Rare personnel change: CICC Chairman personally takes charge of subsidiary

The industry expects that CICC will further increase its management of the wealth management platform, and there may be many highlights in the future

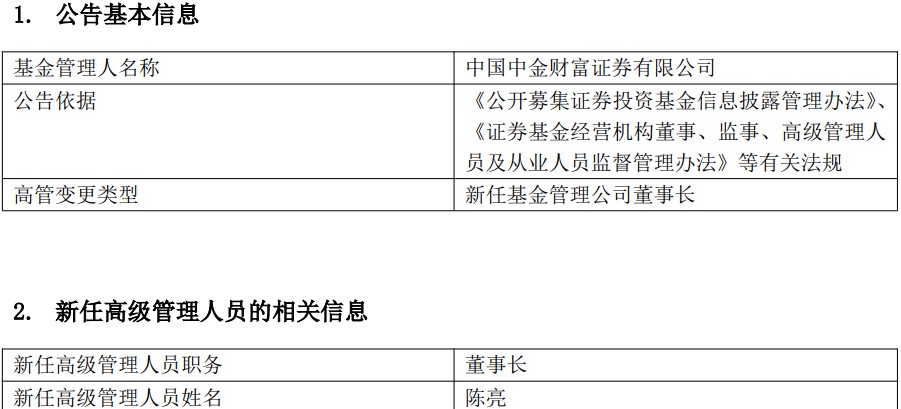

Recently, China International Capital Corporation Wealth Securities Co., Ltd. (hereinafter referred to as "CICC Wealth") disclosed an executive appointment announcement.

Chen Liang has been appointed as the chairman of CICC Wealth, which means that the chairman of CICC also concurrently serves as the chairman of both the parent company and the subsidiary, overseeing the "mother-child" structure.

This personnel arrangement is not common in the securities industry. Industry insiders expect that CICC will further enhance its management of this wealth management platform, which may have many highlights in the future.

As leading brokerages continue to increase their wealth management layouts, what is the future path for CICC Wealth?

What is Chen Liang's Background?

In fact, Chen Liang is a veteran in the Chinese securities industry.

Public information shows that Chen Liang was born in January 1968 and holds an Executive MBA from Fudan University.

In the early 1990s, Chen Liang began his career in the securities industry.

From October 1994 to February 2001, he served as the director of the computer department, deputy general manager of the securities department, and manager of the Wenyi Road securities business department at Xinjiang Hongyuan Trust Investment Co., Ltd.

It can be seen that Chen Liang accumulated experience in grassroots business departments in the early stages.

From February 2001 to September 2009, he held various positions including general manager of the Urumqi business headquarters of Hongyuan Securities Co., Ltd., assistant general manager, general manager of the Xinjiang marketing brokerage center, and general manager of the brokerage business headquarters.

Since September 2009, he officially began his executive career in the securities industry. By January 2015, he served as deputy general manager of Hongyuan Securities Co., Ltd. and chairman of Hongyuan Futures Co., Ltd.

During this period, Chen Liang achieved cross-domain management capabilities in both securities and futures businesses.

Afterwards, he experienced mergers and reorganizations at the brokerage he worked for, serving from December 2014 to May 2019 as a member of the party committee of Shenwan Hongyuan Group Co., Ltd. and Shenwan Hongyuan Securities Co., Ltd., general manager of Shenwan Hongyuan Group Co., Ltd., and executive director of Shenwan Hongyuan Western Securities Co., Ltd., as well as party secretary of Shenwan Hongyuan Western Securities Co., Ltd. from August 2015 to May 2019.

Starting in June 2019, Chen Liang bid farewell to the Shenwan Hongyuan system, where he had worked for twenty years, and was transferred to another brokerage giant, Galaxy Securities, serving as president, vice chairman, and chairman. Until October 2023, he was transferred to a company that also belongs to CICC, currently serving as the party secretary and chairman of the management committee of the company.

It can be seen that Chen Liang has a record of being the "top leader" at three large brokerages, and the market has various interpretations of his "move" from Galaxy Securities to CICC.

The Growth Trajectory of CICC Wealth

The growth trajectory of CICC Wealth can be traced back to 2005.

That year, China Jianyin Investment Co., Ltd. acquired the assets of the former Southern Securities and established China Jianyin Investment Securities Co., Ltd.

Three years later, at the end of 2008, the company's equity was transferred to Central Huijin Investment Ltd., thus gaining a central enterprise background, significantly enhancing its capital strength and resource support In November 2011, the company was renamed China International Capital Corporation Limited.

In March 2017, CICC took over all the equity held by Central Huijin, and since then, China International Capital Corporation has become a wholly-owned subsidiary of CICC, laying the organizational and collaborative foundation for the transformation of wealth management. At that time, CICC had long focused on investment banking, while its brokerage and wealth management segments were relatively weak, contrasting sharply with traditional securities firms that excelled in retail business.

In September 2019, the company was renamed CICC Wealth, officially positioning itself with "wealth management" as its core focus.

Since then, wealth management has gradually become an important source of revenue for CICC. In the first half of 2025, CICC's wealth management business achieved revenue of 4.179 billion yuan; during the same period, CICC Wealth recorded operating revenue of 3.821 billion yuan and net profit of 987 million yuan, representing year-on-year growth of 46.74% and 88.66%, respectively.

According to the official website of CICC Wealth, as of July 2025, the assets under management of CICC Wealth's buy-side advisory services have crossed the milestone of 100 billion yuan.

The so-called buy-side advisory refers to professional services provided by securities firms based on client interests, independently offering asset allocation, product selection, and portfolio management, distinguishing it from the traditional sell-side model that is product sales-oriented