Uber's Q3 total bookings surged by 21%, but operating profit fell short of expectations, dropping over 4% in pre-market trading | Earnings report insights

Uber's total bookings in the third quarter of 2023 increased by 21% year-on-year, reaching $49.7 billion, exceeding analysts' expectations. However, operating profit was $1.11 billion, below the expected $1.62 billion, leading to a pre-market stock price drop of over 4%. Revenue was $13.47 billion, a year-on-year increase of 20%, and net profit was $6.6 billion, a year-on-year increase of 154%. Despite strong performance in the food delivery and ride-hailing businesses, the freight business remains in a loss position. Management expressed uncertainty about the business outlook for the coming months, with fourth-quarter guidance indicating total bookings are expected to grow by 17%-21%

On November 4th, Eastern Time, Uber announced its third-quarter earnings report before the U.S. stock market opened. For the three months ending September 30, the operating profit was $1.11 billion, while analysts had previously expected $1.62 billion. The adjusted EBITDA was $2.26 billion, which was also slightly below expectations. Despite weak revenue profits, operational data was impressive, with total bookings increasing by over 20% year-on-year to $49.7 billion, marking the largest increase since 2023.

Financial Performance:

- Third-quarter revenue was $13.47 billion, a year-on-year increase of 20%, compared to market expectations of $13.26 billion

- Net profit was $6.6 billion, a year-on-year increase of 154%

- Adjusted EBITDA grew by 33% to $2.26 billion

Core Business Progress:

- Monthly Active Users (MAPCs) grew by 17% to 189 million, with average monthly trips per user increasing by 4%

- Mobility total bookings grew by 20% to $25.1 billion, with adjusted EBITDA increasing by 21% to $2 billion

- Delivery total bookings grew by 25% to $23.3 billion, with adjusted EBITDA surging by 47% to $921 million

- Freight business remained sluggish, with total bookings flat at $1.3 billion, still in a loss position

The earnings report provided a relatively broad fourth-quarter guidance, reflecting management's uncertainty about the business direction in the coming months. The fourth-quarter guidance for total bookings is $52.25-53.75 billion (year-on-year growth of 17%-21%), lower than the 22% growth in the third quarter, and the adjusted EBITDA guidance is $2.41-2.51 billion (year-on-year growth of 31%-36%).

Strong Business Growth, Profit Pressure Remains

From the business data, Uber indeed delivered a good operational performance in the third quarter. The total bookings (Gross Bookings) in the third quarter increased by 21% year-on-year to $49.7 billion, exceeding analyst expectations. This impressive growth in total bookings was primarily driven by the mobility and delivery businesses, reflecting strong market demand.

CEO Dara Khosrowshahi stated that the growth in the U.S. market was accelerated by "the proliferation of low-cost products and easing insurance pressures," while strong summer travel activities boosted international demand. Overall trip volume also achieved the largest increase since the rebound post-pandemic.

According to the earnings report, the company achieved an operating profit of $1.111 billion for the third quarter ending September 30, far below the analyst expectation of $1.622 billion. The company's Chief Financial Officer Prashanth Mahendra-Rajah stated in his remarks that part of the reason was due to undisclosed legal and regulatory matters. Additionally, the adjusted EBITDA was $2.226 billion, which was also slightly below expectations

Can the High Growth of the Delivery Business Continue?

The highlight of the third quarter came from the Delivery business, with EBITDA soaring 47% to $921 million after adjustments, far exceeding the 21% growth rate of the Mobility business. This difference reflects the scale effects of the delivery business beginning to emerge, but it also exposes Uber's increasing reliance on a single growth engine.

The competitive landscape of the delivery market is complex, with DoorDash continuing to exert pressure in the U.S. market, while the international market faces strong resistance from local players. The Delivery business saw a revenue growth of 29%, but total bookings grew by only 25%, indicating that Uber is raising its platform commission rates, a strategy that can enhance the company's profitability in the short term.

The Freight business continues to lag, with total bookings flat at $1.3 billion and adjusted EBITDA losses of $20 million. Although the loss is relatively small, it remains uncertain when this business will achieve profitability against the backdrop of a persistently sluggish industry.

Six Strategic Areas Debut Publicly

CEO Khosrowshahi publicly outlined Uber's six strategic areas of focus for growth in the medium term on Tuesday. These areas include expanding its ride-hailing and delivery businesses, establishing a hybrid platform that includes both human and autonomous vehicles, offering various gig work types, and developing generative artificial intelligence.

Uber has made public progress in these efforts, including forming partnerships for autonomous vehicles, creating an AI labeling business for enterprises, and launching new digital tasks for drivers. The company only began sharing details of its vision earlier this year.

CFO Mahendra-Rajah stated that Uber has divested about $1.4 billion from its $10.3 billion equity investment in other companies. These proceeds will be allocated to priorities such as launching more autonomous taxis globally.

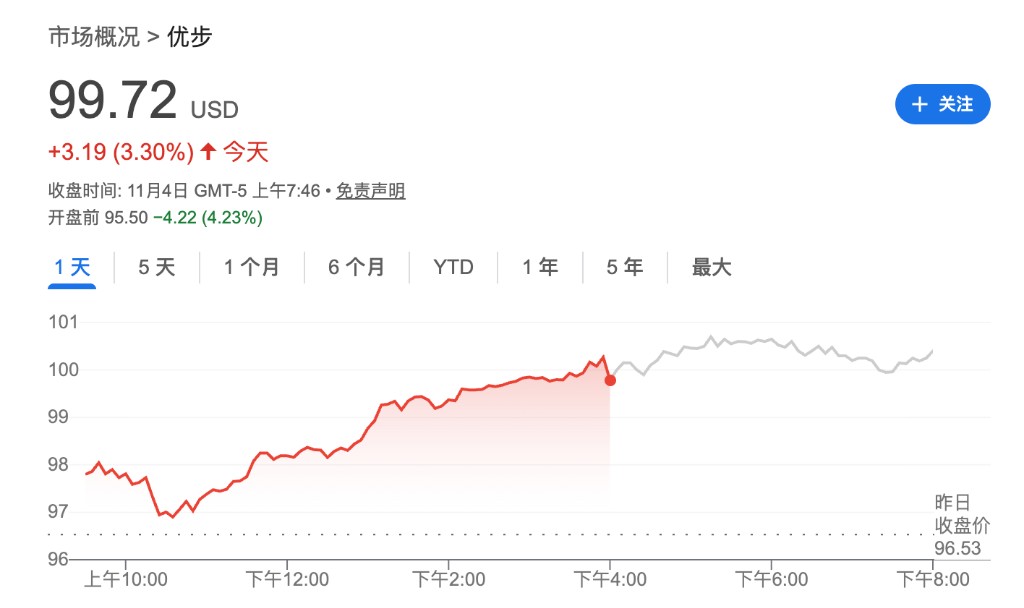

After the earnings report was released, Uber's pre-market stock price fell over 4% to $99.72 per share. Year-to-date, Uber's stock price has risen over 57%.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk