Arista's earnings report exceeded expectations, but the stock price plummeted. The CEO stated that we are in the "golden age of network connectivity under the AI explosion."

Network equipment manufacturer Arista's revenue and profit in the third quarter exceeded expectations, but the stock price fell more than 8% due to a lack of significant upward guidance adjustments. However, the company's management is very confident, with the CEO describing the current opportunity as an "undeniable AI megatrend" and "the golden age of network connectivity," believing that as the scale and complexity of AI models grow, the demand for network scale is also expanding simultaneously

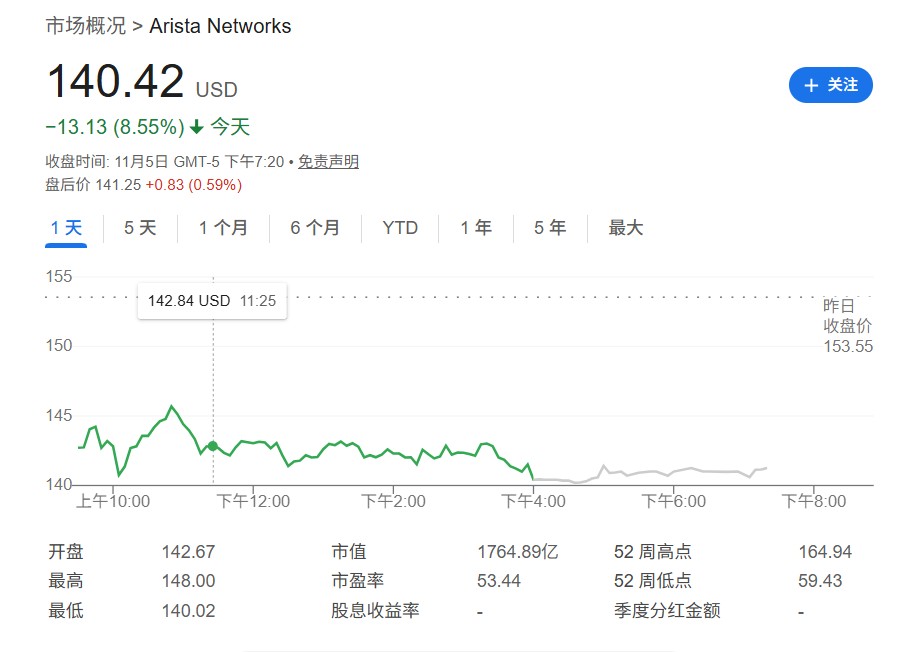

Despite delivering an earnings report that exceeded expectations, the stock price of network equipment manufacturer Arista Networks unexpectedly plummeted. This not only reflects the market's extremely high expectations for AI-related stocks but also raises investors' scrutiny of its future growth drivers.

In the latest third-quarter earnings report, Arista Networks announced a 27% year-over-year revenue increase to $2.31 billion, with adjusted earnings per share of $0.75. Both key metrics surpassed Wall Street analysts' consensus expectations of $2.26 billion and $0.72.

However, this strong performance report failed to boost its stock price, as the company's shares fell in after-hours trading following the earnings release and continued to decline the next trading day, dropping over 8%.

The market's negative reaction primarily stems from its failure to meet investors' higher expectations. Arista provided a fourth-quarter revenue guidance range of $2.3 billion to $2.4 billion, with a midpoint of $2.35 billion, which is only slightly above analysts' expectations of $2.33 billion. Additionally, the company decided to maintain its long-term forecast of 20% sales growth for 2026, which, for investors eager to see "earnings exceed expectations and guidance raised," is clearly not impressive enough.

In stark contrast to the market's short-term pessimism, the company's management is confident about the future. Arista CEO Jayshree Ullal stated during the earnings call that the company is in an "undeniable and explosive AI mega trend," describing it as the "golden age of network connectivity." She indicated that the rise of AI will drive the total addressable market (TAM) for the networking industry to grow to over $100 billion in the coming years.

Growth Guidance Fails to Meet Market High Expectations

For a stock that has surged nearly 40% before the 2025 earnings report, merely "meeting" or "slightly exceeding" expectations in guidance is insufficient to support its high valuation.

Analysts at Evercore ISI noted in a report that "the negative stock reaction post-earnings reflects the reality that long-term earnings forecasts did not see substantial upward revisions."

Analysts at Raymond James also believe that the stock price decline may be the result of "overly high expectations and no real change in fundamentals." They maintain a "market perform" rating on the stock.

From the investors' perspective, Arista's maintenance of the 20% sales growth forecast for 2026 suggests that future growth may not accelerate as they had hoped.

Product Sales Below Expectations Raise Concerns

Deeper concerns arise from the details of the company's revenue structure. According to Raymond James analysts, Arista's performance exceeded expectations mainly due to service revenue, which was 18% higher than their model predictions; however, product revenue, including its flagship network switches, did not meet their expectations Arista's core business is providing hardware devices such as network switches for data centers, with major clients including tech giants like Microsoft and Meta. Therefore, relatively weak product sales may raise concerns among some investors about the short-term demand for its core hardware business, even though the company's overall revenue continues to grow strongly.

CEO Optimistic About AI-Driven "Golden Era"

Despite the lukewarm market response, Arista's management remains firmly optimistic about the long-term opportunities driven by artificial intelligence.

CEO Jayshree Ullal stated during a conference call that as the scale and complexity of AI models grow, the demand for network scale is also expanding in tandem. Ullal emphasized that the company's goal of achieving $1.5 billion in total AI-related revenue by 2025 is "on track."

William Blair analyst Sebastien Naji wrote in a research report that Arista's management believes "we are still in the early stages of the AI megatrend."

He pointed out that Arista not only occupies a favorable position in the AI backend network market but is also benefiting from increased demand for AI frontend networks (partly driven by growth in inference demand).

Betting on Ethernet to Strengthen AI Network Position

To seize the opportunities brought by AI, Arista is actively laying out next-generation network technologies.

According to recent media reports, Arista has teamed up with industry giants such as AMD, NVIDIA, Cisco, Meta, and Microsoft this quarter to jointly launch the "Scalable Network Ethernet (ESUN)" initiative, aimed at promoting Ethernet technology to better serve AI infrastructure.

Ullal revealed that Arista's Ethernet product portfolio is fully compliant with the Ultra Ethernet Consortium (UEC) standards and will continue to enhance compliance features. It is expected that various AI network designs around Ethernet will materialize in 2026 and truly emerge in 2027