The buying power at dips has weakened, U.S. stock index futures have fallen, spot gold has returned to the $4,000 level, and U.S. Treasury yields have risen

U.S. stock index futures collectively declined, with S&P 500 futures down 0.15%, Nasdaq 100 futures down 0.26%, and Dow futures down 0.11%. European stocks opened lower across the board. The yield on the 10-year U.S. Treasury bond fell 2 basis points to 4.14%, while spot gold returned above $4,000 per ounce, rising 0.73% during the day

Corporate profits and optimistic economic data have been digested by the market, but concerns over the high valuations of technology stocks have not dissipated. As the buying power on dips weakens, European and American stock markets show weak performance, and risk aversion continues to push up U.S. Treasury bonds and gold prices.

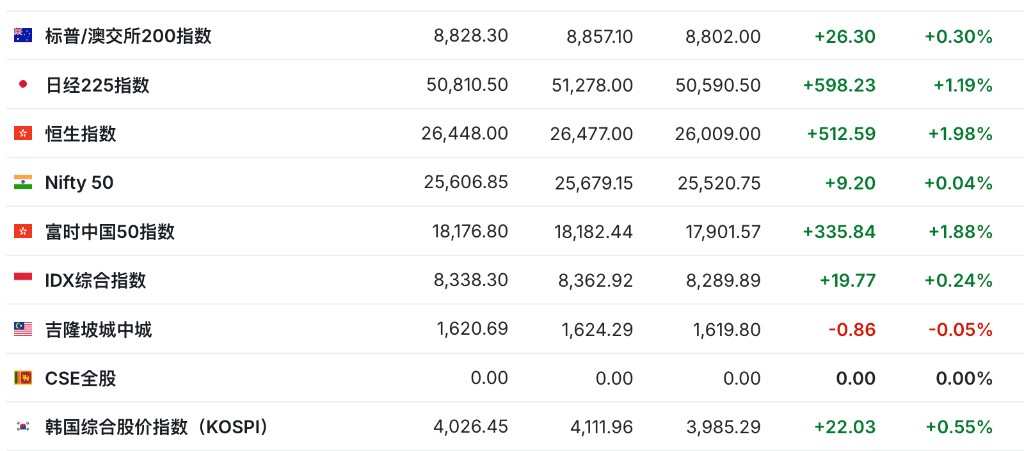

On November 6, U.S. stock index futures collectively fell, European stock indices opened lower overall, and Asian stock indices saw more gains than losses. U.S. Treasury yields rose, spot gold once again broke through the $4,000 mark, crude oil rebounded slightly, the U.S. dollar index remained basically flat, and cryptocurrencies retreated.

Takehiko Masuzawa, head of stock trading at Japan's Philip Securities Co., Ltd., stated that the market is recovering today, with buying on dips dominating. Investors are cautious about artificial intelligence semiconductor stocks, but they are not continuing to sell off—because there are still investors looking to buy these stocks.

Core market trends:

- U.S. stock index futures collectively fell, with S&P 500 futures down 0.15%, Nasdaq 100 futures down 0.26%, and Dow futures down 0.11%

- The Euro Stoxx 50 index opened down 0.3%, Germany's DAX index down 0.2%, the UK's FTSE 100 index down 0.1%, and France's CAC 40 index down 0.4%

- The Nikkei 225 index rose 1.19%

- The yield on 10-year U.S. Treasury bonds decreased by 2 basis points to 4.14%

- The U.S. dollar index fell 0.14%, reported at 100.05

- Spot gold returned to above $4,000/ounce, up 0.73% for the day

- WTI crude oil rose 0.62%, at $59.97/barrel

- Bitcoin fell 0.3%, and Ethereum fell 1.5%

U.S. stock index futures collectively fell, with S&P 500 futures down 0.15%, Nasdaq 100 futures down 0.26%, and Dow futures down 0.11%. Concerns over technology stock valuations persist, and after the market digested stronger-than-expected U.S. ISM services index and ADP employment data, U.S. stock index futures declined. The market is focused on the Supreme Court's stance on Trump's tariffs. According to CCTV News, this case is seen as an important test of the boundaries of President Trump's powers and whether he can expand executive authority.

Nick Twidale, chief market analyst at AT Global Markets in Sydney, stated:

Investors will definitely pay attention to this (tariff outlook), and I don't think we will see much of a market reaction until it translates into any actual action.

As concerns over technology stock valuations eased, Asian stock markets rebounded following the overnight gains in U.S. stocks, with the Nikkei 225 index rising 1.19%. As U.S. stock index futures declined, optimism weakened, and the rebound momentum narrowed

Spot gold rose 0.73%, reported at $4008.12 per ounce.

More news is being updated continuously