Berkshire plans to issue yen bonds to pave the way for further acquisitions of the five major trading companies?

Berkshire plans to issue yen bonds again, sparking speculation that it will increase its holdings in Japan's five major trading companies. Analysts say that Buffett's yen financing means he has locked in investment opportunities in Japan, and this move is also seen as an important barometer of sentiment in the yen credit market, driving the stock prices of Itochu, Mitsubishi Corporation, and others to rise by more than 2%, outperforming the Tokyo Stock Exchange Index

Warren Buffett's Berkshire Hathaway is planning to issue a new batch of yen-denominated bonds, which has sparked market speculation that the company may be raising funds to further increase its positions in Japan's five major trading companies.

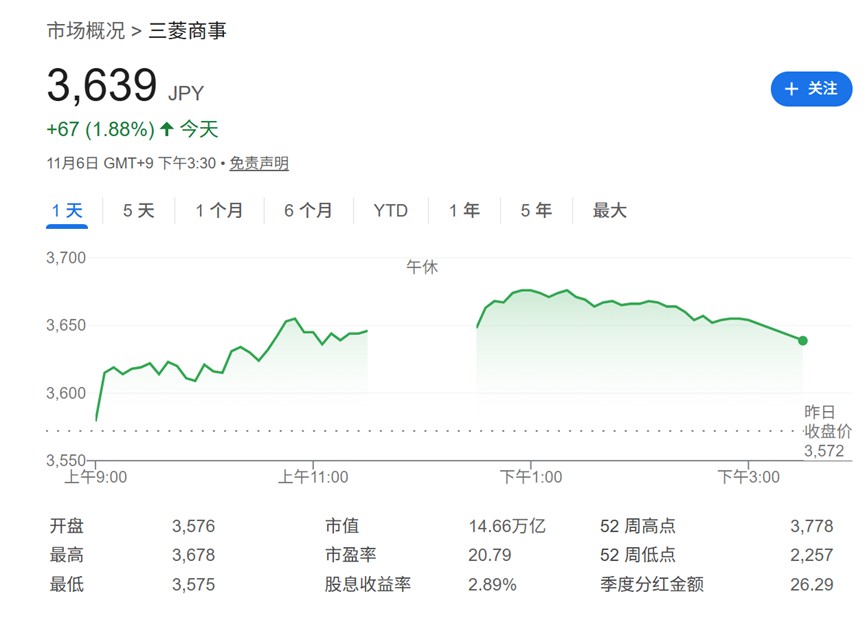

According to reports on the 6th, this investment giant has hired banks to arrange for this potential issuance, marking its second foray into the yen bond market this year. Following the news, the stock prices of Itochu Corporation, Mitsubishi Corporation, and Sumitomo Corporation all rose by more than 2%, outperforming the Tokyo Stock Exchange index.

Analysts believe that given Berkshire's substantial cash reserves, its financing through bond issuance in the yen market strongly suggests that it has locked in specific investment opportunities in Japan. This move is interpreted not only as an acknowledgment of the valuations of Japanese trading companies but may also serve as a "barometer" for gauging current investor sentiment in the yen credit market.

Berkshire's actions come at a time when overseas investors are showing heightened interest in Japan, with the country's major stock indices recently hitting new highs. However, this issuance plan contrasts with broader market trends. Due to rising interest rates in Japan and the possibility of further tightening of monetary policy by the Bank of Japan, the issuance of yen bonds by overseas institutions has slowed this year, making Berkshire's intentions more indicative.

Speculation on Increased Holdings Heats Up

The market generally links Berkshire's bond issuance plan directly to its investment strategy in Japanese trading companies. Hiroshi Namioka, chief strategist at T&D Asset Management, stated:

"Given that Berkshire currently holds a large amount of cash, the fact that it is issuing yen-denominated bonds indicates that it sees investment opportunities in Japan—funds are likely to be directed towards trading companies."

Since Buffett first disclosed his holdings in Japan's five major trading companies—Itochu Corporation, Marubeni Corporation, Mitsubishi Corporation, Mitsui & Co., and Sumitomo Corporation—in August 2020, the stock prices of these companies have more than doubled. Buffett revealed in this year's letter to shareholders that Berkshire began building its position in 2019.

Although Berkshire agreed to keep its stake in each company below 10%, as the holdings approach this limit, Buffett added that these five companies have agreed to "moderately relax" this restriction. Buffett wrote in the letter:

"Over time, you may see Berkshire's stake in these five companies increase."

A Signal of Global Undervalued Assets

Berkshire's financing intentions further reinforce the market's positive view of the asset values of Japanese trading companies. Analysts believe this move indirectly confirms that these companies are still undervalued on a global scale.

"This potential issuance is a signal that, from a global perspective, Japanese trading companies are still cheap and considered undervalued, making this move positive for their stock prices," commented Namioka from T&D Asset ManagementDuring the Tokyo trading session, the stock prices of Itochu Corporation, Mitsubishi Corporation, and Sumitomo Corporation all rose by more than 2%, outperforming the Tokyo Stock Exchange Index (Topix). Among them, driven by the dividend increase and stock split plan, Itochu Corporation's stock price showed particularly strong momentum.

The "Barometer" of the Yen Bond Market

In the current macro environment, Berkshire's issuance plan is not only related to its own investments but is also seen as a key test for the entire yen credit market. This year, driven by the global AI boom and the recovery of mergers and acquisitions, global bond sales have soared to a record level of approximately $6 trillion. However, at the same time, the issuance scale of yen bonds by overseas issuers has dropped to about 1.8 trillion yen, a four-year low.

The rise in Japanese interest rates and concerns about future central bank actions have made local investors more cautious when buying corporate bonds this year. Berkshire, with its AA credit rating and higher potential spreads compared to local companies of the same rating, has historically been a star issuer in the yen market. Since its debut in 2019, the company has issued nearly 2 trillion yen in bonds, becoming the largest overseas issuer of yen notes during the same period.

Haruyasu Kato, a fund manager at Asset Management One Co., pointed out that for Berkshire's proposed issuance, "the biggest focus will be on the total issuance size." He added:

"This will serve as a litmus test to gauge investor sentiment and the availability of funds in the entire yen credit market."