The United States officially announced a new list of critical minerals, which for the first time includes copper, silver, uranium, and potash

The U.S. government has updated its critical minerals list for the first time, adding minerals such as copper, uranium, silver, and potash, marking a significant adjustment since its release in 2018. This move may impact the Trump administration's Section 232 investigation, which involves tariffs and trade restrictions. The updated list will affect mining investments and mining permits, aiming to reduce reliance on imports and enhance domestic supply. Related mining stocks in the U.S. stock market showed mixed performance, with copper mining ETFs rising, while nuclear power concept stocks generally fell

The largest adjustment to the key minerals of the U.S. government since their introduction has been finalized. This decision directly affects the Section 232 investigation announced by the Trump administration in April, which may lead to tariffs and trade restrictions on related products.

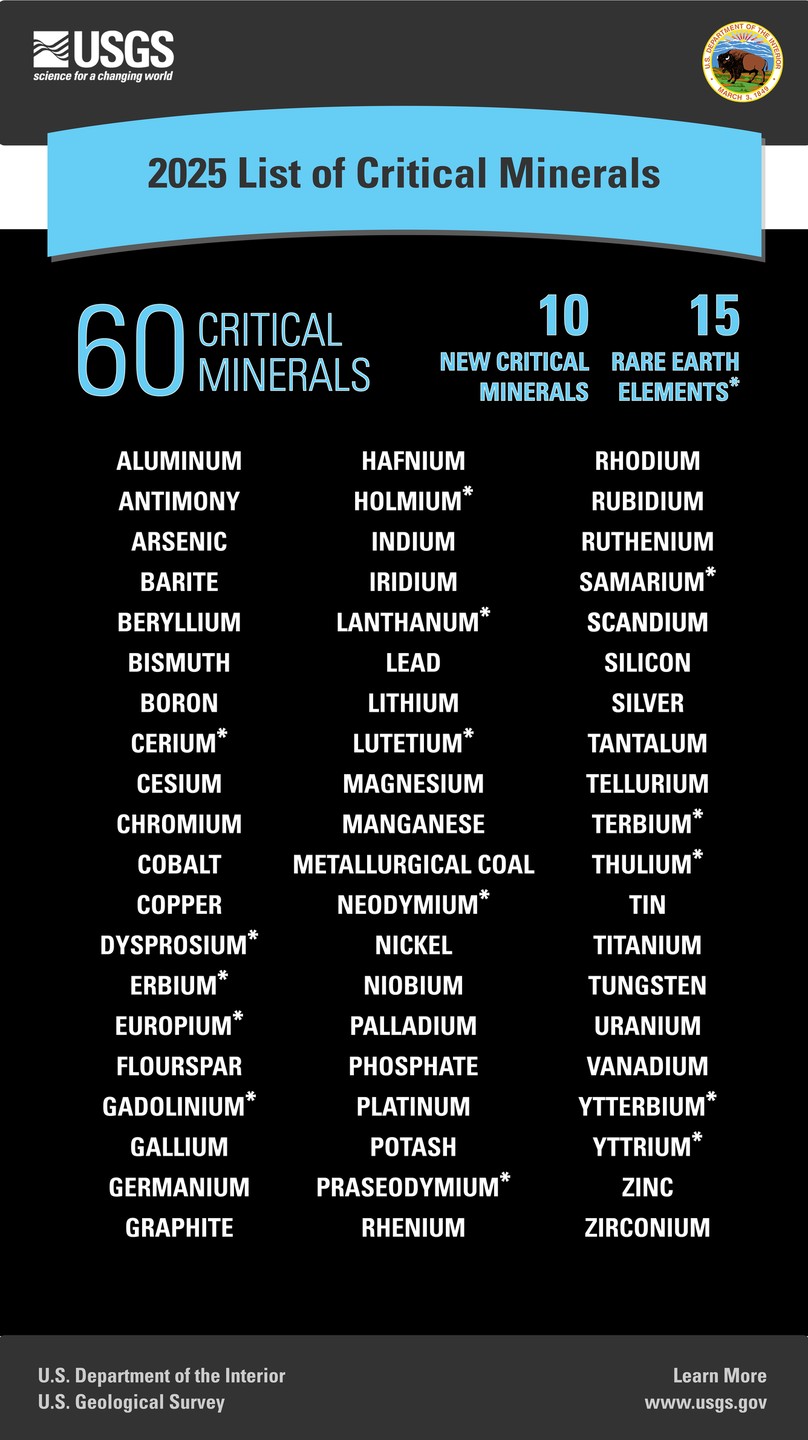

On Thursday, December 6th, U.S. Eastern Time, the U.S. Geological Survey (USGS) under the Department of the Interior released the latest key minerals list, which for the first time includes copper, marking the most significant adjustment since the list was first published in 2018. The new list replaces the 2022 version and adds uranium, silver, metallurgical coal, potassium, rhenium, silicon, and lead. When the draft key minerals list was announced at the end of August this year, U.S. Secretary of the Interior Doug Burgum stated that this move would provide a roadmap for reducing U.S. dependence on imports and expanding domestic production.

After the release of the new key minerals list for 2025, U.S. stocks saw a rise in copper mining ETFs by about 2% in early trading on Thursday, with Southern Copper Corporation up 1.6%, Freeport down 1.2%, and McEwen down 1.9%. U.S. rare earth concept stocks USAR fell over 1%, and Energy Fuels dropped more than 5%. Nuclear power concept stocks plummeted, with LEU down over 15%, Nexgen Energy down nearly 8%, Oklo down 6%, NuScale down over 5%, and Uranium Energy down over 4%. The uranium mining nuclear energy ETF fell over 3%.

The key minerals list determines which products will be included in the Section 232 investigation related to the processing of key minerals and their derivatives announced by the Trump administration in April, affecting future tariff policies and trade restrictions. The list will also impact mining investments, mine waste recycling, mineral processing tax incentives, and mining permit approval processes.

The Trump administration has prioritized enhancing domestic supply of these minerals, believing that excessive reliance on foreign supplies jeopardizes national security, infrastructure development, and technological innovation. The expansion of this list comes at a time when U.S. electricity demand is experiencing its first growth in twenty years, driven by the demand for data centers and artificial intelligence, leading to increased needs for grid transformation.

Copper and Potash First Included to Address Supply Chain Risks

Copper, as an excellent conductor, is widely used in transportation, defense, and power network construction. With the increase in electricity demand driven by the development of data centers and artificial intelligence, its strategic importance is becoming increasingly prominent.

When the draft key minerals list was announced at the end of August, Juan Ignacio Diaz, head of the International Copper Association, stated that copper "supports electrification, defense, and clean energy, and its supply chain is facing increasing pressure." Recognizing copper as a key mineral "is beneficial for the U.S. because it can strengthen its competitiveness and the foundation for energy transition."

The U.S. imports nearly half of its copper consumption, primarily from Chile, Peru, and Canada, while most of the global copper refining capacity is concentrated in China. The resource industry has long pushed the U.S. government to include metals like copper on the list to gain federal funding support and simplified government permit approval processes Potash is primarily used for fertilizer production, with about 80% of the potash used in the United States imported from Canada. Kendra Russell, head of the Energy and Mineral Resources team at the U.S. Geological Survey (USGS), stated that potash was included because recent modeling shows that major supplying countries may set trade barriers. The fertilizer industry lobbying group, the "Fertilizer Institute," has been advocating for potash to be classified as a critical mineral to seek tariff exemptions.

Inclusion of Silver Raises Market Concerns

The inclusion of silver has raised concerns among precious metal traders and manufacturers reliant on the material. The United States heavily depends on imports to meet domestic silver demand, and any tariffs on silver could severely impact the metal market. Silver has widespread industrial applications in electronics, solar panels, and medical devices.

The USGS stated that the inclusion of silver is to address the low-probability but high-impact potential scenario of supply disruptions from Mexico. Reports indicate that this list categorizes critical minerals for the first time into high risk, higher risk, and medium risk based on their risk levels.

The new assessment method incorporates the economic consequences of supply shocks and highlights "single point failure" situations, which refer to vulnerabilities from relying on a single domestic producer. USGS Deputy Director Sarah Ryke stated, "In 2024, mineral resource-related industries will contribute $400 billion to the U.S. economy, and this method can distinguish which industries are most affected by supply disruptions."

Metallurgical Coal and Uranium Finally Included

Notably, an executive order signed by Trump this year directed the Department of the Interior to assess whether metallurgical coal and uranium should be included in the list. These two minerals did not appear in the draft released in August, but the final published list included them.

Metallurgical coal is used in steel production, while uranium is used as fuel for nuclear power plants. During the 30-day public comment period following the release of the August draft, the Department of the Interior welcomed input on whether to add these two minerals to the final list. Analysts believe that the final decision may have considered various factors, including environmental concerns, domestic supply status, and international trade relations.

Additionally, the USGS removed arsenic and tellurium from the critical mineral list. Tellurium was excluded due to increased domestic production, as the U.S. has shifted from being a net importer to an exporter. Arsenic was removed because recent data indicates that the main producing country is Peru, reducing the risk of supply disruptions. According to the requirements of the Energy Act of 2020, the critical mineral list must be updated every three years, and this list includes a total of 54 minerals.

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk