Institutions that are "taking profits" are assessing the timing for "re-entering gold": the short-term focus is on the stickiness of "gold ETFs"

After the rise in gold prices, institutional investors are optimistic about the medium-term outlook for gold, having taken profits in the short term and seeking opportunities to re-enter. JP Morgan's report indicates that although there has been a net outflow of approximately 35 tons from global gold ETFs recently, the outflow rate is relatively slow, showing that holdings are sticky. If gold prices fall below USD 3,900 per ounce, it may trigger a deeper washout. The enthusiasm of global central banks for purchasing gold remains high, supporting gold prices

After experiencing a sharp rise in gold prices and a pullback to around $4,000 per ounce, the market is at a critical stage of contention.

According to news from the Chase Trading Desk, JP Morgan released its latest research report on November 6, stating that despite the recent pullback in gold prices, institutional investors remain optimistic about the medium-term outlook for gold, while in the short term, they have taken profits and are seeking opportunities to re-enter.

After participating in the London Bullion Market Association (LBMA) Global Precious Metals Conference in late October and communicating with Asian clients, it was found that the market generally views the recent pullback in gold prices as "healthy." Following the explosive demand inflow in the third quarter of 2025 and early October, such an adjustment is necessary and normal.

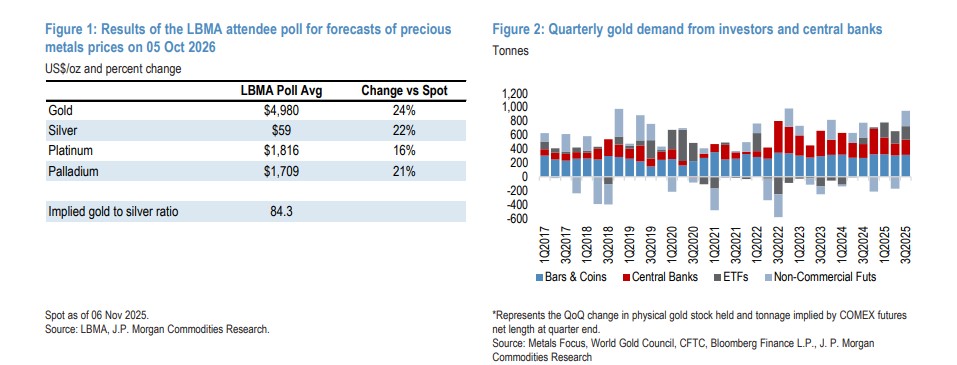

According to the report, attendees are extremely optimistic about the long-term trend of gold prices, predicting that by the next LBMA meeting on October 5, 2026, the average gold price will reach $4,980 per ounce.

Behind this optimistic sentiment is the astonishing demand data from the third quarter of 2025: total demand from investors (including ETFs, futures, gold bars, and coins) and central banks reached approximately 950 tons, equivalent to about $10.6 billion in nominal value, nearly 50% higher than the average level of the previous four quarters.

Short-term Focus: The "Stickiness" of ETF Fund Flows and Re-entry Timing

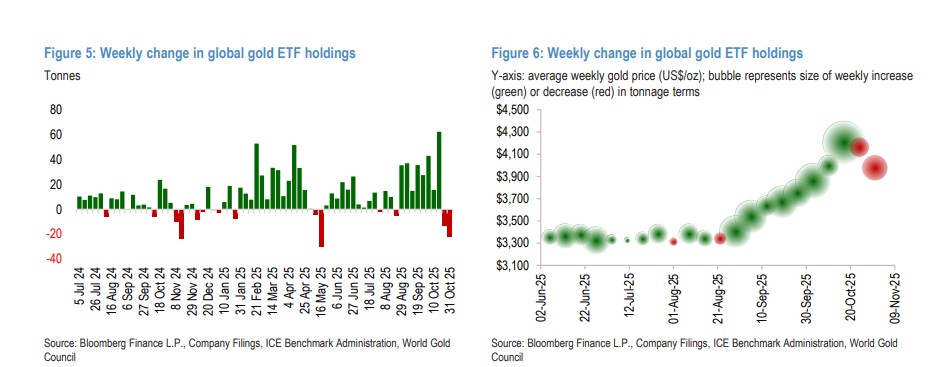

The report points out that many institutional investors took profits last month when gold prices surged vertically and are currently trying to determine the timing and price for re-entry. In the short term, everyone's attention is focused on the "stickiness" of recent ETF inflows.

Data shows that in the past two weeks, global gold ETFs experienced a net outflow of about 35 tons. However, this outflow is only about half of the record inflow of 62 tons for the week ending October 17. JP Morgan's analysis suggests that the speed of fund outflows has not been as rapid as during inflows, indicating that current ETF holdings are "relatively sticky."

However, risks still exist. The report warns that if gold prices fall below the critical level of $3,900 per ounce, it could trigger a deeper "washout." It is estimated that about 42 tons of recent inflow funds have a cost basis at $4,000 per ounce and above, and these positions may face liquidation pressure if prices decline further.

Structural Support: Central Banks' Enthusiasm for Gold Purchases Remains Strong

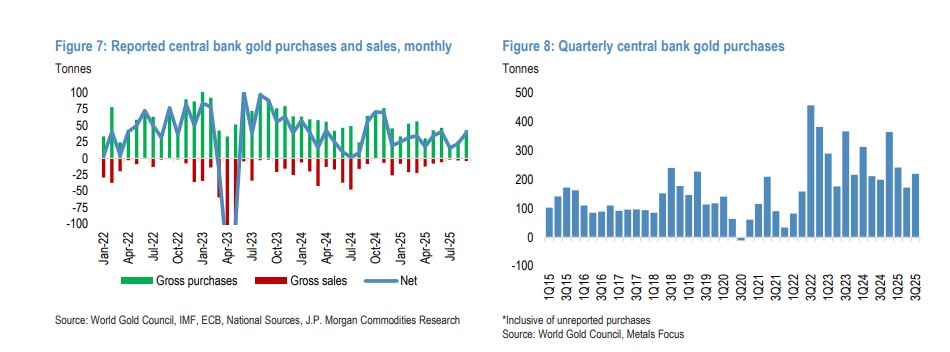

The report believes that the continuous and price-insensitive purchasing behavior of global central banks is the "cornerstone" supporting the long-term bull market in gold.

JP Morgan's report provides encouraging data: in the third quarter of 2025, the total net gold purchases by global central banks reached 220 tons, a quarter-on-quarter increase of 30%, equivalent to an annualized purchase rate of 880 tons It is particularly noteworthy that even in September, when the average gold price was USD 3,668 per ounce, the officially reported net purchase volume still reached 39 tons, making it the strongest month since 2025.

Among them, the Central Bank of Brazil purchased 15 tons of gold in September. In addition, the Central Bank of South Korea also stated at the meeting that it plans to "consider increasing gold holdings from a medium to long-term perspective," marking the first signal of gold purchases from the bank since 2013. These signs indicate that central banks are purchasing from a top-down asset allocation perspective and are relatively insensitive to price fluctuations.

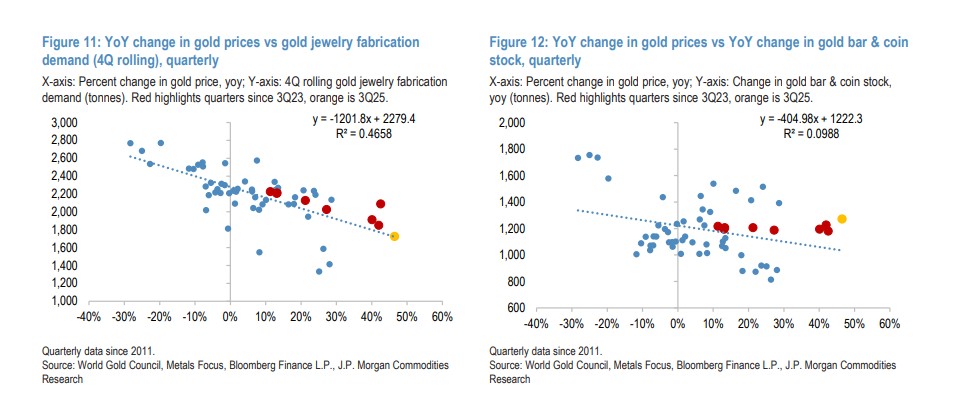

Demand Divergence: Weak Jewelry, Strong Demand for Gold Bars and Coins

Physical demand has shown a clear divergence. According to data from institutions such as the World Gold Council, high prices have impacted jewelry demand. In the third quarter of 2025, global jewelry demand decreased by 19% year-on-year in terms of tonnage, with the Indian market experiencing a year-on-year decline of as much as 31%.

However, retail demand for gold bars and coins has remained exceptionally strong, with a year-on-year increase of 17% last quarter, partially offsetting the gap in jewelry demand.

This trend is particularly evident in China: in the third quarter, jewelry demand in China decreased by 17% year-on-year, while demand for gold bars and coins increased by 20% year-on-year. JP Morgan believes that China's recent adjustment of the value-added tax policy will further encourage investors to shift from jewelry to ETFs and investment gold bars.

Potential Risks: Recycling Supply and Sentiment Reversal

The report concludes with a potential risk worth noting: gold recycling supply. Currently, despite high prices, the growth of recycled gold supply remains "relatively moderate," with a quarter-on-quarter decline of about 1% in the third quarter of 2025.

However, an interesting market dynamic is worth paying attention to: holders are reluctant to sell too early in a bull market. But if market sentiment reverses and gold prices experience a sharp and sustained decline, it may trigger panic selling.

When holders begin to worry about "missing the best selling point," it may lead to a surge in recycling supply, thereby increasing supply pressure in an already declining market and exacerbating the downward trend in prices.

The above exciting content comes from the Wind Trading Platform.

For more detailed interpretations, including real-time analysis and frontline research, please join the【Wind Trading Platform ▪ Annual Membership】

Risk warning and disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk