The most expensive CEO in human history is born! Musk's "trillion-dollar compensation" behind the "ten-year wager agreement"

Tesla shareholders approved an unprecedented compensation plan that will be distributed in 12 tranches, requiring Musk to increase Tesla's valuation by $500 billion each time and achieve specific operational goals, such as delivering Tesla's 20 millionth vehicle. For each completed step—a combination of an operational goal and a valuation milestone—Musk will be granted 1% of the stock. If all 12 tranches' targets are met, he will receive approximately 12% of the company's shares, valued at about $1 trillion

Tesla shareholders have approved an unprecedented compensation plan that deeply ties CEO Musk to the company's future over the next decade. If fully realized, this deal could make Musk's worth nearly one trillion dollars, making it not only the largest executive compensation plan in business history but also a massive bet on Tesla's transformation into a giant in artificial intelligence and robotics.

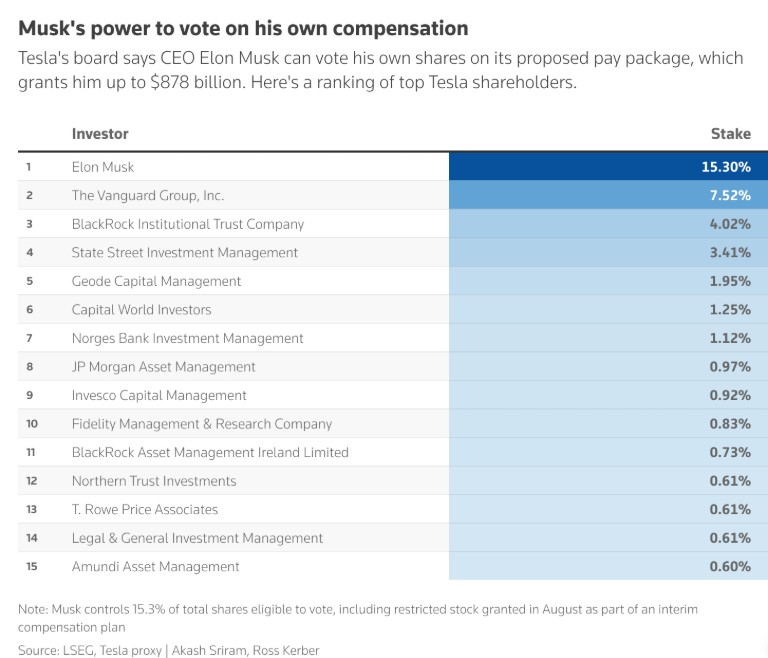

On Thursday, during the annual shareholder meeting held at Tesla's Austin factory, the compensation plan was approved with over 75% support. This result marks a key trust vote for Musk, especially after the plan faced public opposition from some well-known investors, proxy advisory firms, and activists.

The approval is seen as a crucial recognition of shareholder confidence in Musk's leadership, aimed at ensuring he remains focused as Tesla approaches a "critical turning point" in the fields of artificial intelligence and robotics. Previously, Musk's activities outside of Tesla, including his political statements, had negatively impacted the Tesla brand. Now, this exorbitant compensation plan ties his personal interests more closely to Tesla's future growth.

At the meeting, Musk announced that Tesla would embark on "a whole new book," with its mission shifting from "accelerating the world's transition to sustainable energy" to "achieving sustainable prosperity." He outlined a future vision composed of Optimus humanoid robots, Cybercab autonomous vehicles, and a vast fleet of self-driving cars enabled through software upgrades, decisively shifting the company's focus from electric vehicles to artificial intelligence and robotics.

An Unprecedented "Wager"

The scale of this compensation plan far exceeds that of any CEO in the world. According to the AFL-CIO's CEO compensation database, Microsoft CEO Satya Nadella's compensation for 2024 is just over $79 million, Apple CEO Tim Cook's is about $75 million, and Starbucks CEO Brian Niccol's compensation is slightly below $96 million. Musk's potential earnings dwarf these figures. Unlike these executives, Musk does not receive a traditional salary from Tesla.

The astonishing scale of this deal has drawn criticism, with consumer advocacy group Public Citizen stating in a report, "The realm of executive compensation will unfortunately face a new frontier—just how absurd can CEO pay become?"

Georgetown University finance professor Rohan Williamson noted that the rationale for Musk receiving such a massive compensation is largely unique to Tesla, although similar deals may become more common in founder-led startups. Regardless of perspective, this is a huge sum, but the agreement attempts to emphasize Musk's central, if not sole, role in the company's rise and future fate

12-Level Unlock Mechanism and Huge Goals

This compensation plan will be distributed in 12 batches, most of which require Musk to increase Tesla's valuation by $500 billion each time and achieve specific operational goals, such as delivering Tesla's 20 millionth vehicle. For each completed step—a combination of an operational goal and a valuation milestone—Musk will be granted 1% of the stock.

Specifically, the unlocking of compensation requires meeting two major categories of goals:

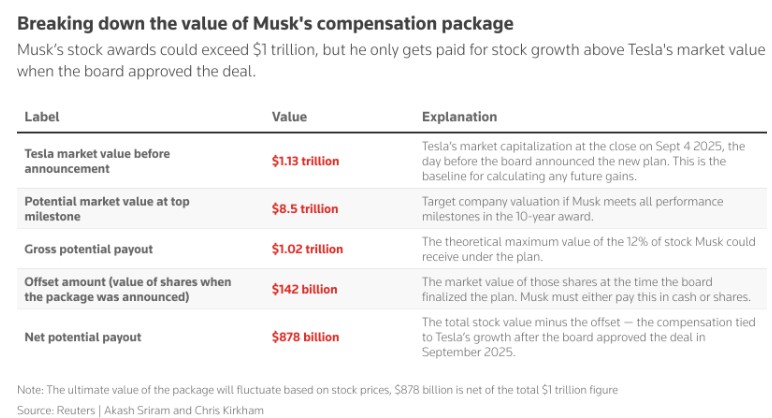

- Market Value Goals: Tesla's market value must increase in increments of $500 billion until it reaches $8.5 trillion.

- Operational Goals: This includes a series of ambitious milestones such as delivering the 20 millionth vehicle, operating 1 million robotaxis, selling 1 million robots, and achieving core profits of up to $400 billion.

Whenever a market value goal and an operational goal are achieved simultaneously, Musk will unlock approximately 1% of the company's stock options. If all 12 batches of goals are fully achieved, he will receive about 12% of the company's shares.

If Musk achieves all the goals, he will be eligible for 12% of the stock, valued at approximately $1 trillion. However, the true value of the compensation plan is $878 billion, as the board aims to pay only for the value added to the company by Musk. The structure of the plan is to provide Musk with stock worth $1 trillion, minus the stock value on the day the board approved the proposal in early September. Musk can choose to pay in cash or accept fewer shares to offset the original value.

The value of this compensation plan is always a moving target, as it fluctuates with changes in stock prices. Even if Musk fails to achieve most of the goals, the plan could still yield him tens of billions of dollars in gains.

Board's Discretionary Power Sparks Controversy

The controversy surrounding the plan has never ceased. Critics argue that its scale is excessive and that the terms of the plan grant the board a certain degree of discretion.

This has led critics to believe that these milestones are more like suggestions than mandatory requirements. Corporate governance expert and ValueEdge Advisors Chair Nell Minow stated, "While it claims to be linked to some very ambitious goals, in reality, it gives the board discretion to grant him a corresponding number of shares regardless of whether he meets those goals." Minow is a Tesla investor who voted against the compensation plan, calling it a "win for me, lose for you" proposal.

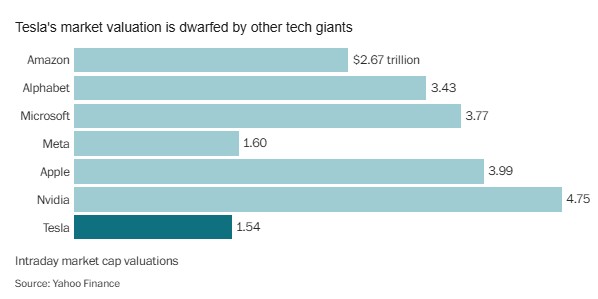

Tesla investor Ross Gerber, who has become a well-known critic of Musk in recent years, bluntly stated, "This is insane, it's absurd... you're giving him 100% of the company's value today." The plan could potentially inflate Musk's net worth to nearly Tesla's current total market value of about $1.5 trillion.

However, the Tesla board insists that this is a necessary move to retain Musk. Board Chair Robyn Denholm wrote in a letter to shareholders: "Do we want to retain Musk as CEO of Tesla and incentivize him to drive Tesla to become the world's leading provider of autonomous driving solutions and the most valuable company?" "She warned that if a fair 'performance-based pay' plan cannot be provided, there is a risk of Musk abandoning his executive position.

Musk himself has also been candid, having publicly stated that he feels uneasy about 'developing Tesla into a leader in artificial intelligence and robotics' without gaining approximately 25% voting control of the company, and has threatened to possibly shift his focus to his AI startup xAI. Musk claims that what he seeks is not money, but sufficient influence in building a 'robot army.'

Betting on a 'New Chapter' in AI and Robotics

The victory at this shareholder meeting has cleared the way for Musk to put his grand vision for artificial intelligence into practice. He elaborated on the company's future product roadmap, with the humanoid robot Optimus being highly anticipated. Musk envisions that the number of these robots could eventually reach hundreds of billions, with applications ranging from industrial production to home assistance and even healthcare.

During Tesla's quarterly earnings call last month, Musk stated that the ambition to change the world is what drives him to demand high pay, not greed. "It's not that I want to spend this money," he said during the call, mentioning the grand plan to turn Tesla into a giant in artificial intelligence and robotics. "If I don't have strong influence, I am not willing to build a robot army."

Shareholders also voted to support Tesla's investment in Musk's AI startup xAI, despite many abstentions. While Tesla's potential investment in xAI raised concerns about conflicts of interest, this move is widely seen as beneficial for both companies, as Tesla's autonomous driving ambitions rely on critical AI capabilities, while xAI will benefit from a major client like Tesla.

Despite Musk's past record of 'over-promising,' shareholders ultimately chose to support his vision with their votes. This exorbitant compensation plan is both an acknowledgment of Musk's past achievements and the ultimate bet on whether he can lead Tesla to create miracles again in a new era defined by artificial intelligence