The sluggish consumer industry: When will the spring breeze arrive?

The consumer industry is facing a decline, and Starbucks China was acquired by Hillhouse Capital at a valuation of $13 billion, with business gradually recovering. Meanwhile, Papa Johns' stock price plummeted by 21%, and the collapse of the acquisition reflects private equity's cautious attitude towards the restaurant industry. Pizza Hut's sales have declined for eight consecutive quarters, facing operational difficulties

The consumer industry’s third-quarter reports are accelerating downward, aligning with the overall perception of the macro economy and the consumer sector.

The industry is facing its darkest hour, and we are observing when the pace of marginal deterioration will improve.

From the perspective of fund holdings and valuation analysis, left-side signals still need to wait. Some sectors have already reached historical 1% valuations, which are worth close attention and tracking.

1. What happened? The consumer industry is undergoing a transformation

$13 billion! Starbucks China ultimately achieved a "sale" at this valuation, with Hillhouse Capital holding a 60% stake in the joint venture, while Starbucks retains the remaining 40% stake and continues as the owner and licensor of the brand and intellectual property. Both parties will jointly manage the current 8,000 stores in China and plan to expand to a scale of 20,000 stores in the future.

Starbucks China's business has actually been gradually recovering. In the latest fourth quarter of fiscal year 2025, Starbucks China achieved operating revenue of $831.6 million, a year-on-year increase of 6%, maintaining positive growth for the fourth consecutive quarter. For the entire fiscal year 2025, Starbucks China's market revenue reached $3.105 billion, a year-on-year increase of 5%, higher than the global average growth rate. In the next phase, Hillhouse Capital is expected to bring more localized factors such as product price adjustments and downward strategies to help Starbucks' business continue to recover.

On the other side of the ocean, the consumer industry is also facing profound changes.

Papa Johns' stock price plummeted by 21%, marking the largest single-day decline since the outbreak of the pandemic in March 2020. In terms of news, private equity giant Apollo Global Management withdrew its acquisition offer to take Papa Johns private at a price of $64 per share a week ago. The collapse of this acquisition highlights the cautious attitude of private equity firms towards the restaurant industry's prospects. Against the backdrop of continued pressure on consumer spending, even established chain brands find it difficult to attract buyers.

Source: WIND

Source: WIND

The world's largest restaurant group, Yum! Brands Inc., announced the initiation of a strategic review of its Pizza Hut business, not ruling out the sale of this struggling pizza brand. Pizza Hut's sales have declined for eight consecutive quarters, with current annual sales of about $1 billion, a 20% decrease compared to a decade ago. Pizza Hut's predicament mainly stems from its inability to attract customers. This is not an issue for the entire pizza market—competitors Domino's and Papa Johns continue to see revenue growth in the North American market.

Goldman Sachs has just issued a "red" warning regarding the health of American consumers, stating that consumer fatigue has spread from low-income groups to the middle class, with several corporate executives indicating that current consumer confidence has reached its "worst level in decades."

2. Why is it important? Industry difficulties are intensifying

The weakness in the consumer industry has gradually become a consensus, and the key question is when the turning point will appear. Pessimistic expectations have already been priced in, and the Federal Reserve's anticipated easing and balance sheet expansion in 2026 is expected to help stabilize and rebound the consumer industry

Due to ongoing inflationary pressures leading consumers to reduce dining out, the overall weakness in the U.S. consumer sector is intensifying. Chipotle Mexican Grill has lowered its sales forecast for the third time this year. CEO Scott Boatwright stated, "Consumers are feeling the pressure, and we are feeling their retreat." He pointed out that customers lost by Chipotle are turning to grocery stores rather than other chain restaurants, indicating that people are choosing to cook at home to save costs. Following the sales forecast downgrade, the company's stock price fell by as much as 16.5%. The trend of consumption downgrade is spreading from the lower class to the middle class.  Source: WIND

Source: WIND

As Goldman Sachs consumer goods expert Scott Feiler noted, more companies are reporting a slowdown in consumption, especially among consumers aged 25-35. Over the past two weeks, consumer stocks have faced significant sell-offs, with the consumer discretionary sector underperforming the market by about 500 basis points.

Kraft Heinz CEO Carlos Abrams-Rivera also stated during the earnings call, "We are facing one of the worst consumer confidence levels in decades." The company has significantly lowered its full-year sales guidance, expecting a decline of 3% to 3.5%. This reflects the worsening predicament of the entire consumer industry.

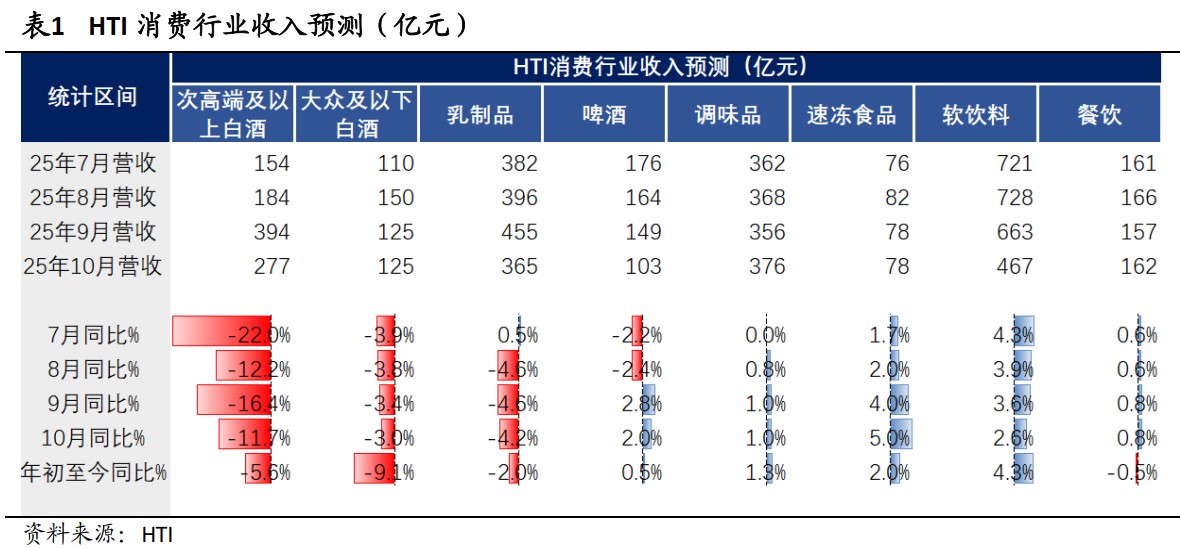

Domestically, the issue of consumption weakness is also present. In the VIP article "Baijiu Q3 Report: Industry Accelerates Clearance, Bottom Still Needs to Wait," we have outlined the accelerating decline in the performance of the baijiu industry in the third quarter. Along with further declines in real estate prices, domestic consumption momentum continues to weaken.

Haitong International pointed out in its research report that despite the overlap of the National Day and Mid-Autumn Festival holidays, extending the holiday to 8 days, commodity consumption continues to show a sluggish trend. According to data from the State Administration of Taxation, the growth rates of commodity consumption and service consumption during the holiday were 3.9% and 7.6%, respectively, with digital products and automotive consumption related to travel growing rapidly, while food showed stable growth. From the third-quarter reports of listed companies, most essential consumer companies maintained growth, but the growth rate continued to slow.

III. What to Focus on Next? Both Holdings and Valuations Decline

① From the perspective of fund holdings.

In Q3 2025, the direction of active equity funds reducing positions: domestic consumption and defensive sectors. The industries with the largest decrease in allocation ratios are banking, food and beverage (within the secondary industry, baijiu), home appliances, and automobiles. This is mainly based on the weak industry prosperity, with defensive sectors showing low elasticity during periods of accelerated market growth.  ② From a valuation perspective.

② From a valuation perspective.

As of October 31, 2025, the historical percentile of the PE ratio for the food and beverage sector is 20% (21.3x), an increase of 2 percentage points from the end of last month, ranking 29th among 31 industries.  Source: Haitong International

Source: Haitong International

The historical percentile of the PE ratio for the A-share food and beverage sub-industry is at a relatively low level since 2011, with beer (1%), and fermented seasoning products (15%), among others. The industries with the lowest absolute PE values are liquor (19.3x), beer (20.9x), meat products (21.4x), and pre-processed foods (22.1x), among others.  Source: Haitong International

Source: Haitong International

Overall, the consumer sector is showing signs of accelerating bottoming out in the third quarter, with the bottom increasingly near, but achieving a reversal in the short term is not easy. In the future, value recovery may occur in two stages—

① Combine sales dynamics to see when industry demand can recover month-on-month. The market has fully priced in the sluggish performance and price expectations, and policy expectations and liquidity improvements will help the valuation recover quickly, which belongs to the first stage, priced by dividend yield, benefiting from low valuations;

② In the second stage, when the supply-demand relationship in the industry improves, and indicators of price and performance are realized, the market's "long-term belief" in consumer assets will return, and the conditions for returning to DCF valuation will be met, with the industry PE center expected to return.

Risk warning and disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk