BYD begins to abandon DiChain

BYD announced that it will gradually abandon its cooperation with DiChain and instead adopt bank acceptance bills or commercial acceptance bills for payments. This move will primarily be implemented starting with small and medium-sized enterprises and is expected to be completed within 1 to 2 years. Industry insiders believe that this decision is influenced by national policy pressures and may be related to the requirements of the central bank and the Ministry of Industry and Information Technology. This change will help reduce financing costs and improve the overall financial condition of the automotive industry

"I have good news to tell you, BYD has abandoned DiChain!" On November 2, 2025, the head of a private auto parts supplier in China excitedly told Automotive Business Review, "Thank you for your calls over the past two years."

Immediately, we reached out to several BYD suppliers for more information.

"Indeed, BYD intends to cut ties with DiChain," "Payments will be converted to bank acceptance bills or commercial acceptance bills," "There will also be cash," "Starting with small and medium-sized enterprises, implementation has already begun," "BYD is currently keeping this highly confidential and cannot comment"...

These BYD suppliers have been receiving news over the past two weeks, "Currently, communication is still point-to-point, and overall it remains confidential."

Regarding why BYD wants to keep it confidential, industry insiders speculate, "The reason for choosing point-to-point communication is likely due to the limited scope," he said, "Currently, it mainly starts with small enterprises, probably because the amounts involved are smaller, which puts less pressure on BYD and has a smaller impact on DiChain."

However, many suppliers are still unaware, especially those who have already cut off supply to BYD and hold DiChain electronic debts. Some said, "There is no news yet; it should be settled after maturity." Others expressed, "It's highly likely that those already paid with DiChain will not change." But another source indicated, "It is expected to gradually abandon DiChain over the next 1 to 2 years."

Previously, Automotive Business Review reported in the article "In-depth | Survey of Hundreds of Suppliers: Payment Initiative 30 Days, Our Lives Are Harder" that relying on supply chain finance electronic debt certificates, BYD can save hundreds of millions in financing costs each year.

Why has BYD finally started to abandon DiChain?

"Because of national pressure," suppliers speculate. Some also hinted, "The state does not allow it anymore." However, it is currently unclear whether this is from the central bank, the Ministry of Industry and Information Technology, or other departments.

Automotive Business Review believes this is a significant benefit for the automotive industry and national livelihood.

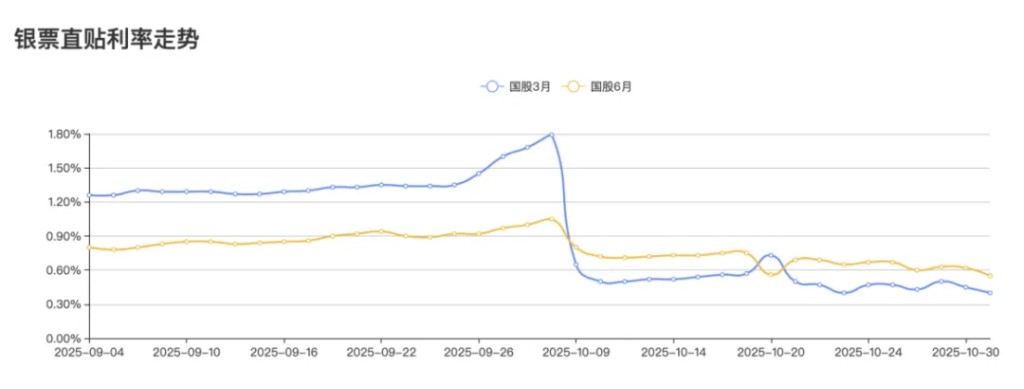

A supplier stated, "Although bank acceptance bills and commercial acceptance bills also have cycles, the impact on the reconciliation period is not significant after this conversion, but the discount interest can be much lower. Previously, the discount interest for DiChain was around 5% to 10%." Public data shows that the direct discount rate for bank acceptance bills has fallen below 1%.

A person from a major manufacturer commented, "At least this makes competition fairer for central state-owned enterprises and car companies with correct values."

Some industry insiders believe, "This way, BYD's financial transparency will improve. In the short term, its financial statements may deteriorate, but the one to two-year digestion period also gives BYD enough room to maneuver, ensuring cash flow is not affected."

Some observers bluntly stated, "The scale and impact of DiChain have become too large, far exceeding the automotive supply chain, and many regions with delayed information are still using DiChain for private financing."

The Huge Risk of Opacity

"No one knows how big the risk is." Observers here believe, "Because no one knows how much accounts payable BYD has hidden through the Di Chain method, all that can be seen are the figures on the financial statements."

The opacity of the Di Chain is also related to its nature. Unlike commercial acceptance bills and bank acceptance bills, Di Chain certificates are electronic debt certificates. The former are statutory notes, and the holder can assert rights without tracing trade disputes; the latter belong to the "contractual debt" relationship under the Civil Code, and are only protected by it.

This means that once the payer questions the transaction for any reason, the validity of the debt certificate needs to be reassessed. The opacity of the Di Chain's scale is the biggest risk hanging over suppliers and financial institutions.

According to the non-statutory nature of the Di Chain—its issuance and circulation process is managed independently by Shenzhen Di Chain Technology, a subsidiary of BYD, and it does not connect to the central bank's Electronic Commercial Bill System (ECDS)—it can be said that, apart from BYD itself, no one knows the scale.

In this situation, when all financial institutions rate BYD based on financial report data, it may lead to more "uninformed suppliers" and "uninformed financial institutions" willing to accept the Di Chain, thus causing further expansion of the Di Chain.

"BYD's quick ratio is already very tight, around 1, while the industry generally considers 1.5 to be relatively healthy." A financial person explained to Automotive Business Review, "Considering the Di Chain, the danger is evident."

He said, "This is similar to the earlier white bills, but white bills cannot be split and transferred due to their repayment risk, whereas with the help of the Di Chain, Di Chain certificates can circulate among multiple levels of suppliers, and the risk is transmitted layer by layer from the first-level suppliers."

Media reports have indicated unverified information that there are already 10,000 registered suppliers on the Di Chain, covering over 2,000 core suppliers of BYD, encompassing more than 90% of the new energy vehicle industry chain and extending into the photovoltaic and energy storage sectors. The official disclosure in 2022 indicated that service transactions had already surpassed 100,000.

Previously, Automotive Business Review had commented on the "interest transfer" aspect, but the deeper impact on the supply chain is the "voice" that BYD has formed relying on the Di Chain.

"The Di Chain is like a chip held by BYD over the suppliers, forcing suppliers holding the Di Chain to comply with BYD's demands. Whether to cooperate or reduce prices, suppliers have to consider."

"In this situation, suppliers will gradually become more constrained by BYD, and the pressure on BYD will inevitably be transmitted to the suppliers." This person pointed out, "If BYD rolls, the suppliers will roll together; if BYD collapses, the suppliers will also be in danger."

Although there is no shortage of discussions in the industry about BYD's slowdown, such as its difficulty in achieving annual sales targets. From January to October 2025, cumulative sales reached 3,701,852 units, which, although a year-on-year increase of 13.88% and a historical high for the same period, is only 67.3% of its earlier expected annual sales of 5.5 million, leaving only 2 months for sales pressure to be imagined.

Although there is no shortage of discussions in the industry about BYD's slowdown, such as its difficulty in achieving annual sales targets. From January to October 2025, cumulative sales reached 3,701,852 units, which, although a year-on-year increase of 13.88% and a historical high for the same period, is only 67.3% of its earlier expected annual sales of 5.5 million, leaving only 2 months for sales pressure to be imagined.

However, it is difficult to change the fact that BYD is "in demand" in many public opinion circles. Although no one knows BYD's true liquidity solvency, as British union activist and commentator Thomas Joseph Dunning said: "If there is a 10% profit, it is guaranteed to be used everywhere; with a 20% profit, it becomes active."

Private financing will not stop due to risk considerations. Some small and medium-sized banks are also willing to earn a profit margin, after all, the performance pressure on the banking system is also enormous now.

The opaque Di Chain has already implicated more and more interest groups.

The State Forces to Clear Mines

An industry insider pointed out that in fact, canceling the Di Chain also benefits BYD. "In the short term, BYD will indeed have a negative impact, but in the long run, the benefits outweigh the drawbacks, which is equivalent to the state helping BYD 'clear mines.'"

"It may not be obvious in a day or two, but BYD has relied on the Di Chain for nearly ten years, and it is feared that even it itself will forget that the money on the Di Chain belongs to others."

"It's like you run a barbershop and issue cards; if you issue too many cards, you might think all the money in your hands is yours and feel that you are doing well, so you might blindly expand." He reminded, "In fact, those cards are just your liabilities. BYD is the same. If it continues to blindly expand, once the market environment changes and suppliers start to 'run on' it, the consequences are unimaginable."

The term "run on" is usually used in the financial industry, but from BYD's current "token issuance rights" based on the Di Chain, it is not an exaggeration to say it has financial institution attributes. Historically, around 1857, the U.S. railway industry experienced a financial system collapse due to disorderly expansion, and the bankruptcy of Lehman Brothers caused by a "run on" was only 17 years ago.

According to the third quarter financial report for 2025, as of the end of September, BYD had cash and cash equivalents of 117.47 billion yuan, but the total of accounts payable and notes payable during the same period was 225.01 billion yuan. Additionally, considering the off-balance-sheet scale of the Di Chain in the thousands of billions, the pressure is considerable.

From Tianyancha, it can be seen that Shenzhen Di Chain Technology Co., Ltd. was established on May 30, 2016, with a registered capital of 2.6 billion yuan. The official introduction states it is a "BYD member" with a registered capital of 260 million yuan, exceeding 99% of its peers in Guangdong Province.

The period of Di Chain's establishment coincided with BYD's rapid expansion, with sales soaring from 376,000 units in 2015 to 4.27 million units in 2024. This decade was also a time for BYD's capacity expansion and global marketing network layout 2015 was undoubtedly a key year, as BYD's debt-to-asset ratio reached 68.8%, and the accounts payable turnover days (calculated using the total of accounts payable and notes payable) peaked at 172.6 days.

It is generally believed that a high proportion of operating liabilities (accounts payable, advance receipts) is healthier, while a high proportion of financial liabilities (bank loans) should be approached with caution.

DiChain has made this ratio appear healthier by managing operating liabilities—because the interest-free use of upstream suppliers' funds has kept BYD's interest-bearing liabilities at a very low amount, with the proportion of interest-bearing liabilities to total liabilities long maintained at around 5%.

However, when DiChain's scale was "no longer disclosed," the risks became more puzzling due to the "pressing pause" on information. This occurred in May 2023, when DiChain publicly stated its scale reached 400 billion yuan; it remains unknown how much DiChain has grown in the past two and a half years.

According to public information, since 2022, BYD has seen its debt-to-asset ratio exceed 75% for three consecutive years. According to the China Securities Regulatory Commission's listing review guidelines, the debt-to-asset ratio for listed manufacturing companies should be ≤75%. For exceptional cases like BYD, it requires "consideration of cash flow stability, reasonableness of debt structure," and "full disclosure of reasonableness and debt repayment guarantees."

The existence of DiChain has conveniently obscured this information.

In May 2025, Wei Jianjun announced during a live broadcast that he was "willing to pay out of pocket to audit the entire industry," targeting BYD's financial data, while comparing BYD to "Evergrande in the automotive circle."

BYD, on the other hand, showcased a comparison chart of its debt-to-asset ratio, stating that the ratio was 74.64% in 2024 and further decreased to 70.71% in the first quarter of 2025, with interest-bearing liabilities only at 28.6 billion yuan, accounting for only 5%.

Thus, BYD believes that compared to international automakers like Ford, its financial condition is relatively healthy. Moreover, BYD achieved a net profit of 40.254 billion yuan in 2024, a year-on-year increase of 34%, indicating strong profitability.

Now, BYD is beginning to abandon DiChain. Considering the scale of DiChain, reducing or even eliminating it would require increasing bank loans, which would significantly raise interest-bearing liabilities and consequently increase the debt-to-asset ratio, putting considerable pressure on the company's operations.

Regardless of whether it is a national requirement, this is undoubtedly an important milestone for the company and the industry. It can be said that the Chinese automotive industry's counter-cyclical progress has made substantial advancements.

Author of this article: Automotive Business Review, Source: Automotive Business Review, Original Title: "Shock | BYD Begins to Abandon DiChain"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk