The worst sell-off since April! U.S. dollar index futures continue to decline, valuation concerns impact Asian markets, gold rises over 1%

Asian stock markets experienced the most severe sell-off in seven months, with South Korea and Japan's stock indices falling more than 5% from the record highs reached on Tuesday. Following a strong rally in global stock markets driven by the AI boom and expectations of interest rate cuts, concerns over high valuations are rapidly escalating, triggering a widespread market correction, with technology stocks being the hardest hit in this round of sell-off

The "Black Tuesday" of the US stock market has spread to Asian markets, with concerns over the overvaluation of technology stocks weakening market risk appetite, leading investors to hit the brakes on the prolonged AI-driven rally.

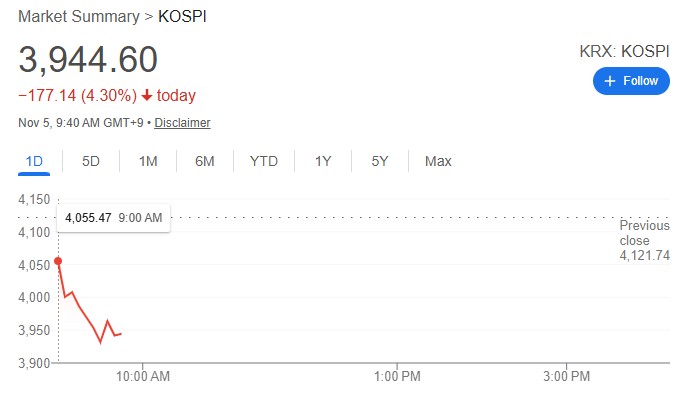

On Wednesday, US stock index futures further declined in early Asian trading, with Asian stock markets experiencing the most severe sell-off in seven months, as South Korean and Japanese indices fell more than 5% from the record highs reached on Tuesday. The South Korean Kospi 200 index futures dropped over 5% at one point, prompting South Korea to trigger the "Sidecar" mechanism at 9:46 AM local time, pausing programmatic sell orders for five minutes. This was the first time South Korea triggered this mechanism since April this year.

The following are the major asset trends:

S&P 500 futures fell 0.18%, Nasdaq 100 index futures dropped 0.34%, and Dow futures rose 0.07%, continuing the weak performance of US stocks on Tuesday;

The benchmark index of the South Korean stock market plummeted, with the Kospi index dropping 6% at one point, falling below the important psychological level of 4000 points. Valuation concerns severely impacted sectors such as chip stocks, defense stocks, and shipbuilding stocks, which had performed well recently;

The Nikkei 225 index fell over 4%, and the MSCI Asia-Pacific index dropped 1%;

In the currency market, the Bloomberg Dollar Spot Index remained basically flat; the yen strengthened for the second consecutive day, with USD/JPY down 0.16%;

The bond market showed increased demand for safe-haven assets, with the yield on the US 10-year Treasury bond remaining flat at 4.08%, and the yield on Japan's 10-year government bond falling 1.5 basis points to 1.66%;

In the commodities market, WTI crude oil fell 0.08% to $60.51 per barrel;

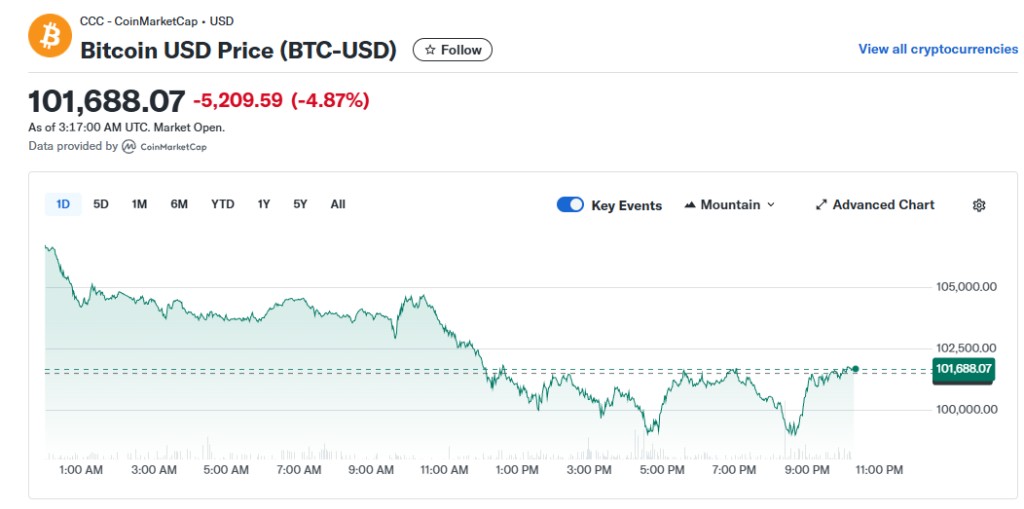

Bitcoin narrowed its decline after falling below $99,000 per coin.

Spot gold rose over 1%, reported at $3,982. Spot silver rose 1.4%, reported at $47.79.

After a strong rally driven by the AI boom and expectations of interest rate cuts, concerns over high valuations are rapidly rising among investors, triggering a widespread market correction. Technology stocks are at the forefront of this sell-off, with risk warnings from Wall Street executives further intensifying market risk aversion, leading funds to flow into traditional safe-haven assets.

This adjustment comes after the Nasdaq index has risen for seven consecutive months, with a cumulative increase of over 50% since the low in April. Several market analysts pointed out that profit-taking, the ongoing US government shutdown, the plunge in cryptocurrencies, and the strengthening of the yen are multiple factors intertwining to drive this correction.

Matt Simpson, a senior market analyst at StoneX, stated that considering the Nasdaq index's seven-month rise and over 50% increase since the April low, the current sell-off is merely a slight adjustment in the grand scheme of things. "At some point, profits need to be realized. However, when momentum shifts like it has in the global market, stop-loss orders are triggered, forcing traders to close positions in other markets to cover losses, which in turn triggers new bearish activity."

Tony Sycamore, a market analyst at IG, believes this is the beginning of an adjustment. He noted that the rally since the April low has been continuous, combined with warnings from CEOs about a correction, and the purchase of put options on Nvidia and Palantir by Michael Burry, the prototype character from the movie "The Big Short," along with the US government shutdown entering record days, all these factors combined have initiated this round of risk-averse sellingThis wave of selling is spreading from Wall Street to Asia. Charu Chanana, Chief Investment Strategist at Saxo, pointed out that this is a typical position liquidation and profit-taking day for leading Asian artificial intelligence and semiconductor stocks after reaching record highs. The volatility of large U.S. tech stocks has weakened sentiment for global growth stocks and AI concept stocks, while a significant pullback in cryptocurrencies has tightened broader risk appetite, and the strengthening yen has put pressure on Japan's export-oriented stocks.

Updated at 16:19:

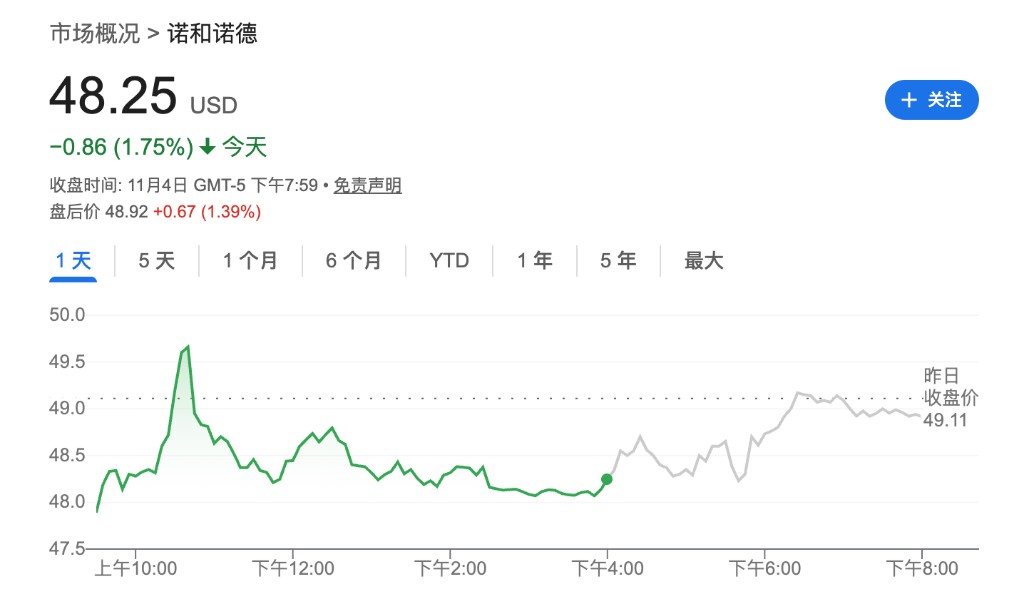

Novo Nordisk's European stock fell 4.3% as the company's third-quarter performance was below expectations, and it lowered its full-year sales growth forecast.

Updated at 15:28:

S&P 500 futures fell 0.18%, Nasdaq 100 index futures fell 0.34%, and Dow futures rose 0.07%. Stock index futures showed more declines than gains, continuing the weak performance of U.S. stocks on Tuesday.

Updated at 12:45:

Spot gold rose over 1%, trading at $3,971. Spot silver rose 1.3%, trading at $47.75.

Updated at 11:15:

The benchmark index of the South Korean stock market plummeted, with the KOSPI index dropping 6% at one point before narrowing its losses. As of the time of writing, the KOSPI index is down 3.69%.

The Nikkei 225 index's decline continues to widen, down 4.65% as of the time of writing.

The Nikkei 225 index's decline continues to widen, down 4.65% as of the time of writing.

Bitcoin rebounded after falling below $99,000, trading at $101,688 as of the time of writing.

Updated at 9:45:

The Nikkei 225 index fell over 4% during the day.

Bitcoin has fallen below $99,000 per coin, down nearly 2.5% for the day.

Bitcoin has fallen below $99,000 per coin, down nearly 2.5% for the day.

8:50 Update:

Following a decline in U.S. stocks on Tuesday, U.S. stock index futures continued to slide in early Asian trading, with the Nasdaq 100 futures, which are heavily weighted in technology stocks, leading the decline. As a result, Asian stock markets opened lower, after the MSCI Global Stock Index recorded its largest single-day drop in nearly a month.

The South Korean stock market saw a decline of more than 4% at one point, with sectors such as semiconductor stocks, defense stocks, and shipbuilding stocks leading the drop.

As investors reduce their risk exposure, market risk aversion has noticeably increased. U.S. Treasury prices have risen across the yield curve. The yen, as a traditional safe-haven asset, has strengthened against the dollar for the second consecutive day, while the Bloomberg Dollar Spot Index has also reached its highest point since May.

The article is continuously updated