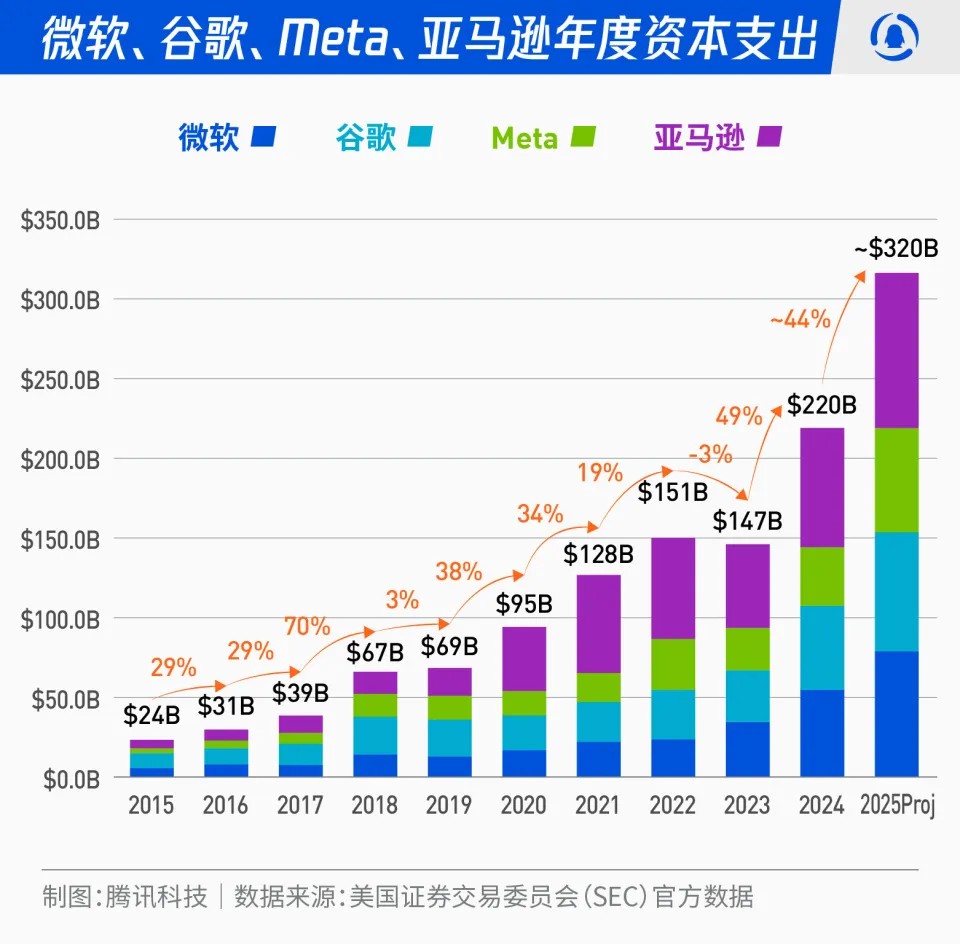

At the end of October, Meta delivered a contradictory report card: third-quarter revenue was approximately $51.2 billion, a year-on-year increase of 26%, setting a historical high; but at the same time, it raised its 2025 capital expenditure to $70-72 billion and clearly stated that the absolute capital expenditure for 2026 would be even larger, with a significant acceleration in total expense growth. These investments are primarily directed towards AI infrastructure construction, incremental cloud spending and depreciation, as well as AI talent compensation.

Worse still, a one-time tax impact of approximately $15.9 billion resulted in a GAAP earnings per share of only $1.05, far below market expectations. After the earnings report was released, the stock price significantly retreated, dropping over 13% in two trading days, with the main market question being, "When will we see returns from this massive investment?"

In fact, before the Q3 earnings report was released, Meta announced a $27 billion "Hyperion" data center joint venture project in mid-October. The transaction structure is as follows: Blue Owl contributes about 80%, Meta contributes about 20%, issuing approximately $27 billion in A+ rated bonds through an SPV, along with about $2.5 billion in equity, anchored by long-term institutional funds such as PIMCO and BlackRock.

The key design is: these assets do not enter Meta's balance sheet, and after the data center is built, Meta will lease it back long-term while retaining operational control.

Looking at the development history of various industries, there is a very clear rule: when assets are financialized and securitized, the industry often experiences explosive growth.

The demand for capital in the AI industry is far greater than in most previous fields, making it one of the "most capital-intensive" industries. In the face of this challenge, the industry has been actively exploring solutions, including innovative models that combine RWA (real-world assets) with the AI industry.

Other people's stones can be used to polish jade.

Meta's design is a typical case of such attempts.

01 Financing Layering, Risk Pricing: The Structured Path of the $27 Billion Intelligent Computing Center

The core mechanism of the entire transaction can be divided into four levels:

Step one, equity layering reduces on-balance sheet pressure. Meta only invests 20%, while Blue Owl invests 80%. This means Meta provides technology and branding, while Blue Owl provides funding. This way, Meta does not have to pay out a large sum of cash at once, nor does it have to include this investment on its balance sheet, avoiding excessive financial leverage.

Step two, financing through an SPV structure. Morgan Stanley helped establish a dedicated company, namely an SPV (Special Purpose Vehicle), which can be understood as a dedicated project company. By issuing bonds through the SPV, the assets and risks of this financing are isolated from the parent company. This SPV issued $27 billion in A+ rated bonds and $2.5 billion in equity, packaging the future cash flows of the data center into a financial product—tentatively called "AI Infrastructure Bonds," sold to qualified investors according to contractual termsStep 3, Meta leases back the computing center. After the data center is built, Meta does not directly own it but signs a long-term lease. From an accounting perspective, this money becomes an annual operating expense (OpEx) rather than a one-time large capital expenditure (CapEx). This way, Meta can alleviate pressure on its balance sheet, maintain a high credit rating, and continue to operate the computing center.

Step 4, introduce the Residual Value Guarantee (RVG) mechanism. Meta guarantees that the value of this data center will still be assured after 16 years. If the actual selling price of the relevant assets in the future is lower than a certain guaranteed price, Meta, as the "backstop," is responsible for making up the price difference. This is equivalent to adding a layer of "insurance" to the bonds, thereby granting the bonds an A+ rating.

Despite the RVG guarantee and the higher rating, investors still demand an interest rate that is 225 basis points, or 2.25 percentage points, higher than U.S. Treasury bonds as risk compensation. This interest rate is even higher than that of corporate bonds directly issued by Meta. Why is this the case? Because these structured bonds carry more uncertainty: they rely on the cash flow performance of the underlying assets, depend on whether the RVG counterparty can fulfill its commitments, and face complexities in legal structure and relatively poor liquidity. These additional risks naturally require a thicker risk premium.

Through this design, the $27 billion data center investment is structured as A+ rated debt with a small amount of equity, held by insurance companies, pension funds, and other long-term capital. Meta retains operational control but converts capital expenditures into operating expenses, thereby reducing financial leverage and maintaining its credit rating.

02 The Benefit-Risk Trade-offs for Meta and Bond Buyers

Specifically, what are the benefits and risks of this design for Meta and bond investors?

For Meta, the first benefit is optimizing the balance sheet. Meta converts the $27 billion capital expenditure into an off-balance-sheet asset plus a long-term lease model, with a special purpose vehicle (SPV) undertaking construction and holding, while Meta pays rent periodically, which is recorded as an operating expense.

As a result, Meta's balance sheet does not directly bear the burden of massive project debt, presenting a better apparent leverage ratio and free cash flow, which helps maintain its credit rating and preserves space for stock buybacks and dividends.

Secondly, it accelerates the AI expansion process. Ultra-large-scale AI data centers require significant capital investment, and by bringing in Blue Owl to provide 80% of the capital, the construction speed is no longer constrained by the pace of self-owned capital expenditures. At the same time, Meta leads the construction and operational management, ensuring that the project progresses as planned and meets technical standards.

In terms of control, although it is a joint venture model, Meta is responsible for construction management and long-term leasing of these facilities, still holding the technical direction and operational standards of the computing center. When necessary, it can maintain strategic flexibility by adjusting leases or repurchasing.

