Is the U.S. money market facing a new wave of pressure? Wall Street warns: The Federal Reserve may be forced to restart asset purchases

Wall Street warns that three years of quantitative tightening and massive government bond issuance have pushed bank reserves into a dangerous zone. Barclays states that while the decline in the TGA account and the reduction in government bond issuance may provide short-term relief, liquidity still faces multiple challenges by the end of the year, and the effectiveness of the Federal Reserve's key tool, the SRF, is in question. The President of the Dallas Federal Reserve has made it clear: "If the rise in repo rates proves not to be temporary, the Federal Reserve needs to start purchasing assets."

The financing pressure in the U.S. money market is raising growing concerns on Wall Street, with several major investment banks warning that the ongoing funding pressure may force the Federal Reserve to take more rapid action, and could even potentially restart the long-dormant asset purchase program.

The gap between key market interest rates and the rates set by the Federal Reserve reached its highest level since 2020 last Friday. Although the tri-party repo rate eased this Wednesday, market participants generally believe this is only a temporary relief. Deirdre Dunn, head of interest rate business at Citigroup and chair of the Treasury Borrowing Advisory Committee, stated, "This is not a one-time anomaly of fluctuations over a few days." Meanwhile, Barclays U.S. interest rate strategist Samuel Earl also believes that "the financing market has not yet emerged from its difficulties."

Wall Street analysts point out that three years of quantitative tightening coinciding with record U.S. Treasury issuance is pushing bank system reserves into dangerous territory. Dunn from Citigroup noted, "The market may no longer be in an environment of ample reserves." Barclays also pointed out that although there are short-term positive factors (decline in TGA and reduction in Treasury issuance) supporting the situation, liquidity at the end of the year still faces "many hidden dangers."

Analysts generally believe that ongoing funding pressure may force the central bank to expand its balance sheet again, ending a three-year process of quantitative tightening. Dallas Fed President Lorie Logan clearly stated last week, "If the rise in repo rates proves not to be temporary, the Federal Reserve needs to start purchasing assets." This statement highlights the decision-makers' concern over market pressures.

Financing Pressure Eases but "Has Not Yet Emerged from Difficulties"

After signs of pressure appeared in key parts of the financial system at the end of last month, short-term financing rates stabilized this week. The spread between the tri-party repo rate and the Federal Reserve's reserve balance rate narrowed during the week, alleviating some pressure in the money market. However, market participants have not relaxed their vigilance.

Scott Skyrm, executive vice president at repo market specialist Curvature Securities, stated that although the market has "returned to normal," partly due to banks using Federal Reserve tools to relieve money market pressure, "financing pressure will at least reappear at the end of next month and year-end."

Barclays, in its latest research report, stated that the recent funding pressure mainly stems from two factors: the massive issuance of short-term Treasury bills (T-bills) and the continuously growing financing demand from leveraged investors.

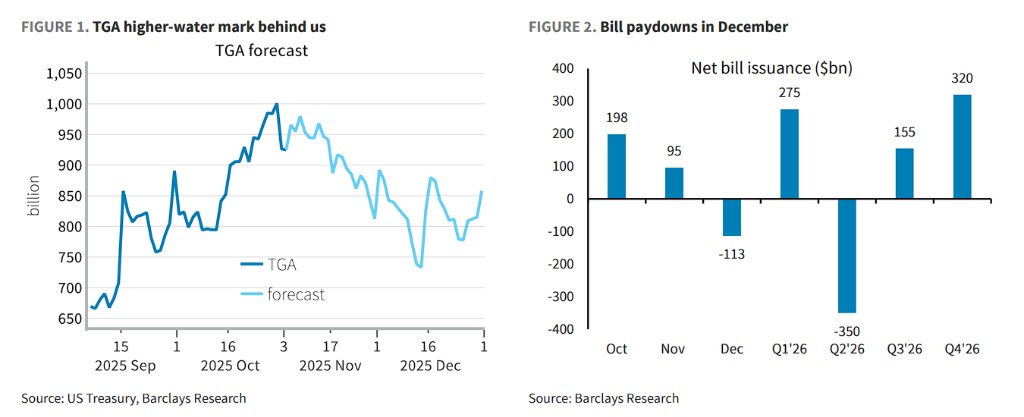

The large issuance of Treasury bonds in October pushed the balance of the Treasury General Account (TGA) to $1 trillion on October 30, far exceeding the Treasury's quarterly target of $850 billion.

This process has withdrawn a significant amount of liquidity from the banking system, causing the reserve balance to drop to nearly $2.8 trillion by the end of the month. Against this backdrop, coupled with the Bank of Canada withdrawing funds from the U.S. repo market due to its fiscal year-end, it is not surprising that financing pressure escalated at the end of the month.

The bank noted that at the end of October, repo rates surged again, coinciding with the Federal Reserve's decision to end QT early due to rising funding pressures weeks earlier. Although after the end of the month, the Secured Overnight Financing Rate (SOFR) has fallen back within the Fed's target range, the market's tense sentiment has temporarily eased, but a core question once again confronts investors: Has the Federal Reserve pushed the reserve levels of the banking system too low? **

Many analysts believe that the Federal Reserve is nearing the boundary of withdrawing too much money from the financial system due to three years of quantitative tightening. When this happens, the level of bank reserves may drop to dangerous territory. Citi's Dunn stated:

"It can be said that we are no longer in an abundant reserve environment, and these events may continue to occur."

Short-term positives: TGA decline and reduced Treasury issuance will inject liquidity

However, according to a Barclays report, despite the ongoing risks, the bank pointed out two positive factors that are expected to alleviate funding pressure before the end of the year.

First, the TGA account balance has peaked.

Barclays expects that $1 trillion is the "high watermark" for the TGA balance. As the Treasury plans to reduce its cash balance to $850 billion by the end of the year, this means that approximately $150 billion in reserves will flow back from the TGA account to the banking system.

The report also assessed the impact of a government shutdown, believing that its effect on the TGA balance is relatively small, at most about $25 billion per month, which is negligible compared to the massive reserves and total account amounts.

Second, the peak issuance period for short-term Treasuries has also passed.

To achieve the $850 billion cash target, the net issuance of Treasuries before the end of the year will be minimal. More specifically, there will still be net issuance in November, but there will be significant net repayments in December. According to signals from the Treasury during the fourth quarter refinancing meeting, the net repayment of Treasuries in December will be between $100 billion and $120 billion, which will be an important "tailwind" for liquidity before the end of the year.

Potential risks cannot be ignored: liquidity "reefs" abound at year-end

Despite the short-term alleviating factors, Barclays also emphasized that some structural pressures will continue to pose threats to the funding market in the fourth quarter.

Traditionally, the fourth quarter is a period of increased funding pressure, as Global Systemically Important Banks (GSIBs) actively shrink their balance sheets to manage their systemic risk scores.

Additionally, as stock prices have risen this year, equity repo business will mechanically consume more of the already limited bank balance sheet space. These risks are occurring in a context where reserve levels are already low, making the liquidity situation at year-end even more fragile.

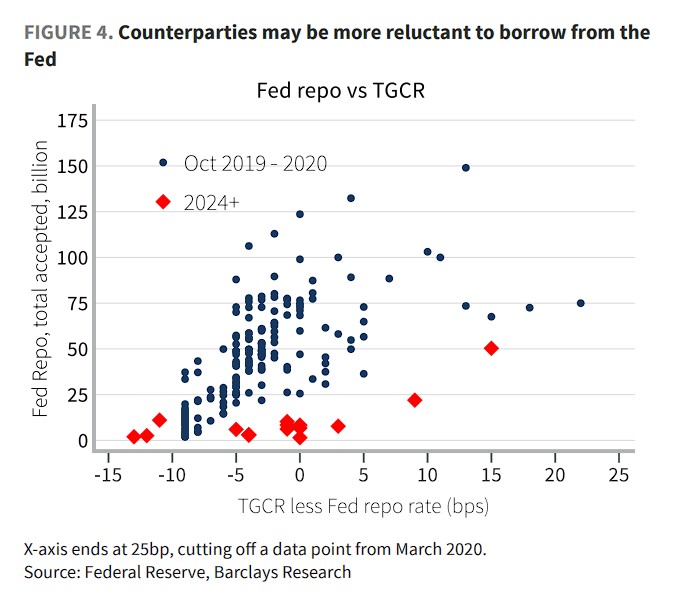

Even more concerning is that the effectiveness of the Federal Reserve's key tool for controlling the upper limit of interest rates—the Standing Repo Facility (SRF)—is being challenged. The SRF is designed to provide liquidity to the market and keep repo rates below its set upper limit.

However, in the past week, the three-party general collateral repo rate (TGCR), which represents the borrowing rate for money market funds, has repeatedly risen above the SRF rate.

This means that traders prefer to borrow from money market funds at a higher cost rather than using the Federal Reserve's SRF.

This means that traders prefer to borrow from money market funds at a higher cost rather than using the Federal Reserve's SRF.

Dallas Fed President Logan has publicly expressed disappointment about this. Barclays pointed out that this reflects the implicit costs of borrowing from the Federal Reserve, such as balance sheet costs, stigma, and relationship management. Compared to the 2019-2020 cycle, borrowers are even less willing to borrow from the Federal Reserve this time.

Samuel Earl stated in the report that if the TGCR continues to significantly exceed the SRF rate, it will be the clearest signal of the tool's ineffectiveness, which may prompt the Federal Reserve to take action to strengthen the tool, particularly through a central clearing mechanism.

Will the Federal Reserve be forced to restart asset purchases?

Some analysts and policymakers have indicated that if the pressure does not ease, the Federal Reserve may need to begin directly purchasing assets.

Former New York Fed market department member and current Dallas Fed President Logan pointed out last week that if the recent rise in repo rates is not temporary, she believes the Federal Reserve needs to start purchasing assets.

Bank of America interest rate strategist Swiber stated:

"Such aggressive Treasury issuance is at a historically high level, posing a risk of exhausting traditional investors' demand for U.S. Treasuries. To better balance Treasury supply and demand, we believe a long-dormant buyer may be needed: the Federal Reserve."

Barclays believes that the Federal Reserve is closely monitoring repo pressures but is unlikely to intervene immediately.

On one hand, there are "hawkish" members on the committee who are reluctant to expand the balance sheet and do not want to easily "rescue" the repo market. On the other hand, if the Federal Reserve were to immediately purchase Treasuries due to volatility caused by Treasury issuance, it would resemble "fiscal dominance," which the Federal Reserve is keen to avoid.

However, the repo market is an important driver of the federal funds rate direction. Therefore, if repo rates remain at the top of the target range or even higher, the Federal Reserve will ultimately have to take action. Barclays expects that if high interest rate conditions persist for several more weeks, the Federal Reserve may make adjustments.

At that time, the Federal Reserve will first strengthen the SRF, such as by introducing a central clearing mechanism, lowering the SRF rate, or providing regular repo operations to alleviate year-end funding pressures.

The basic forecast of the report is that the Federal Reserve will not need to increase reserves by expanding the balance sheet until next year. However, if the situation significantly worsens, it may deploy both repo operations and direct Treasury purchases (RMPs) simultaneously to quickly alleviate market pressures