The "layoff wave" in the United States has erupted intensively, raising alarms in the job market

The wave of layoffs in the United States is intensifying, with well-known companies such as Starbucks and Amazon announcing layoffs, raising concerns among economists about the health of the job market. According to data from Challenger, Gray & Christmas, as of September, the number of layoffs in U.S. companies approached 950,000, setting a record high since 2020. Although the Federal Reserve Chairman believes that the market cooling is gradual, the scale and speed of layoffs indicate that companies are decisively cutting costs, and the previously stable situation may have come to an end

The phenomenon of "labor hoarding" that has prompted U.S. employers to cling tightly to their employees over the past few years seems to be coming to an end. With a series of well-known companies like Starbucks and Amazon announcing layoffs, a wave of layoffs is hitting the U.S. business community, raising economists' growing concerns about the health of the job market, which may be an early warning sign of a market shift.

Recent developments show that although each layoff has its own business explanation, these events collectively form a disturbing pattern. From Starbucks' corporate restructuring to Amazon attributing layoffs to artificial intelligence, and Target cutting jobs to improve operational efficiency, these seemingly isolated decisions are being interpreted by the market as a broader trend signal.

According to data from the job placement company Challenger, Gray & Christmas, this trend is strongly supported by data. As of September this year, the total number of layoffs announced by U.S. companies has approached 950,000, setting a record for the highest number in the same period since 2020. Dan North, a senior economist at Allianz Trade Americas, pointed out that when a figure is nearly the worst level since the Great Recession, "this is not an encouraging number."

Although Federal Reserve Chairman Jerome Powell believes the labor market is only experiencing a "very gradual cooling," market participants are highly alert to any signs of deterioration. The scale and speed of layoffs indicate that corporate managers are more decisively cutting labor costs to protect profits, and the previously stable situation of "low hiring, low firing" may have come to an end.

Layoff Data Hits New Highs

This year, the layoff data in the U.S. job market has been particularly striking. According to a report released by Challenger, Gray & Christmas, the number of layoffs announced in the first nine months of this year has approached 950,000. This figure is not only the highest level for the same period since the onset of the pandemic in 2020, but if excluding the special circumstances of 2020, this data even surpasses the total number of layoffs in any complete year since 2009.

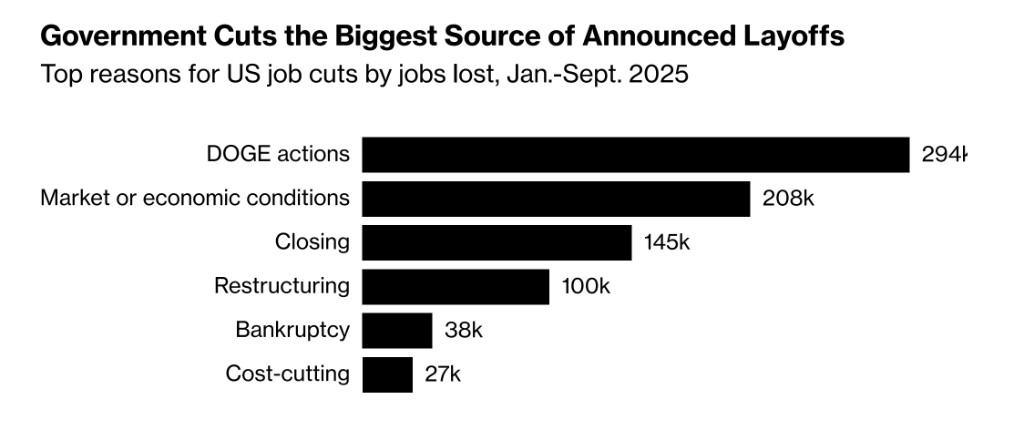

The layoff phenomenon has affected multiple industries. Government sectors are the hardest hit, with nearly 300,000 job cuts announced this year. The technology and retail sectors have also been severely impacted; for example, Southwest Airlines has conducted large-scale layoffs for the first time in its history. Due to government shutdowns and cuts to the federal statistical system during the Trump administration, official data release agencies like the U.S. Bureau of Labor Statistics have recently faced information flow issues, making data from private institutions like Challenger particularly important in assessing market conditions.

From "Labor Hoarding" to Cost Cutting

The recent wave of layoffs marks a significant shift in corporate hiring strategies. Until recently, the U.S. economy was still in what economists referred to as a "low hiring, low firing" model. Affected by recruitment difficulties during the pandemic, many companies tended to "hoard labor," unwilling to lay off employees even when business slowed down Now, the situation has changed. Citigroup economist Veronica Clark stated, "Overall, companies may feel there is no longer a need to excessively retain employees." Dan North more bluntly pointed out, "We are no longer in an environment of 'low hiring, low firing'; we are laying off." Several key factors are behind the shift in corporate attitudes. First, advancements in artificial intelligence and automation technologies have given managers more confidence when it comes to layoffs. According to a LinkedIn survey, over 60% of executives believe that AI will eventually replace some entry-level jobs. Second, to protect profits, many large companies choose to absorb additional expenses such as tariffs by cutting labor costs rather than fully passing those costs onto consumers.

Divergent Opinions Among Economists, Market Remains Cautious

Despite the concerning layoff data, economists have differing views on the future outlook of the job market. Federal Reserve Chairman Jerome Powell's remarks are relatively optimistic; he believes the market is only "very gradually cooling down" rather than facing serious problems.

However, many market observers take a more cautious stance. Clark stated that she would be more worried if the number of initial jobless claims remains stable at 260,000 or above, while currently, this data has mostly stayed in the range of 220,000 to 240,000 over the past year. Cory Stahle, a senior economist at job search website Indeed, closely monitors layoffs in non-tech industries and believes that the increase in layoffs in sectors such as transportation and retail is "the real worrying beginning."

In this uncertain environment, the demand for temporary workers has increased. According to Noah Yosif, chief economist at the Society for Human Resource Management, the demand for short-term labor services has rebounded in recent months after experiencing about three years of stagnation. This reflects that while companies are cautious about long-term hiring, they are utilizing temporary workers to fill the gaps left by laid-off long-term positions, highlighting their hesitation regarding the future direction of the economy.

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at one's own risk