Goldman Sachs: People are no longer "buy everything" in AI trading, but are "more selective," it's a "zero-sum game."

Goldman Sachs stated that the AI investment boom has entered the elimination stage, where the "buy everything" strategy has become ineffective, and funds have become selective with a divergence among winners. OpenAI executives mentioned that financing for AI infrastructure may require government involvement, leading to industry uncertainty, increased market volatility, and while investors have not lost confidence in core assets, the demand for hedging has surged

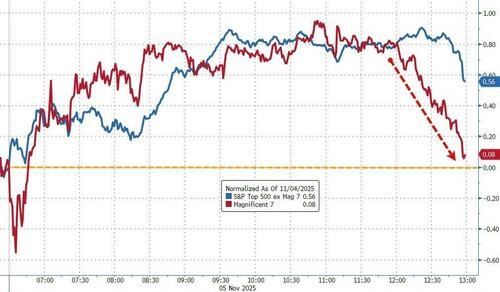

According to the latest observations from Goldman Sachs traders, the investment boom in the artificial intelligence sector is entering a new phase, where the once prevalent "buy everything" strategy is no longer effective, replaced by a more selective "zero-sum game" that differentiates winners from losers.

Recent market fluctuations have highlighted this shift. NVIDIA's stock price and the overall market experienced a pullback following remarks from OpenAI Chief Financial Officer Sarah Friar. She suggested at a recent business conference that attracting investment for massive AI computing and infrastructure may require government support.

Friar stated that given the uncertainty surrounding the lifecycle of AI data centers, an ecosystem composed of banks, private equity, and even government is needed to provide funding. She explained that federal loan guarantees would "significantly reduce financing costs," a statement that raised market concerns about the future financing models for the AI industry and caused a short-term impact on investor sentiment.

Goldman Sachs trader Lee Coppersmith pointed out that although positions in the AI sector remain heavy, investors' choices are becoming increasingly selective. He noted that recent trading feels less like a "buy everything" story and more like a zero-sum game, with the market beginning to show clear winners and losers.

Concerns Over AI Financing Models

Investor confidence in the long-term growth of the AI sector is facing challenges due to uncertainties in financing models. Sarah Friar's remarks have brought this issue to the forefront, as she candidly stated that funding for AI infrastructure development may require government intervention.

Friar explicitly mentioned, OpenAI is seeking to collaborate with banks, private equity, and even government agencies to build a funding ecosystem that can support AI development. She specifically noted that federal loan guarantees are key to attracting substantial investment, as they can significantly lower companies' financing costs.

Despite fluctuations in market sentiment, Goldman Sachs trading data shows that investors have not engaged in large-scale "de-leveraging." Overall capital flows still favor risk assets, and demand for individual stocks remains strong. This indicates that investors' long-term belief in core AI assets has not wavered.

However, a notable change is the significant increase in market hedging activities. Particularly in macro products such as exchange-traded funds (ETFs), futures, and options, the demand for hedging has clearly risen. Goldman Sachs noted that short-selling levels reached extreme highs in the past week (excluding April). Meanwhile, investors' long positions in "core targets" remain unchanged. Goldman Sachs believes this reflects more of the market's short-term tension rather than a fundamental shift in outlook

Market navigation difficulty increases, investors need to be selective

Goldman Sachs analysis believes that the current market is becoming "more difficult to navigate." In this environment, investment strategies need to be more prudent. Holding "high-quality compounding companies" remains a reasonable choice, but some lower-quality companies driven more by "hope than performance" may have stock prices that have overly reflected nearly perfect growth and policy expectations, with risks accumulating.

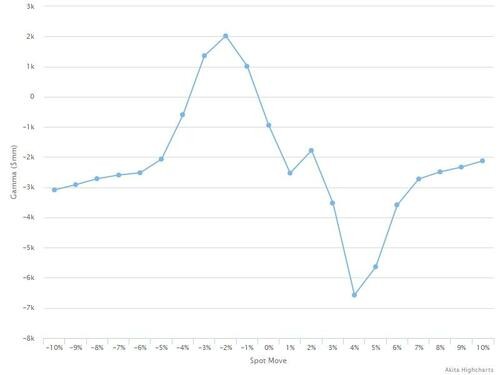

From a macro perspective, Goldman Sachs' "monetary policy" factor has retreated from its 2023 peak, indicating that the market's reliance on "central bank support" is decreasing. Additionally, Goldman Sachs' trading department has noted that the market is generally in a bullish state regarding the S&P 500 index's gamma, especially in the downside range, which provides a buffer for the market during localized sell-offs and explains the recent resilience shown by the market during pullbacks.