One Year After Trump Took Office: U.S. Stocks Underperform Global Markets, Central and Eastern Europe Completely Surpasses!

Since Donald Trump was elected president, global stock markets have experienced historic performance: the benchmark stock indices in China, Europe, and Canada, when measured in U.S. dollars, have all outperformed the S&P 500 index, and the MSCI ex-U.S. index's lead over Wall Street has reached its highest level since 2009. This pattern stems from a shift in investor strategy—from initially hedging against the volatility risk of U.S. stocks to seeking investment opportunities in global markets that offer more value than U.S. stocks

A year ago, investors generally believed that if Trump won the presidential election, his tariff threats and tax cuts would lead to international stock markets underperforming the United States. However, the global market is now witnessing a historic reversal.

Since Trump won the election last November, benchmark stock indices in China, Europe, and Canada, priced in U.S. dollars, have outperformed the S&P 500 index. The MSCI global (excluding the U.S.) stock index has recorded its highest lead over Wall Street's benchmark since 2009.

In the first year of Trump's second term, investors flocked to global stock markets. Initially, it was to hedge against potential volatility in U.S. stocks caused by his chaotic tariff policies, and then they shifted to seek more attractively valued alternatives to the S&P 500. This trend confirms the forward-looking judgments of strategists like Goldman Sachs' Peter Oppenheimer and Bank of America's Michael Hartnett, who suggested in 2024 that investors look beyond the U.S.

Hartnett currently points out that although the leading growth rate of global stock markets may slow down as U.S. corporate earnings strengthen and bond yields decline, he remains optimistic about the future performance of international markets.

Asian Stock Markets Benefit from AI Supply Chain Position

Asian stock markets have performed particularly well, thanks to the region's core position in the AI supply chain. Leading companies in chip manufacturing, foundry, and equipment, such as TSMC, Samsung Electronics, and Tokyo Electron, have driven the overall upward trend.

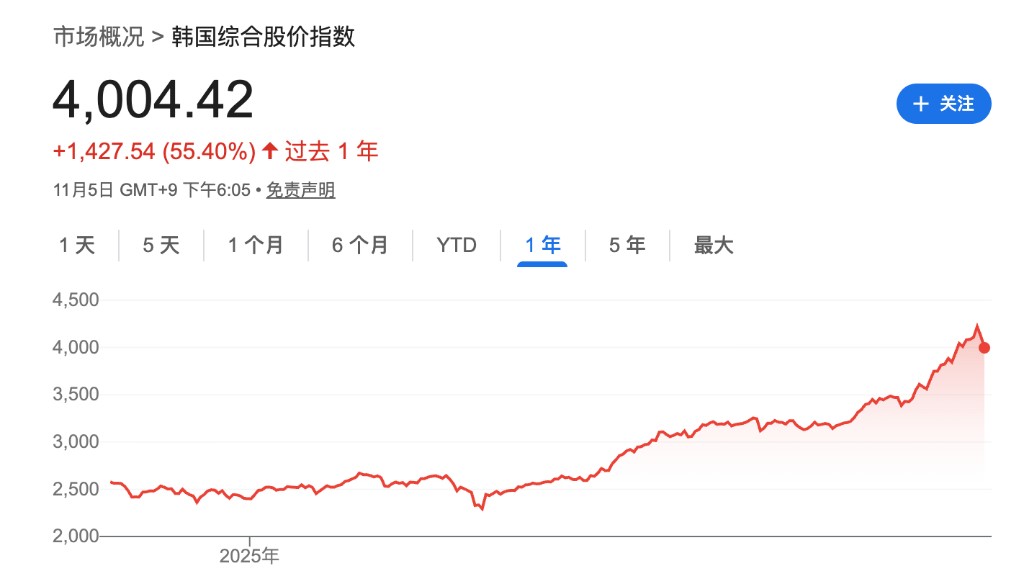

The South Korean Kospi index has soared 55% over the past year, leading major Asian markets and highlighting its status as the most attractive AI investment target in the region.

Aberdeen Investments fund manager Xin-Yao Ng stated:

"I wouldn't be surprised if there is a pullback by the end of the year, as the market has been momentum-driven, and after such a strong rally, some funds will want to lock in profits before year-end. I still believe this rally has the potential to continue, but I'm not sure how long it can last, and the risks are undoubtedly rising."

With valuations already at high levels, the next phase of the rally will depend on whether companies can deliver profits from AI investments, whether capital expenditure trends can extend to 2026, and whether Trump will adopt a cooperative stance on trade policy.

Europe Performs Better Than Expected, Limited Tariff Impact

The European market has performed far better than expected.

On one hand, European economic indicators have rebounded, inflation has been controlled, and the European Central Bank has lowered interest rates to 2%, well below U.S. levels. On the other hand, the EU, especially Germany, is increasing defense and infrastructure spending over the next decade, with positive effects expected to begin showing by the end of this year, boosting financial, defense, and energy transition stocks.

In addition to loose fiscal and monetary policies, European companies have effectively mitigated the impact of tariffs through price increases, cost-cutting, and direct trade negotiations at the industry or company level with the Trump administration For example, pharmaceutical companies such as Novartis and Roche have negotiated with the United States on drug price reductions and committed to investing billions of dollars in exchange for the U.S. delaying the imposition of upcoming industry tariffs. AstraZeneca in the UK also reached a similar agreement in October.

Florian Allain from Mandarine Gestion stated:

"Looking ahead, I expect Germany's stimulus plan to accelerate economic growth in Europe, thereby narrowing the growth gap between Europe and the U.S."

Canadian Stock Market Outperforms the U.S. for the First Time in a Decade

Since early April, the Canadian stock market has seen a strong upward trend. The S&P/TSX Composite Index has risen 23% since the election, poised to outperform U.S. stocks for the first time since 2010.

Philip Petursson from IGM Wealth Management stated:

“Earnings growth here (in Canada) will be as strong as in the U.S., but at a better price. On a price-to-earnings basis, I can buy stocks with the same earnings profile at two-thirds the price of the S&P 500 Index.”