The "Black Tuesday" for retail investors in the US stock market: Under the pressure of earnings reports and short selling, meme stocks and the cryptocurrency market both decline

On Tuesday, the retail stock index tracked by Goldman Sachs plummeted 3.6%, about three times the decline of the S&P 500 index, marking the largest single-day drop since April 10. Despite retail investors still net buying $560 million that day, it failed to prevent the Nasdaq from falling more than 2%. Analysts advise investors to respond cautiously to potential volatility on Wednesday

For retail investors keen on chasing popular stocks, the overnight U.S. stock market experienced its worst trading day since April.

On Tuesday, under the combined impact of Palantir's earnings report, bearish bets from well-known short sellers, and turmoil in the cryptocurrency market, stocks and assets that were previously favored by retail investors faced a fierce sell-off. All three major U.S. stock indices fell collectively, with the Nasdaq plunging over 2%.

According to the retail-heavy stock index tracked by Goldman Sachs, the index plummeted 3.6% that day, approximately three times the decline of the S&P 500 index, marking the largest single-day drop since April 10.

At the opening of the U.S. stock market on Tuesday, retail trading enthusiasm did not immediately wane. According to data compiled by JP Morgan, as of 11 a.m. New York time on Tuesday, retail investors were still net buying individual stocks and ETFs worth $560 million.

This may have been one reason for the market's brief rebound in the early session, narrowing the S&P 500 index's losses, but the upward momentum did not last, and the market turned downward again. Melissa Armo, CEO of the trading education platform Stock Swoosh, described the U.S. stock market's performance on Tuesday:

This happens when people start to panic and sell off.

Poor Earnings and the Entry of the "Big Short"

Specifically, two major events directly triggered the sell-off of popular retail stocks. First, Palantir's earnings report raised concerns about its growth prospects.

Wall Street Insights mentioned that Palantir's earnings report showed strong performance in the third quarter, but the market questioned the sustainability of its high valuation. This retail "darling," which has surged over 150% this year, saw a significant drop yesterday, closing down nearly 8% and continuing to decline in after-hours trading.

(Palantir's stock price in sharp decline)

(Palantir's stock price in sharp decline)

Second, regulatory filings from legendary investor Michael Burry became the last straw that broke the camel's back.

According to a 13F regulatory filing, hedge fund manager Michael Burry, known for the movie "The Big Short," established bearish positions in Palantir and chip giant Nvidia in the previous quarter.

Just days earlier, Burry had issued a warning to retail investors about excessive market exuberance, and this disclosure of short positions undoubtedly confirmed his bearish stance, quickly exacerbating market panic.

Cryptocurrency Turmoil Intensifies Sell-Off

In addition to the direct impact on the stock market, turmoil in the cryptocurrency space also heightened pressure on retail investors and dragged down stocks related to cryptocurrencies According to Wall Street Watch, the price of Bitcoin has accelerated its decline, falling below the $100,000 mark for the first time since June, dipping to around $99,932, and breaking through the 200-day moving average, marking the second-largest single-day drop of the year. Ethereum, ranked second by market capitalization, also plummeted over 10%, falling to around $3,225.

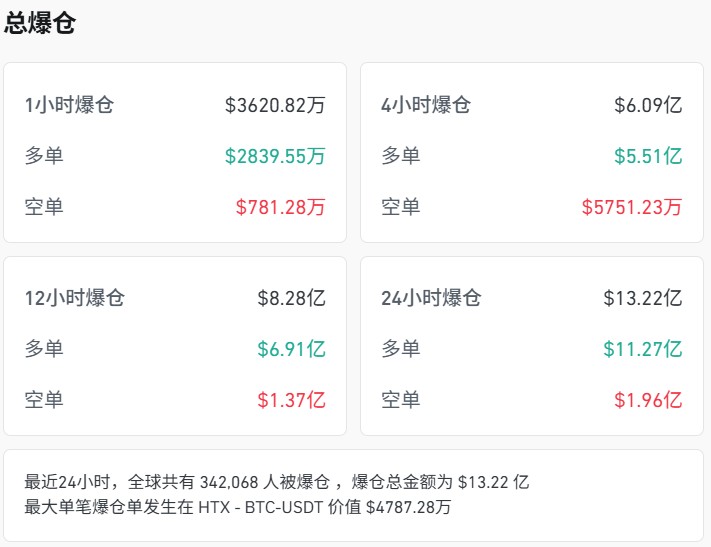

According to coinglass statistics, 342,000 people across the network were liquidated in the past 24 hours, with liquidation amounts exceeding $1.3 billion, of which long positions accounted for 85% of the losses.

The recent decline in the cryptocurrency market is not far from the historic liquidity crisis three weeks ago, which caused a market shock that led to the forced liquidation of billions of dollars in cryptocurrency leverage positions.

Looking ahead, market sentiment remains tense. Melissa Armo stated, she is preparing for another round of declines that may occur on Wednesday. She suggested:

If traders can endure some pain, they can start preparing a potential stock buying list. If not, I recommend selling