Why did October exports exceed expectations and turn negative?

In October, China's exports fell by 1.1% year-on-year, exceeding market expectations, marking the first negative growth since March. Exports to the United States decreased by 25.2%, and the growth rate of exports to ASEAN and the European Union also slowed down. Labor-intensive products such as clothing and footwear recorded negative growth, while high-tech manufacturing exports such as integrated circuits and automobiles remained resilient. The reasons for the decline in exports include the misalignment of data from the same period last year and seasonal effects from the National Day holiday

Core Viewpoints

On November 7th, the General Administration of Customs announced that China's exports in October (in USD terms) recorded a year-on-year decline of -1.1%, down from +8.3% in the previous period, while the Wind consensus expectation was +3.2%. October's exports fell below expectations, marking the first negative growth since March of this year.

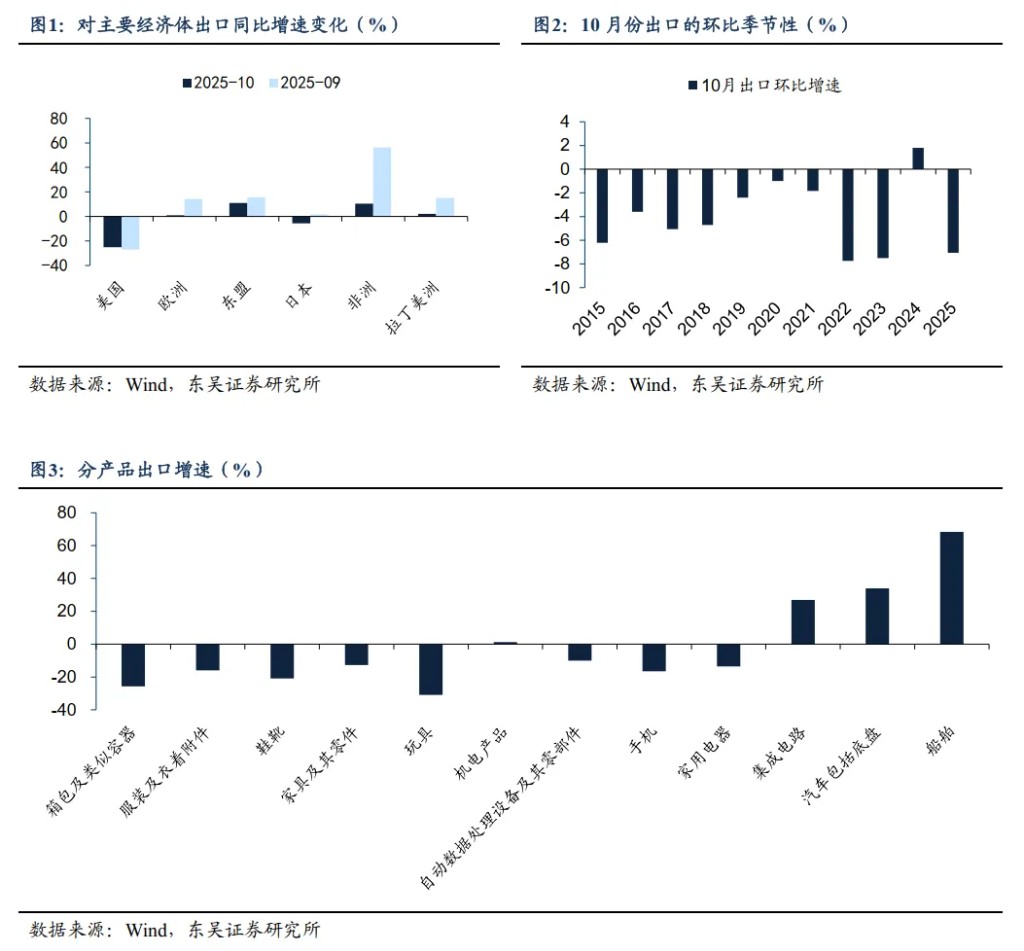

By region, exports to the United States continued to show significant negative growth, exports to ASEAN maintained some resilience, while exports to other countries and regions experienced varying degrees of decline:

(1) Among the three major trading partners, the growth rate of exports to the United States recorded -25.2%, narrowing from -27.0% in September; the growth rate of exports to ASEAN recorded +11.0%, a slight decline from +15.6% in September but still showing some resilience; the growth rate of exports to the European Union recorded +0.9%, a significant drop from +14.2% in September.

(2) Among emerging trading partners, the growth rates of exports to Africa and Latin America still recorded positive growth, but the year-on-year growth rates both saw significant declines, falling from 56.4% and 15.2% in September to 10.5% and 2.1%, respectively.

By product, labor-intensive exports continued to show significant negative growth, while high-tech manufacturing exports maintained strong resilience:

(1) In terms of labor-intensive products, the year-on-year growth rates for clothing, bags, and footwear recorded -16.0%, -25.7%, and -21.0% negative growth, respectively, all further weakening compared to September; furniture exports turned from positive growth in September to negative, recording -12.7%.

(2) In terms of technology-intensive products, the growth rate of mobile phone exports in October significantly declined from -1.7% in September to -16.6%; exports of integrated circuits, automobiles, and ships maintained strong resilience, with year-on-year growth rates of +26.9%, +34.0%, and +68.4%, respectively.

Reasons for the unexpected decline in October exports:

(1) The impact of the misalignment of exports in September and October last year is highlighted. From the seasonal changes in exports, influenced by the National Day holiday, October exports typically show a seasonal decline. Over the past 10 years, the average month-on-month growth rate for October exports recorded -3.8%, while last October's month-on-month growth rate recorded a rare positive growth of +1.8%, causing a misalignment in export data between September and October last year, with September data being relatively low and October data being relatively high. This exacerbated the impact of this year's seasonal decline in October exports on the year-on-year readings.

(2) The decline in exports to the European Union may be influenced by the easing of relations between the US and Europe. Since the implementation of reciprocal tariffs in April this year, the uncertainty in US-EU trade relations has led to continuous month-on-month growth in China's exports to the EU, resulting in exports consistently exceeding expectations. However, after the joint statement on the trade agreement was announced in August, US-EU trade relations eased, and China's exports to the EU began to weaken marginally, with the month-on-month growth rate for September recording -7.1%, and further declining to -8.6% in October, indicating that the easing of US-EU relations has impacted China's exports to the EU (3) The unexpected decline in exports to other regions may be due to the end of "rush to re-export" at the end of the year. Affected by reciprocal tariffs, China's exports have shown a clear "rush to export" characteristic. With the easing of Sino-U.S. trade relations in the second half of the year and the gradual weakening of the "rush to export" momentum, the slowdown in the year-on-year growth rate of exports to ASEAN, Africa, and other emerging markets in October may also indicate the end of "rush to re-export." Another point that can support this is that the PMI indices of African and ASEAN economies were both in the expansion range in October, indicating that there is no actual weakening of demand. Looking ahead, under the backdrop of further increasing bases in November and December, the weakening of month-on-month export momentum may still pose a risk of further decline in year-on-year export growth, and there is a possibility of negative year-on-year export growth in the fourth quarter.

Authors: Lu Zhe, Li Changmeng, Source: Macro Fans Zhe, Original Title: "Why Did Exports Unexpectedly Turn Negative? - Commentary on October Export Data"

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk