The personnel changes in the hundred billion private equity firm have undergone a "leopard change," with the behind-the-scenes big boss replaced!

A private equity firm's equity structure has changed, with a high-performing fund manager becoming the largest shareholder and actual controller. Recently, the firm announced plans for a "temporary opening" on September 30, 2025, allowing investors to redeem their investments. This move typically signals significant changes in the private equity industry, which may affect client interests

Three years ago, a private equity institution quietly established by a group of public fund managers was founded in Shanghai.

What puzzled the market was that among the partners, two of the historically larger and more reputable fund managers held unexpectedly "weak" shareholding ratios; while the largest shareholder, who was not well-known, occupied a controlling position.

There were rumors in the market that a more powerful capital force stood behind this private equity firm, leading to a new ranking of shareholding, and some even speculated that a certain "private equity giant" was hidden among its shareholders, with tales of a leader of a hundred billion-level fund personally selecting talents and forming a team. However, none of these were confirmed.

The accumulation of time ultimately led to a change in results.

Information from the industry indicates that the latest shareholding structure of this private equity firm has changed, with the most outstanding private fund manager "taking over" the position of the largest shareholder and actual controller, while another equity fund manager occupies the position of the second largest shareholder.

Although the corporate governance results of this institution still leave the outside world "in the fog," the power landscape has finally aligned with industry common sense and has begun to become "clear."

A Notice of "Temporary Opening"

Recently, an inconspicuous announcement has once again drawn significant attention to Qincheng Fund within the industry.

Channel information shows that the "Qincheng Jinxuan Senyu XX Private Securities Investment Fund," managed by Lin Sen, will arrange a "temporary opening" on September 30, 2025.

The fund manager explained that this move is due to a change in the controlling shareholder and actual controller of the fund manager. According to the contract, investors are allowed to temporarily redeem their investments as the change approaches.

"Simple Wording" Hides "Deep Meaning"

On the surface, this is merely a procedural operation, but in the private equity industry, such "temporary openings" often conceal deeper meanings.

Insiders revealed to Zhi Shi Tang: "Temporary openings" are usually actions taken only when there are significant changes at the company level, major events affecting the product, or when the market faces important junctures.

The occurrence of such actions often signifies the emergence of "extraordinary" circumstances. Moreover, it implies potential significant adjustments to client interests, thus necessitating a special arrangement for open subscriptions and redemptions, allowing existing investors the opportunity to reconsider whether to continue investing.

And Qincheng Fund has done just that, arranging this temporary opening specifically during the normal closed operation phase of the fund, and clearly stating that "no redemption fees will be charged."

Executive Filing Information "Abnormal Movement"

The announcement from Qincheng Fund has already revealed the direction of the "abnormal movement" — a change in the company's "actual controller."

The latter is evidently a significant event that usually has a huge impact on the long-term governance, management system, and team stability of private equity firms.

Subsequently, more information was disclosed. On October 16, the website of the Asset Management Association of China updated a notice related to Qincheng Fund:

If the temporary opening day is merely a surface signal, then the changes in regulatory filing information confirm the fact of the company's "power restructuring."

According to the association's disclosure, the "significant event change" application submitted by Qincheng Fund involves key items such as changes in the qualification proof documents of the main body, changes in contributors, changes in the actual controller/first largest shareholder, and changes in the legal opinion letter for manager registration From a compliance perspective, this is already one of the core categories of changes.

The status bar indicates that this application is currently in the "Returned for Correction" stage, meaning that the association has requested the manager to further improve the documents or clarify details after reviewing the materials.

Legal Person "Has Changed"

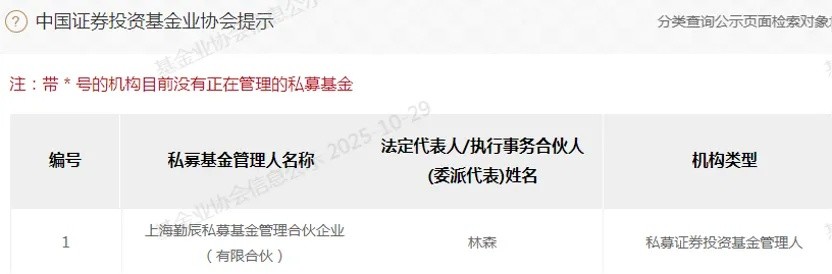

Additionally, the association's information also shows that Lin Sen is currently the legal representative and executive partner (designated representative) of Shanghai Qincheng Private Fund Management Partnership (Limited Partnership).

In other words, in the new business and filing system, Lin Sen's role is likely not just as a "fund manager," but appears in a more important legal role sequence within the company.

In response to the regulatory filing, the business registration change was completed as early as September 1, 2025.

According to the business information statistics from Tianyancha:

On September 1, the executive partner of Qincheng Fund changed from "Shanghai Qincheng Enterprise Management Consulting Co., Ltd." to Lin Sen personally; on the same day, the company's contact person changed from Liu Yuekai to Zhang Hang, and a new partnership agreement was filed.

Thus, the "evidence" of Lin Sen's control over Qincheng Fund is becoming increasingly substantial.

Clear "Timeline"

Looking back, the timeline of this set of data changes is very clear:

September 1: Business change completed → October 16: Filing change submitted to the Asset Management Association → Association returned for correction.

In the compliance path of shareholder changes for private fund managers, business changes are often the first step, indicating a preliminary adjustment of control;

The filing application submitted to the Asset Management Association is the second step—the regulatory confirmation stage.

Only when the association formally approves does the new shareholder structure and legal representative information count as "effective filing," making it a compliant entity, which also has the opportunity to be officially recognized by the market.

In other words, Qincheng Fund is currently in a transitional phase of "old owner exiting, new owner correcting."

Shareholder List "Changes Face" to Individuals

If the temporary opening and filing correction unveiled the "veil" of personnel changes, then the business change records of this hundred-billion private fund directly revealed the "equity bottom line" of Qincheng Fund.

According to the business information, on September 1, 2025, there was a significant adjustment in the investors and funding methods of Qincheng Fund.

The original two partnership enterprises—Shanghai Lijuchen Enterprise Management Consulting Partnership (Limited Partnership) and Shanghai Qincheng Enterprise Management Consulting Co., Ltd.—have all exited.

In their place are three individual shareholders: Lin Sen, Cui Ying, and Zhang Hang. The three contributed 5.1 million yuan, 2.9 million yuan, and 2 million yuan respectively, holding shares in proportions of 51%, 29%, and 20% This means that Qincheng Fund has officially completed the transition from "penetrating partnership shareholding" to "direct personal shareholding."

After "straightening out" the company's equity, it is now clearly controlled by three individuals. The previous indirect holding structure, which implemented an intermediate corporate entity, has been abandoned.

Still the Original "Founders"

In fact, the three individuals mentioned above are all founding members who joined Qincheng Fund when it was established in 2022 and independently manage their own products.

However, in the early days of the company's establishment, the existence of the intermediate holding company meant that decision-making power was more inclined towards those who could control the intermediate entity, rather than necessarily being related to the proportion of investors. (Unless there were other "drawer agreements" behind these platforms and individuals).

Of course, the existence of the intermediate holding platform also led to different tax planning paths for the company compared to individuals.

But in terms of specific numbers, the market qualifications and early equity proportions of these founders have always been somewhat unclear to outsiders.

Lin Sen worked overseas in his early years, serving in the risk management department and foreign exchange interest rate trading department of State Street, and was a fund manager at the international bond giant Pacific Investment Management Company (PIMCO) before returning to China in 2015 to join E Fund, where he managed public fund assets of nearly 70 billion RMB.

Although Lin Sen has a strong background in fixed income investment, he completely transformed into an equity strategy fund manager after joining Qincheng.

Cui Ying and Zhang Hang previously worked at Huaan Fund and Penghua Fund, respectively. The former was once a star-level fund manager managing over 10 billion, serving as the general manager of the company's investment department, which can be understood as the leader among fund managers.

However, in the first three years of Qincheng Fund's establishment, its "decision-maker" was not determined based on previous public fund performance, management scale, and reputation.

"Number One Shareholder" Changes Position

From a timeline perspective, this adjustment did not happen overnight.

As early as April 2022, when Qincheng Fund was established, the disclosed equity structure showed that the largest shareholder of the company was Shanghai Lijuchen Enterprise Management Consulting Partnership (Limited Partnership), holding a 90% stake; the remaining 10% was held by Shanghai Qincheng Enterprise Management Consulting Co., Ltd.

At that time, when this private equity firm celebrated its first anniversary and completed its team building, the equity structure was: widely dispersed, but Zhang Hang was in the lead.

After penetration, the two corporate entities behind the scenes were indeed several early members of the Qincheng team: Zhang Hang (fund manager), Lin Sen (fund manager), Cui Ying (fund manager), Zheng Bohong (research director), Chen Chao (investment manager), and Deng Anna (marketing head).

The distribution of shares at that time was quite symbolic:

Zhang Hang held about 29%, making him the largest shareholder after penetration;

Lin Sen and Cui Ying each held 23%, together forming the core "triangle";

Research director Zheng Bohong held about 10%, while Chen Chao and marketing head Deng Anna each held 5%.

That was the structure when the company celebrated its first anniversary and completed its team building: widely dispersed, but Zhang Hang was in the lead.

Three years later, this structure has been completely reshaped

In the new round of changes, all legal partner layers have exited, and the shareholder list has been cleared, leaving only three natural persons:

Lin Sen has risen to become the new "number one shareholder" and actual controller;

Cui Ying ranks second in shares and remains one of the core members;

Zhang Hang has shifted from the largest shareholder to third.

This mode of equity migration is not uncommon in the private equity industry, yet it is highly symbolic. It often signifies the company's transition from a "co-governance during the startup phase" to a "directed leadership" stage.

Clearly, after three years of entrepreneurship, the individuals within the company should have new ideas about their respective influence and power dynamics, and these ideas will gradually "come to the surface."

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk