Qualcomm Q4 revenue increased by 10% year-on-year, Q1 guidance exceeded expectations, future bets on AI chips to challenge NVIDIA | Earnings Report Insights

After the US stock market closed, Qualcomm released its financial report, reporting fourth-quarter revenue of $11.27 billion, a year-on-year increase of 10%, exceeding market expectations of $10.79 billion. The adjusted EPS reached $3.00, also higher than the expected $2.88. It is expected that first-quarter revenue will be between $11.8 billion and $12.6 billion, surpassing analysts' expectations of $11.59 billion

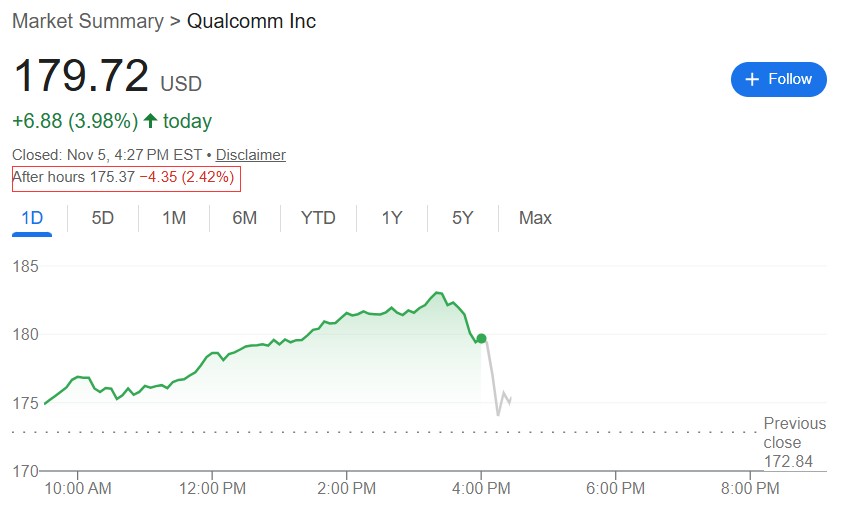

Qualcomm's earnings report exceeded expectations but was met with market indifference, with shares dropping over 2% in after-hours trading.

On November 4th, Qualcomm released its earnings report after the US market closed, reporting fourth-quarter revenue of $11.27 billion, a year-on-year increase of 10%, surpassing market expectations of $10.79 billion. The adjusted earnings per share reached $3.00, also higher than the expected $2.88. In terms of specific performance:

Financial Performance:

- Fourth-quarter revenue of $11.27 billion, a year-on-year increase of 10%, exceeding expectations by $480 million. Adjusted earnings per share of $3.00, exceeding expectations by $0.12.

- In the fourth quarter, due to US tax reform, a $5.7 billion impairment was recorded, resulting in a net loss of $3.12 billion under GAAP.

- Q1 guidance revenue of $12.2 billion (range of $11.8-12.6 billion), exceeding expectations by $580 million, with adjusted EPS of $3.40.

Core Business Progress:

- Fourth-quarter mobile chip revenue of $6.96 billion, a growth of 14%, driven by strong demand in the high-end Android market.

- Fourth-quarter automotive chip revenue of $1.05 billion, a growth of 17%.

- Fourth-quarter IoT business (including Meta orders) revenue of $1.81 billion, a growth of 7%.

- Fourth-quarter licensing revenue declined by 7% to $1.41 billion.

Strategic Transformation Dynamics:

- Launched AI200 and AI250 accelerator chips, planned for release in 2026-2027, competing with NVIDIA's full rack systems.

- Facing risks from the loss of Apple's modem business, actively expanding into diversified markets such as PC, VR, and data centers.

- Long-term tax rate stabilized at 13%-14% after tax reform.

Despite the impressive earnings report, Qualcomm's stock fell by over 2%. Analysts believe that although the performance was strong, investors' expectations for the company's future have already been fully priced into the stock, making it difficult to generate new upward momentum.

Tax Reform Pain, Buyback Efforts Unwavering

Qualcomm reported fourth-quarter revenue of $11.27 billion, a year-on-year increase of 10%, exceeding analyst expectations of $10.79 billion. Adjusted earnings per share were $3.00, also surpassing the expected $2.88.

However, it is noteworthy that under GAAP standards, Qualcomm recorded a net loss of $3.12 billion, primarily due to a one-time tax expense write-down of $5.7 billion.

The company stated that this move is to adopt the Alternative Minimum Tax (AMT), which will stabilize its tax rate at a favorable level of 13% to 14% in the long run.

Despite facing tax impacts, Qualcomm's operating cash flow for fiscal year 2025 is still expected to reach $14 billion, a 15% increase from $12.2 billion last year.

The company repurchased $8.8 billion in stock over the year (buying back 56 million shares, about 5% of the outstanding shares) and paid dividends of $3.8 billion, returning a total of $12.6 billion to shareholders, more than twice the annual net profit (GAAP basis of $5.5 billion) This aggressive capital return strategy continues into the fourth quarter, with a quarterly repurchase of $2.4 billion and dividends of nearly $1 billion, totaling $3.4 billion.

As of the end of the fiscal year, the company's cash and cash equivalents were approximately $10.3 billion (including $2.3 billion in restricted cash), long-term debt was $14.8 billion, and net debt was about $4.5 billion. Considering the expected reduction in future cash taxes, this level of leverage is still acceptable.

AI Layout: Ambitions from End Devices to Data Centers

In the wave of AI, Qualcomm is trying to carve out a differentiated path. Unlike NVIDIA, which focuses on cloud AI, Qualcomm is concentrating on edge AI and hybrid AI scenarios.

On the edge side, the Snapdragon 8 series chips have integrated NPU (Neural Processing Unit), supporting large model inference tasks to run locally on mobile phones. This has clear advantages in privacy protection and low-latency scenarios, but the commercialization speed is slower than expected—mobile phone manufacturers often treat AI as a marketing gimmick, and the number of consumers willing to pay a premium for it is limited.

In the data center field, Qualcomm is betting on ARM architecture-based AI server chips, attempting to challenge the x86 dominance of NVIDIA and AMD.

The Qualcomm CEO mentioned "expanding into data centers and advanced robotics," but did not disclose specific revenue figures, indicating that this business is still in its early stages. Considering NVIDIA's dominance in the AI accelerator market (with H100/H200 chips in short supply), Qualcomm is unlikely to shake up the landscape in the short term.

Automotive autonomous driving is the fastest monetization scenario for AI. Qualcomm's Snapdragon Ride platform has been adopted by multiple automakers, and a significant portion of the $3.96 billion revenue for the year comes from AI-related cockpit chips and ADAS (Advanced Driver Assistance Systems) chips.

Core Business Mobile Chips Remain Crucial

Despite Qualcomm's continuous emphasis on diversification strategies, the mobile chip business still accounts for 62% of revenue, with fourth-quarter revenue from this business at $6.96 billion, a year-on-year increase of 14%.

Qualcomm has long provided processors and modems for Samsung's high-end models and supplies modem chips for Apple's iPhone. However, Apple is developing its own modem and is expected to stop purchasing Qualcomm products in the coming years.

Faced with growth bottlenecks in the mobile business, Qualcomm is betting on the automotive and IoT sectors.

Revenue from the automotive chip business was $1.05 billion, a year-on-year increase of 17%; revenue from the IoT business (including Meta's VR/AR devices) was $1.81 billion, a growth of 7%. Management specifically pointed out that automotive and IoT combined are expected to achieve a 27% growth in fiscal year 2025.

These numbers look good, but the scale is still limited. The automotive business only accounts for 9.3% of total revenue, while IoT accounts for 16%, with the two combined being less than half of the mobile chip business.

Additionally, the weakness in the licensing business (QTL) cannot be ignored. QTL revenue in the fourth quarter was $1.4 billion, a year-on-year decrease of 7%, with annual revenue of $5.6 billion remaining basically flat.

Considering that QTL has a profit margin of up to 72% (pre-tax profit margin), the stagnation of this high-profit business puts pressure on overall profitability The risk warning in the financial report clearly states that "the authorized business model is facing attacks from OEM manufacturers" and "there is uncertainty regarding the renewal of licensing agreements."