Reconsidering Storage: How Long Can Price Increases Last?

The storage market continues to rise in price due to strong demand from AI data centers, and this trend is expected to last until next summer. TrendForce points out that DRAM and NAND prices will significantly rebound in the third quarter of 2025, mainly benefiting from urgent orders from major cloud computing companies and production cuts by industry leaders. Traditional storage manufacturers and module manufacturers have performed well in the capital market, with a surge in NL eSSD orders driving industry prices upward

The main driving force behind the storage market is the price increase of product orders.

Based on the information we currently understand and research, this wave of price increases is likely to continue, lasting until...

From the core targets, the main beneficiaries are mainly... and...

1. What happened? Continuous price increase in storage

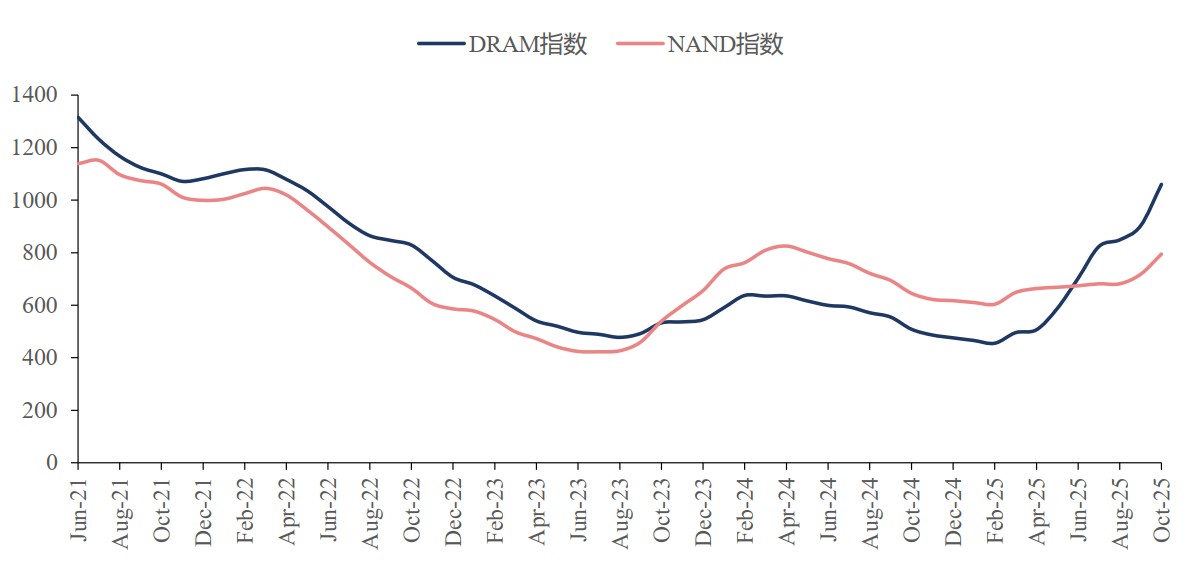

Due to the strong demand for memory driven by AI data centers, TrendForce originally believed that storage prices would enter a consolidation phase in Q4. However, the DRAM & NAND price index showed a significant rebound in Q3 2025, with the production reduction effect of industry leaders gradually manifesting, and the demand side seeing many urgent orders from major cloud computing companies, leading to signs of a price jump. With the continued growth in demand for AI infrastructure, it is expected that storage prices will maintain an upward trend in Q4, and this price increase trend will last until next summer.

Previously, in our VIP article at the end of September titled "Why Did the Storage Sector Surge by 5%? The Industrial Logic Behind the Price Increase," we mentioned—

In the AI era, inference has become the core of value, and "using storage for computation" has become a technological innovation. By migrating the vector data in the AI inference process from expensive DRAM and HBM memory to large-capacity, cost-effective SSD media, the strategic expansion of the storage layer from memory to SSD is the core driving force and industrial logic behind this round of market activity. Its core value lies in sacrificing a small portion of latency attributes in exchange for 8-16 times the storage capacity and significant price advantages, thereby enhancing the throughput of large model inference, greatly optimizing end-to-end inference costs, and providing a feasible path for the large-scale implementation of AI data centers next year.

From the performance of capital markets in the United States, South Korea, Japan, etc., the main beneficiaries of this round of sector surge are traditional storage manufacturers and module manufacturers.

2. Why is it important? Industry transformation

The stock performance of overseas leaders such as SanDisk, Samsung, and SK Hynix has been remarkable, reflecting the market's fervent expectations for the industrial logic behind the price increase. The core force of this frenzy is the unexpectedly high orders for near-line enterprise solid-state drives (NL eSSD), driving the industry into a new round of price uptrend.

Morgan Stanley pointed out that the order volume for NL eSSD from just four major clients has reached about 200EB, not including about 150EB of AI-related demand, which far exceeds the previously assumed 90EB shipment volume for NL eSSD in 2026 by two orders of magnitude. Morgan Stanley expects that the comprehensive price of flash memory will rise by another 15-20% in the first half of 2026.

As AI models shift from training to inference applications, the requirements for data reading speed and latency have become higher, making the structural importance of NAND increasingly prominent. The market undervaluation of NAND elasticity may be higher than that of HBM Morgan Stanley believes that compared to the DRAM memory and mechanical hard drives that the market generally focuses on, the flash memory market shows more significant upside potential due to the sharp reversal in its supply and demand dynamics.

Source: Morgan Stanley

Source: Morgan Stanley

AI task processing is shifting from simple text-based interactions to images and videos, resulting in a substantial increase in data capacity. Although HBM performs excellently in terms of performance, its high cost and limited supply greatly restrict the economic feasibility of large-scale deployment. On the other hand, SSDs have the advantages of low cost and large capacity, and the "storage-based computing" as a breakthrough technological paradigm is gradually maturing, driving CSPs' demand for SSD products. Under the "storage-based computing" technological paradigm, SSDs are no longer just data storage carriers but are core components deeply involved in the AI inference process. By handling warm data such as KV Cache, historical conversation records, and RAG knowledge bases offloaded from HBM and DRAM, SSDs effectively alleviate the reliance on high-cost HBM, significantly reducing the total cost of ownership (TCO).

III. What to Focus on Next? Price Increase Sustainability and Capacity Expansion Game

Morgan Stanley believes that Kioxia and SanDisk will benefit the most due to their strong business correlation. For example, Kioxia's advanced BiCS-8 technology positions it favorably in the eSSD market, with strong growth expected. Based on the expected price-to-earnings ratio of 7.2 times for the fiscal year 2027. Additionally, Samsung and SK Hynix, as giants in the storage market, will benefit from the strengthening of the entire storage product cycle.

Domestically, Tianfeng Securities believes that module manufacturers, memory chip manufacturers, and storage distribution and testing are the three most beneficial industrial links, with leading companies benefiting from the high prosperity of the industry.

From the information gathered during our research and communication, it is understood that due to the experience of previous industrial cycles where "capacity expansion leads to peak," leading companies like SanDisk are currently very cautious about capacity expansion and are unwilling to make large capital expenditures to meet peak market demand, which will further drive up the magnitude and duration of price increases.

From historical experience, looking at the quarterly financial data of Micron, Hynix, and Western Digital from 2012 to the present, when the original manufacturers' gross profit margin reaches above 35%, the probability of increased capital expenditure in the corresponding quarter also amplifies.

If we assume capacity expansion, as storage chips develop towards higher density, the performance requirements for etching, thin film, and bonding processes are becoming increasingly demanding, highlighting the importance of etching equipment, thin film equipment, and bonding equipment. In addition, with the global storage prosperity cycle approaching, the willingness of original storage manufacturers to expand capacity is strengthening, and the imminent IPO of domestic storage manufacturers will have a strong stimulating effect on the demand for related industrial chains.  Risk Warning and Disclaimer

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk