XPeng AI in the future, Bank of America raises its target price: optimistic about the "physical AI" strategy and the ability to monetize technology

Bank of America has raised the target price for XPeng to $27, driven primarily by key validation of its "physical AI" strategy and technology monetization capabilities. Volkswagen has become the first customer of XPeng's VLA 2.0 large model and Turing AI chip, marking the successful commercialization of XPeng's AI technology. Additionally, the bank noted that XPeng's Robotaxi, humanoid robots, and flying cars are all planned for mass production or delivery in 2026

XPeng's "Physical AI" blueprint presented at the AI Day has gained further recognition from Wall Street.

According to the Chasing Wind Trading Desk, a report released by Bank of America on November 6 reaffirmed its "Buy" rating on XPeng and raised the target price for its American Depositary Shares (ADS) from $26 to $27, with the target price for its Hong Kong shares also raised from HKD 101 to HKD 105.

This move follows XPeng's AI Day held on November 5, where the company detailed its latest advancements in artificial intelligence, including a series of disruptive products such as the VLA 2.0 large model, autonomous taxis (Robotaxi), humanoid robots, and flying cars.

The most significant news from this event was the endorsement from Volkswagen. The report disclosed that Volkswagen has become the first customer of XPeng's VLA 2.0 large model and has ordered its self-developed Turing AI chip.

This collaboration is viewed by Bank of America as a key signal, proving that XPeng's leading advantage in advanced driver-assistance systems (ADAS) is beginning to translate into tangible commercial revenue, providing strong evidence for technology monetization.

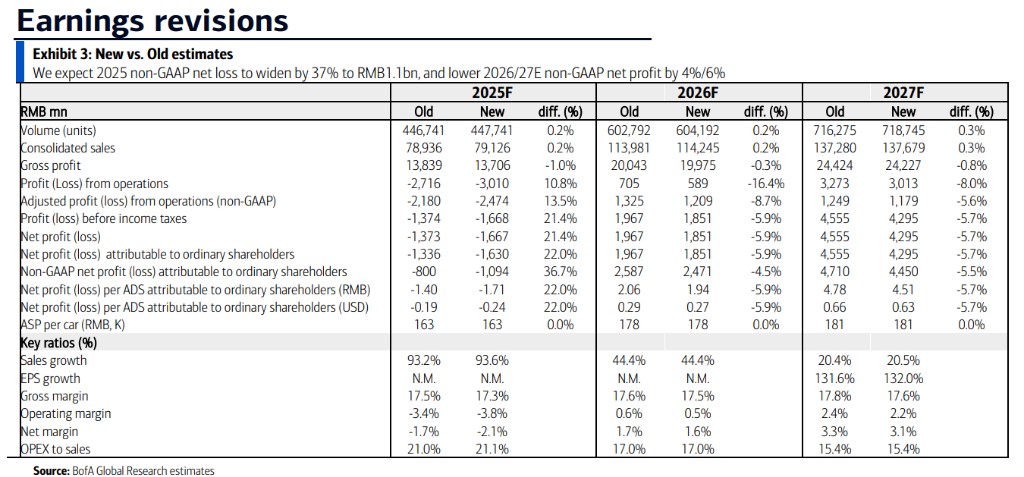

However, the optimistic long-term outlook comes with cautious adjustments to short-term finances. The report noted that, considering changes in the product mix and other factors, the bank has widened XPeng's expected non-GAAP net loss for 2025 by 36.7%, while lowering the net profit expectations for 2026 and 2027 by 4.5% and 5.5%, respectively.

"Physical AI": Volkswagen Becomes the First External Customer

The core of XPeng's AI Day was the release of the "Physical AI" concept, which aims to enable AI to deeply understand, interact with, and change the physical world. Its foundation is the new VLA 2.0 (Vision-Language-Action) large model, which the report describes as the operating system controlling the cerebellum in the world of Physical AI.

According to the report, VLA 2.0 has the following features:

-

Powerful Computing Power: Driven by XPeng's self-developed Turing AI chip, with a computing power of up to 2,250 TOPS and a 12-fold increase in inference efficiency.

-

Large Model Foundation: Trained on a 30,000-card computing cluster on Alibaba Cloud and a foundational model with 72 billion parameters.

-

Wide Application: The model can be applied to cars, Robotaxis, robots, and flying cars.

For investors, the most critical incremental information is that the report clearly states that Volkswagen has become the first customer of XPeng's VLA 2.0 and has ordered the Turing AI chip from XPeng. This collaboration is the strongest proof of XPeng's ability to commercialize its AI technology, demonstrating that its advanced driver-assistance system (ADAS) development capabilities are translating into direct service revenue

Future Blueprint: Robotaxi, Robots, and Flying Cars to Land in 2026

In addition to the core AI models, XPeng has painted a clear picture of its future business landscape for investors, along with a specific timeline.

-

Robotaxi: Plans to launch three Robotaxi models in 2026, equipped with four Turing chips (total computing power of 3,000 TOPS) and the VLA 2.0 model. The report mentions that Amap has become its first global ecosystem partner.

-

Humanoid Robot (IRON): The new generation of humanoid robots is expected to achieve mass production by the end of 2026. Highlights include the use of all-solid-state batteries, with initial applications in commercial scenarios such as guiding and patrolling. The report reveals that Baosteel Group will use XPeng's IRON robots for inspection work.

-

Flying Car (ARIDGE): The brand ARIDGE's "land aircraft carrier" (targeting individual users) plans to start mass production and delivery in 2026. Its flying car factory is planned to have an annual production capacity of 10,000 units.

Financial Considerations Behind the Target Price Increase

Bank of America has set a new target price for XPeng at $27, based on the average of two valuation methods: EV/Sales (Enterprise Value/Sales) and DCF (Discounted Cash Flow).

The report explains that although the bank has lowered the target EV/Sales multiple in its valuation model from 1.8 times to 1.5 times, the fair value derived from the EV/Sales method has actually increased due to the adjustment of the valuation basis from the 2025/2026 sales outlook to the full year of 2026. Analysts believe that XPeng should enjoy a higher valuation multiple compared to its peers, given its higher sales growth expectations for 2025-2026 and the launch of new businesses such as humanoid robots and autonomous taxis.

Despite raising the target price, Bank of America remains conservative in its profit forecast for XPeng. The report anticipates that due to product mix adjustments, the company's gross margin will face pressure, leading to an expanded loss in 2025. However, the bank still expects XPeng to achieve profitability in the fourth quarter of 2025.

The above exciting content comes from [Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)