This year, the number of layoffs in the United States has reached the highest level since 2009, and the perception of an employment market characterized by "no hiring and no layoffs" is being shattered

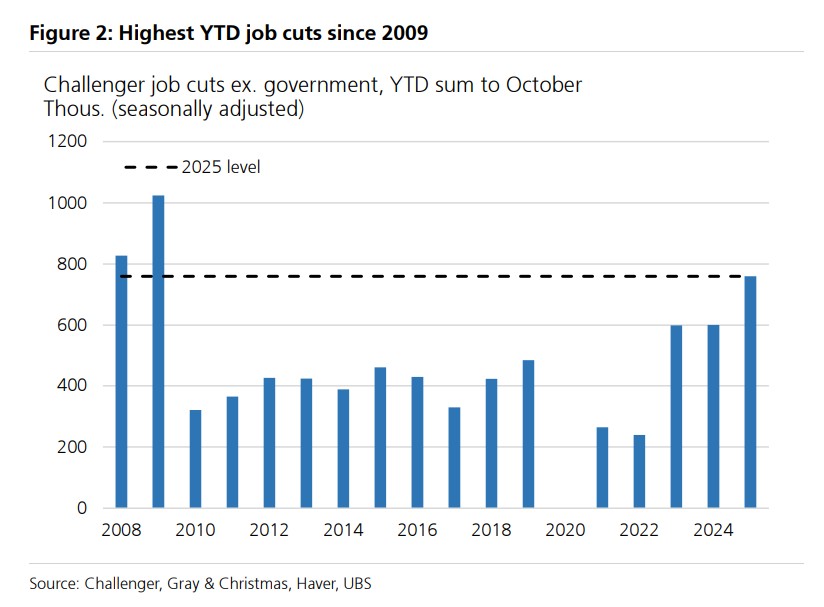

UBS warns that as of October, the cumulative number of layoffs in the United States this year has reached the highest level since 2009. For investors betting on a "soft landing" in the U.S., the cracks in the labor market are widening. As layoff data continues to hit a 15-year high, while the market is still debating minor fluctuations in non-farm payroll data, the real risks may already be brewing

UBS warns that the so-called narrative of "low hiring, low layoffs" in the U.S. job market is collapsing. As of October, the cumulative number of layoffs in the U.S. this year has reached the highest level since 2009.

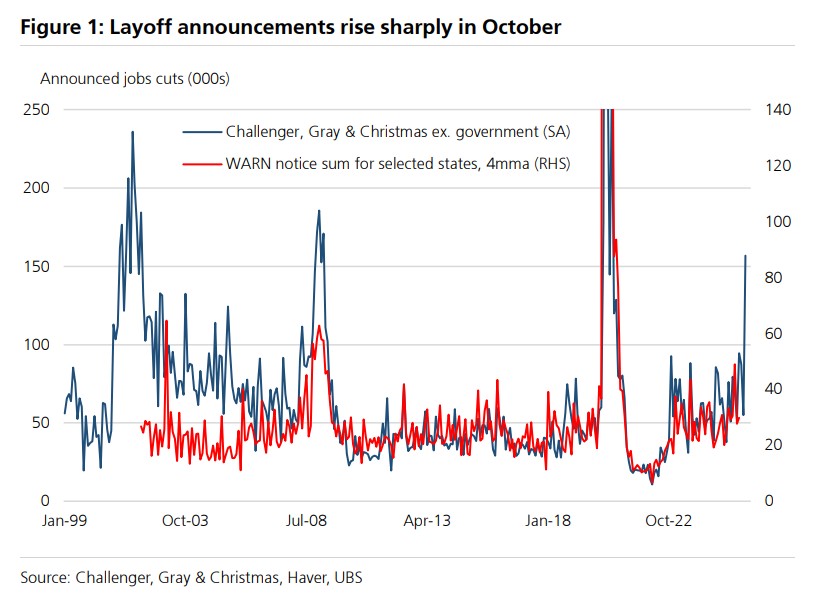

According to the Wind Trading Desk, UBS analysts stated in a report on November 6 that the latest Challenger layoff data shows that the seasonally adjusted layoff announcements in October reached 192,000, a month-on-month surge of 126,000.

More concerning is that after excluding government and non-profit organizations (to avoid interference from "DOGE" political noise), layoffs in the private sector surged to 157,000, the highest level since July 2020, and also the highest October figure on record. The technology sector saw an increase of 25,000 layoffs in a single month, while the warehousing and logistics sector experienced a dramatic rise of 46,000. AI-related layoffs suddenly jumped from zero in September to 31,000 in October.

As of October, the cumulative layoffs in 2025 reached 760,000—this figure not only exceeds the 601,000 in the same period of 2024 but also sets a record for the highest number of layoffs in any year since 2009.

Analysts bluntly pointed out:

"Although the market generally accepts the narrative of 'low hiring, low layoffs,' initial jobless claims, warning notices, and layoff announcements have actually been running above pre-pandemic levels."

The average monthly layoffs over the past six months have been 85,000, far exceeding the normal range of 30,000 to 50,000 during 2014-2019. Amazon announced a reduction of 14,000 corporate employees, UPS cut 48,000 jobs within a year, and Target eliminated 1,800 corporate positions—while these actions by giants may seem like isolated cases, observing them collectively signals a clear sign of systemic tightening.

Holiday Hiring Also Weak

Data on hiring is equally bleak.

The seasonally adjusted total hiring plans for September and October amounted to 400,000, far below the average level of 625,000 during 2014-2019, and also less than 625,000 in 2023 and 670,000 in 2024. Amazon is maintaining a hiring plan of 250,000 seasonal workers this year—on the surface, this appears to be consistent with the previous two years, but it actually suggests a cautious attitude against the backdrop of shrinking demand. Target has even stopped disclosing the number of seasonal positions this year.

UBS warns that for investors betting on a "soft landing" in the U.S., the cracks in the job market are widening. When layoff data continues to hit a 15-year high, while the market is still debating minor fluctuations in non-farm data, the real risks may already be brewing