America's "Star Unicorns": Why Go Public When Private Equity is Larger?

Despite the active financing and high valuations of American star unicorns in the private market, they ultimately choose to go public through an IPO—not due to funding pressure, but as a proactive strategic choice. Industry analysis suggests that companies remain private to focus on long-term investments and acquisitions away from public scrutiny; the timing of going public is often chosen during the peak stage of the company's development to maximize value

This year, private financing activities for large startups in the United States have been far more active than IPOs.

According to data from Bloomberg and PitchBook, as of November 4, there have been 21 private financing deals exceeding $1 billion, totaling $108 billion; while there were only 10 IPOs of the same scale, raising $13.3 billion.

Driven by artificial intelligence and technology giant aspirants, companies like OpenAI and Databricks have secured massive financing and high valuations in the private market. However, a core question remains for investors: why do these companies ultimately still need to go public, given the generosity of the private market?

The answer lies in timing and strategic choices. Chris Evdaimon, a private equity investor at Baillie Gifford, stated that these companies "could go public tomorrow," but they choose to remain private to invest in loss-making businesses or pursue acquisitions without public scrutiny.

Nevertheless, bankers and investors generally believe that these companies will eventually go public. This move is not merely to capitalize on market timing but to maximize value from a position of strength at the peak of their development.

Why is IPO still the endgame?

Currently, many startups prefer to remain private, partly because investors are willing to fund growth before profitability. Evdaimon pointed out, "Right now, the private market is rewarding growth." Additionally, the increasing number of private equity sales provides opportunities for long-term supporters and employees to cash out before an IPO, alleviating the urgency to go public.

Although there is flexibility in raising funds in the private market, the majority opinion is that these highly valued private companies will eventually go public. Evdaimon stated that they are simply choosing the right timing to "maximize value from a position of strength."

Taking OpenAI as an example, the company's recent restructuring is seen as paving the way for a future public listing. Meanwhile, fintech company Klarna Group Plc completed its IPO this September after 20 years of establishment.

How do they perform post-IPO?

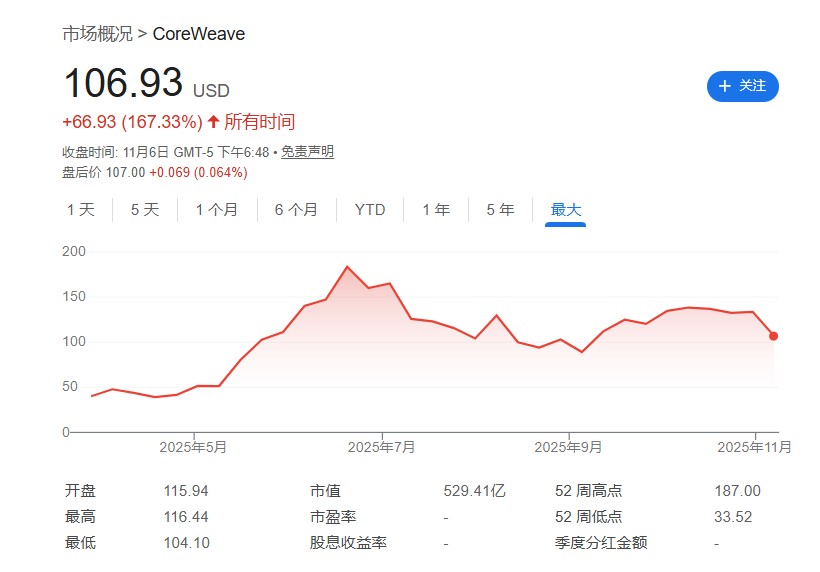

The performance of large IPOs this year has been mixed. Data shows that while the weighted average return of these companies reached 40%, outperforming the S&P 500 index, the stock prices of 4 out of 10 companies have fallen below their offering prices.

The overall strong performance is mainly driven by a few companies, such as stablecoin issuer Circle and CoreWeave.