Not only does AI have a "closed loop," but the US stock market has also "closed the loop": corporate layoffs boost stock prices, rising stock markets stimulate consumption, and strong consumption supports performance

The U.S. economy has fallen into a "reflexive" closed loop: companies reduce costs to boost stock prices, the wealth effect stimulates consumption, and consumption supports performance again. However, JPMorgan Chase warns that this asset price-driven resilience is unsustainable. A decline in the savings rate and weak income expectations are weakening consumption momentum. Once the stock market retreats, the current "buffer" may quickly reverse into an "amplifier" that exacerbates the economic downturn

Not only does AI have a "closed loop," but the U.S. economy is also operating within a non-typical "closed loop": Companies are raising stock prices by cutting costs through layoffs, while the soaring stock market stimulates consumption through the wealth effect, and strong consumption, in turn, supports corporate performance and economic resilience.

Macro trend blogger and economist David Woo describes this phenomenon as a Soros-style "reflexive" closed loop. He warned that this cycle, composed of corporate layoffs, rising stock prices, and consumption support, is creating a bubble. Once the AI-led stock market boom fades or consumer confidence collapses, its fragile balance may be disrupted.

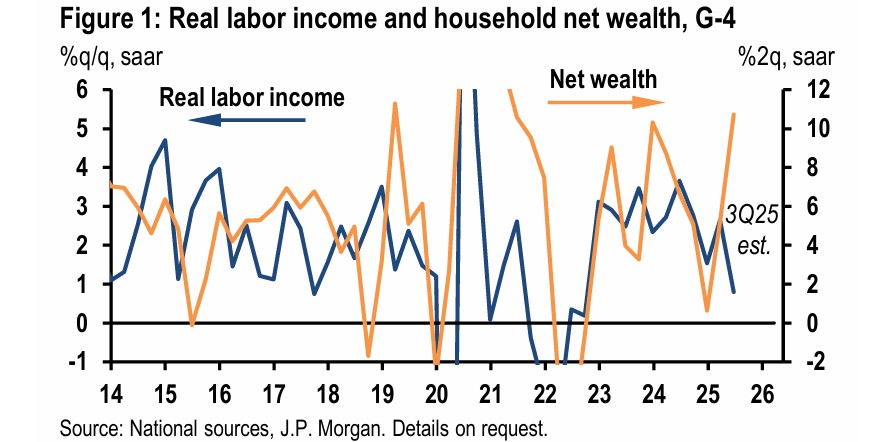

JPMorgan Chase's latest research on the 4th provides data support for this phenomenon. Analysts Joseph Lupton and Maia G Crook pointed out in a report that the current market is exhibiting a "strange decoupling"—the general deterioration of the labor market is occurring simultaneously with strong growth in household wealth. This decoupling is prevalent in developed markets but is particularly pronounced in the United States.

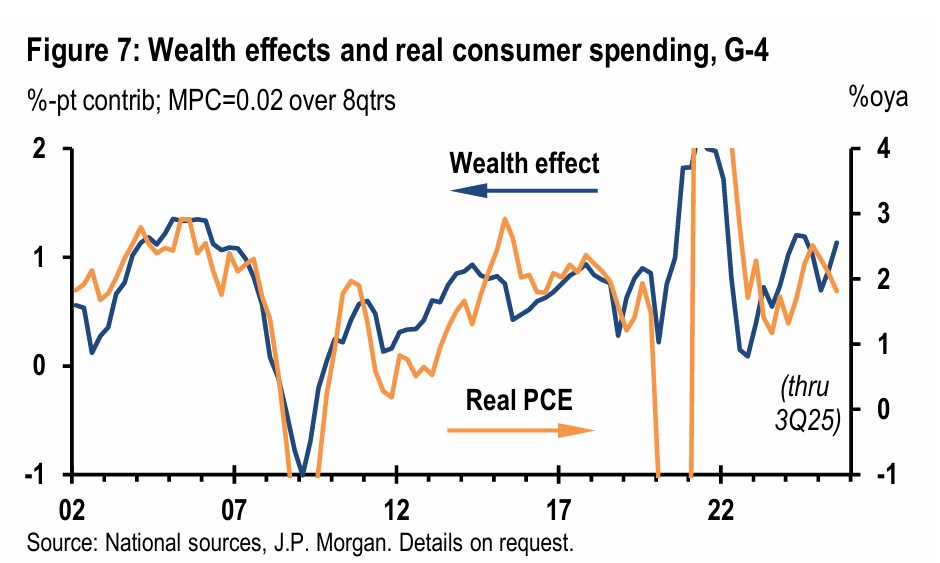

JPMorgan believes that the "wealth effect" brought about by rising stock prices is acting as a bridge, temporarily filling the gap caused by the slowdown in labor income growth. However, analysts also emphasize that this asset price-driven consumption resilience is difficult to sustain in the long term. They warn that once the wealth effect weakens, the stock market may quickly transform from an "economic cushion" into an "amplifier" that exacerbates downward pressure.

Rare Decoupling: Wealth Growth Offsets Weak Wages

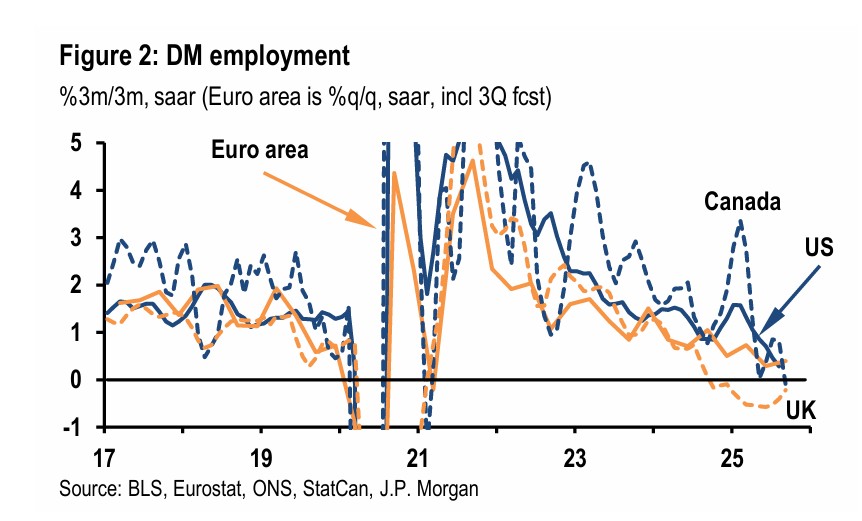

JPMorgan's report details the significant gap between a weak labor market and a booming consumer market. Data shows that employment growth in developed markets has significantly slowed, with the G4 group (the U.S., Eurozone, the U.K., and Japan) seeing employment growth nearly stagnate by the third quarter of 2025, dropping to an annualized growth rate of 0.3%. Meanwhile, the growth of real labor income is also struggling.

However, weak labor income is being offset by sharply expanding household balance sheets. The report notes that driven by the soaring stock market, household wealth in developed markets achieved an annualized surge of over 10% in the two quarters ending in the third quarter of 2025. The U.S. stands out, with household wealth experiencing an annualized increase of up to 14.8% over the past two quarters.

JP Morgan analysis states that this "wealth effect" is key to supporting consumption. When household wealth increases, even if income does not grow, they tend to increase spending. The bank estimates that in the United States, for every additional dollar of wealth, households tend to spend about 3.5 cents more. This effect bridges the gap between currently weak labor income and strong consumer spending.

JP Morgan analysis states that this "wealth effect" is key to supporting consumption. When household wealth increases, even if income does not grow, they tend to increase spending. The bank estimates that in the United States, for every additional dollar of wealth, households tend to spend about 3.5 cents more. This effect bridges the gap between currently weak labor income and strong consumer spending.

Consumption Engine Running Low: Warnings on Savings and Confidence

Although the wealth effect temporarily supports consumption, multiple indicators show that the "fuel" for American consumers is gradually depleting. First, the savings rate has fallen to unsustainable low levels. JP Morgan's chart shows that the personal savings rate in the U.S. has declined by about one percentage point since the first half of 2024 and is far below pre-pandemic levels. This means consumers are maintaining spending by depleting savings, a pattern that is difficult to sustain.

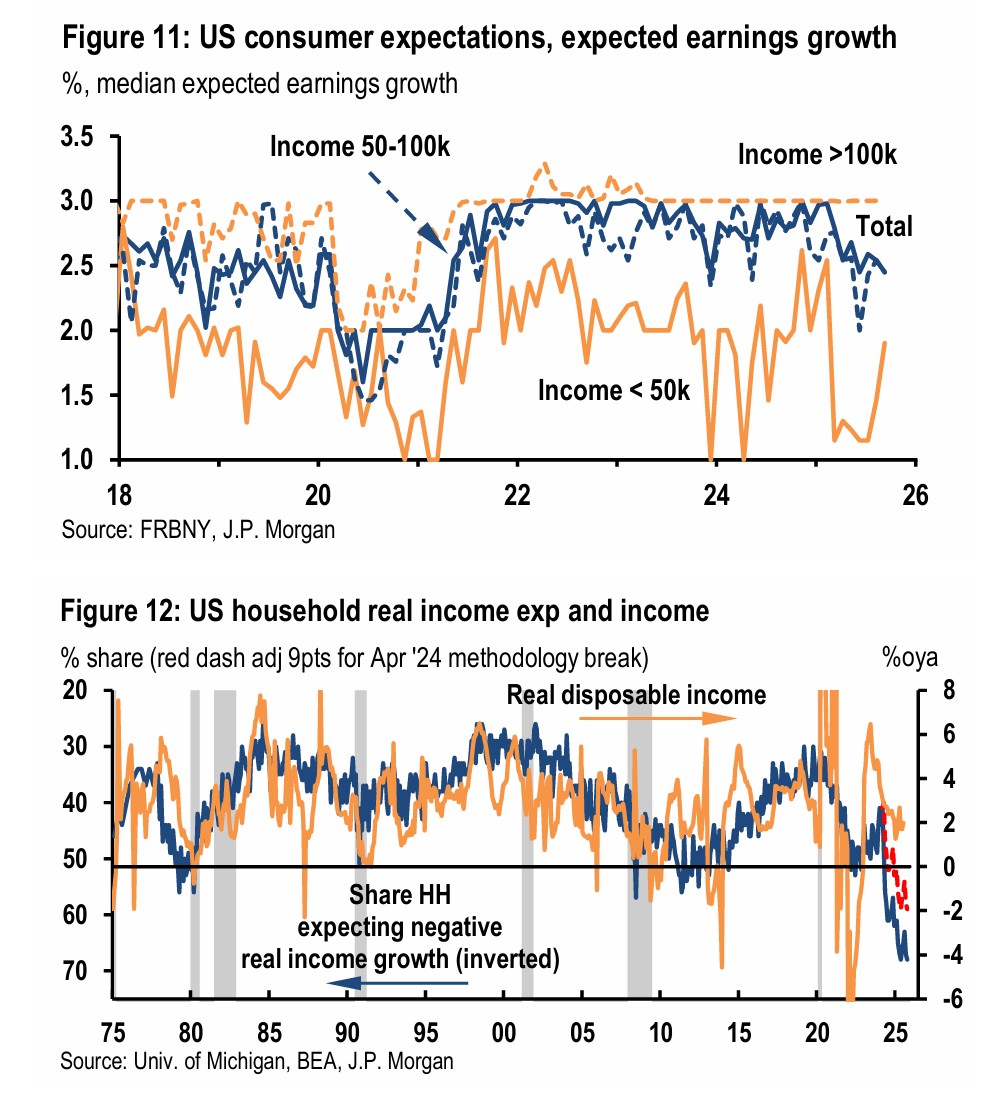

Second, consumer confidence and expectations are sending pessimistic signals. According to a survey by the New York Fed, the median expectation for future nominal income growth among American households has dropped below 2.5%. The results from the University of Michigan are even more severe, with as many as 68% of surveyed households believing that income growth in the coming year will not keep pace with rising prices—this is the most pessimistic level since 1975.

JP Morgan points out that although consumer confidence indicators have recently diverged from actual spending performance, their continued low trend cannot be ignored.

Fragile Balance: When the Stock Market Turns from Cushion to Amplifier

The current operational logic of the U.S. market seems counterintuitive. David Woo believes that U.S. stocks have formed a Soros-style "reflexive" feedback loop—companies protect profits by laying off workers, which drives up stock prices, and rising stock prices stimulate consumption among the wealthy, thereby supporting corporate performance. This self-fulfilling cycle is creating a bubble, and if the AI bubble bursts or consumer confidence collapses, the U.S. economy will fall into a severe recession.

JP Morgan also expresses a similar view, stating that the current resilience of the U.S. economy heavily relies on the continued prosperity of the stock market. In its outlook, JP Morgan expressed a cautious view, stating that "given the already high valuation metrics, it is hard to see the stock market welcoming another prosperous year." Future economic growth will increasingly depend on the recovery of real income growth.

The bank's baseline scenario is that the labor market will gradually recover, thereby validating the current consumption pattern. However, the report also acknowledges that the "risk of sustained labor market weakness is increasing."

The core of the risk is that this positive cycle could reverse at any time. Analysts clearly warn:

"If companies start laying off workers as the wealth effect fades, the stock market could become an amplifier of downward pressure, just as it is currently a cushion for upward pressure."