The financing cost has also been optimized. By providing a 16-year residual value guarantee, Meta helps the bonds issued by the SPV achieve an A+ rating, pushing the interest rate of this ultra-long-term funding into the investment-grade range. Although it is still higher than the cost of Meta's direct bond issuance, it is lower than the typical asking price for pure project financing, and the overall efficiency may be better than financing entirely through on-balance-sheet methodsIn addition, risks are precisely priced and isolated. The uncertainty of technological depreciation and residual value is transformed into a residual value guarantee clause, where Meta only needs to make up the price difference in extreme cases, without having to bear higher comprehensive capital costs throughout the entire construction cycle.

For Blue Owl and bond purchasers, including insurance funds and pensions, this is a highly attractive investment portfolio. It simultaneously offers three layers of protection: high ratings, physical asset backing, and long-term leases with large tenants: stable rental cash flow paid by Meta, heavy assets like data centers as collateral or disposal targets, and an additional 16-year residual value guarantee provided by Meta as downside protection, making the overall risk-return structure very suitable for long-term capital allocation.

The yield level is significantly higher than bonds of the same rating. This is based on a structured private credit product with new underlying assets, facing liquidity uncertainty and risk premium space brought by ultra-long project cycles, thus the coupon rate is about 225 basis points higher than government bonds. For buyers, this provides a more substantial spread return within the investment-grade framework.

This transaction also allows investors to seize growth opportunities in the AI infrastructure sector. Blue Owl obtained 80% of the project's equity and management voice, accumulating a large amount of digital infrastructure assets. For bond investors, this is equivalent to gaining exposure to core assets with predictable cash flows in the new infrastructure field of AI computing power.

The transaction terms are clear and risks can be layered. The construction period, operation period, asset disposal after expiration or non-renewal, and the trigger path for the residual value guarantee are all written into the contract in advance. Different tiers of investors can choose different investment levels such as equity, mezzanine, or senior bonds according to their own risk preferences.

However, both parties also have their respective costs to bear.

Meta's provision of a residual value guarantee brings the tail-end risk of technological depreciation and residual value back onto itself. If the actual value of the asset is lower than expected after the contract period, or if significant technological iterations occur during the contract period causing a sharp decline in asset prices, Meta needs to make up the price difference according to the terms, which constitutes a contingent liability.

For investors, despite the dual protection of an A+ rating and residual value guarantee, there are still multiple uncertainties: Meta's creditworthiness as a counterparty, the actual progress of construction and grid connection, and the potential for drastic changes in rental prices due to technological iterations over a long cycle. Especially for a high-tech company, 16 years is a very long time during a period of significant industry transformation. Sixteen years ago, Yahoo, AOL, and MSN were still around, but with the further evolution of Web 2.0, they quickly became a thing of the past.

03 The Long-term Significance of "AI REITs"

In the financial field, there is a term called asset-backed securitization (ABS), and this new model shows that AI platform manufacturers are attempting to shift AI infrastructure from the traditional corporate capital expenditure (CapEx) model to a financial innovation model centered on private credit and ABS, which can be referred to as AI infrastructure-backed securities (AIBS) The AI computing power industry has many similarities with real estate, and this new AIBS is very similar to REITs. In this way, investors can view the debt of intelligent computing centers as a new type of fixed income product that is "high-rated and low-volatility," while operators can quickly expand using the SPV model without affecting the balance sheet.

What constrains the scale of AI infrastructure is not the amount of capital, but the capital structure.

If this model succeeds, the computing power industry can drive a larger-scale infrastructure boom with financial strength. The industry’s hot discussion about the internal circulation driven by Nvidia-OpenAI has found a breakthrough for capital, continuously injecting liquidity.

Next, what the industry needs to allocate is just electricity, green and centralized electricity.

Author of this article: Yao Jinxin (J Shu), Xiao Jing, Source: Tencent Technology, Original Title: "270 Billion Dollars and Zuckerberg's Financial Skills: Spending Other People's Money to Buy Your Own Computing Power"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk