HUA HONG SEMI Q3 revenue increased by 20.7% year-on-year, with strong demand for 12-inch wafers, and Q4 revenue is expected to rise to USD 650-660 million | Financial Report Insights

HUA HONG SEMI's Q3 revenue reached USD 635.2 million, with a net profit decline of 42.6% year-on-year, but an increase of 223.5% quarter-on-quarter. Its 12-inch business accounted for 59.3% of total revenue. Looking ahead, HUA HONG SEMI expects Q4 sales revenue to continue rising to between USD 650 million and USD 660 million, with a gross margin expected to remain in the range of 12% to 14%

Hua Hong Semiconductor achieved double-digit year-on-year and quarter-on-quarter revenue growth in the third quarter, with net profit declining by 42.6% year-on-year but significantly increasing by 223.5% quarter-on-quarter. Its 12-inch wafer business accounted for 59.3% of total revenue, becoming the core engine driving the company's overall growth.

Looking ahead, Hua Hong Semiconductor expects sales revenue in the fourth quarter to continue to rise to between $650 million and $660 million, with gross margin expected to remain in the range of 12% to 14%.

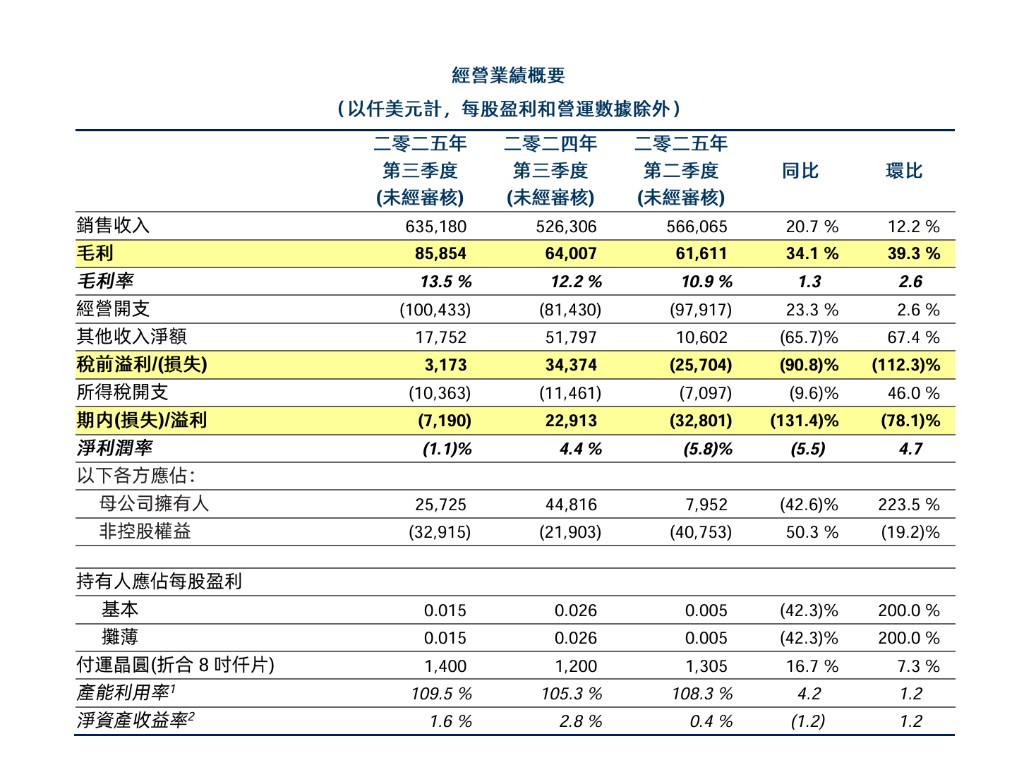

On the 6th, Hua Hong Semiconductor announced its Q3 financial report:

- Third-quarter sales revenue reached a record high of $635.2 million, a year-on-year increase of 20.7% and a quarter-on-quarter increase of 12.2%;

- Profit attributable to the parent company was $25.7 million, a year-on-year decrease of 42.6% but a quarter-on-quarter increase of 223.5%;

- Gross margin improved from 10.9% to 13.5%.

Revenue and Profit Both Improved Quarter-on-Quarter

The financial report shows that Hua Hong Semiconductor's core financial indicators exhibited a positive quarter-on-quarter recovery in the third quarter. The sales of $635.2 million not only significantly surpassed the same period last year but also achieved substantial growth compared to the second quarter.

In terms of profitability, although the net profit of $25.7 million is still lower than last year's $44.8 million, it has achieved more than a twofold quarter-on-quarter leap compared to the second quarter's $7.95 million. This is mainly due to the operating leverage effect brought about by the expansion of revenue scale and the continuous improvement of gross margin. Data shows that the company's gross profit for the quarter was $85.85 million, a year-on-year increase of 34.1% and a quarter-on-quarter increase of 39.3%.

The company's expense expenditures also increased. Among them, R&D expenses reached $100.4 million, a year-on-year increase of 23.3%; sales and distribution expenses and other operating costs also recorded varying degrees of growth, partially offsetting the contribution of gross margin improvement to net profit.

Explosive Growth in 12-Inch Business, Becoming the Main Driver of Revenue

From a business structure perspective, Hua Hong Semiconductor's "8-inch + 12-inch" dual-drive strategy is entering a harvest period, especially with the rise of the 12-inch business.

Financial report data shows that sales revenue from 12-inch wafers in the third quarter reached $376.4 million, a year-on-year surge of 43.0%, with its proportion of total revenue rising from 50.0% in the same period last year to 59.3%, for the first time dominating the company's revenue structure. In contrast, revenue from 8-inch wafers was $258.8 million, a slight year-on-year decrease of 1.6%.

In terms of capacity utilization, the company's 8-inch wafer fab operated at a capacity utilization rate of 109.5%, continuing to run at an overload state. This reflects that the market demand in the specialty process field remains robust.

Strong Demand in Communications and Automotive Applications

From the perspective of demand in different application fields, communications and industrial and automotive electronics are the main drivers of Hua Hong Semiconductor's performance growth this quarter Data shows that sales revenue from "communication" products increased by 106.6% year-on-year, reaching $60.6 million, leading the growth rate among all segments. Revenue from products applied in "industrial and automotive" also performed well, with a year-on-year growth of 32.8% to $164.8 million, demonstrating significant achievements in the company's market expansion in high-value areas such as power devices and IGBTs.

At the same time, the "consumer electronics" sector, which is the company's largest source of revenue, reported revenue of $169 million this quarter, with a year-on-year growth of only 3.5%, indicating relatively moderate growth. Additionally, the "computer" sector also achieved a solid growth of 20.4%.

China Market as the Main Source of Revenue

By region, the Chinese market remains the primary source of revenue and growth contributor for Hua Hong Semiconductor. In the third quarter, sales revenue from mainland China was $407.5 million, a year-on-year increase of 23.2%, accounting for 64.1% of the company's total revenue. Strong domestic market demand, particularly in the localization trend of MCUs and power devices, has provided solid support for the company's performance.

Furthermore, revenue from other regions in Asia, North America, and Europe was $137.9 million, $79.8 million, and $137.9 million, respectively, all achieving year-on-year growth, indicating that the company's global business layout is also maintaining a good development trend