Wall Street slashes Duolingo's target price: performance guidance below expectations, sacrificing short-term profits for long-term growth

Analysts warn that in the context of slowing growth and increasing strategic uncertainty, Duolingo should no longer enjoy the valuation premium it previously had. The company's "strategic focus will shift from short-term monetization to long-term user growth," which means that in the short term, the company will actively sacrifice foreseeable bookings and profits in exchange for uncertain future user growth, directly increasing the difficulty of predicting the company's growth model for 2026 and beyond

After disappointing earnings guidance, Wall Street has lowered the target price for Duolingo.

Analysts warn that the company's "strategic focus will shift from short-term monetization to long-term user growth," meaning that in the short term, the company will actively sacrifice foreseeable bookings and profits in exchange for uncertain future user growth, which directly increases the difficulty of predicting the company's growth model for 2026 and beyond.

Bright Third Quarter Report and Dismal Fourth Quarter Guidance

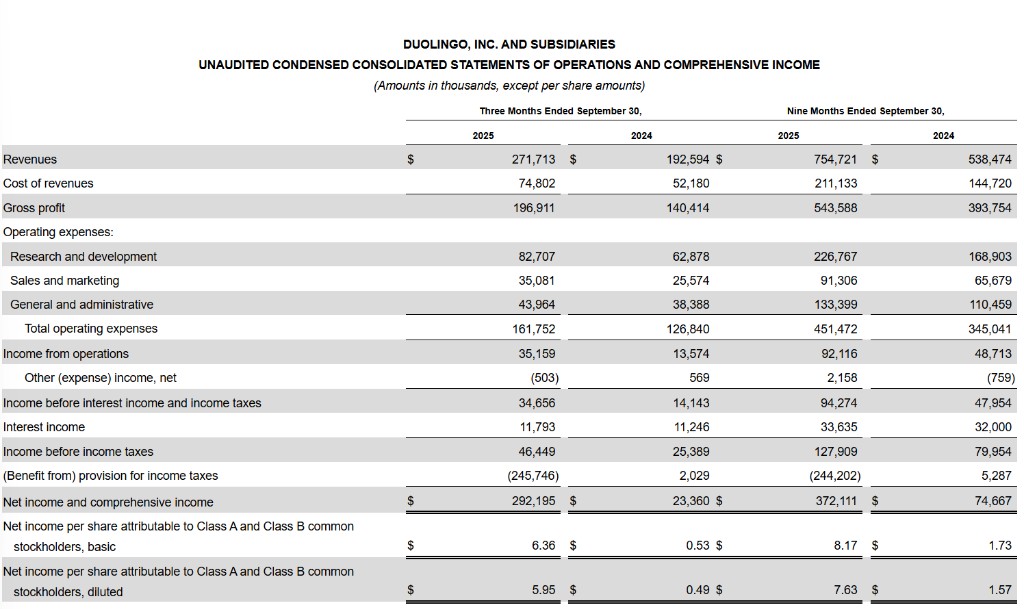

On the surface, Duolingo's performance in the third quarter is robust.

The company's quarterly revenue was $272 million, and adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was $80 million, exceeding market expectations by 4% and 10%, respectively. Both subscriptions and total bookings exceeded expectations by 3%.

However, this impressive report is completely overshadowed by the bleak fourth quarter guidance.

Management expects the median for fourth quarter bookings, revenue, and EBITDA to be $333 million, $275 million, and $77 million, respectively, with bookings and EBITDA falling short of market consensus by 3% and 4%.

More critically, management has clearly stated that future work will focus on long-term projects that "prioritize ensuring user growth," which will inevitably lead to a decrease in the priority of "monetization" in the short term.

This directly confirms the market bears' concerns: the company's current growth rate is slowing, and it needs to sacrifice monetization efficiency to stabilize user growth. Additionally, the company plans to invest more marketing expenses in the U.S. market to support the trend of daily active users (DAU), which will further squeeze short-term profits.

Target Price and Valuation Both Downgraded

The market reacted swiftly and harshly to this uncertainty. Several investment bank analysts have downgraded their ratings and target prices for Duolingo.

UBS significantly lowered Duolingo's target price from $450 to $285, a decrease of 37%; Bank of America reduced the company's target price from $370 to $301; Morgan Stanley maintained an overweight rating on the stock but drastically cut the target price from $500 to $300.

Analysts believe that in the context of slowing growth and increasing strategic uncertainty, Duolingo no longer deserves the valuation premium it previously enjoyed. Bank of America analysts explicitly pointed out that their target price downgrade is based on a lower valuation multiple—reducing the 2026 enterprise value/sales (EV/Sales) multiple from 13 times to 10 times.

UBS is even more pessimistic, lowering its revenue growth expectation for Duolingo in the 2026 fiscal year to 22%, while the EBITDA expectation is only $38 million, reflecting the market's growing concerns about the company's future profitability

Signs of User Growth Stabilization Support Continued Overweight

Despite lowering the target price, Morgan Stanley still maintains an overweight rating. Analysts believe that to change the market's negative perception, Duolingo needs to demonstrate stabilization in user growth, with no significant gap between user growth and booking growth.

First, daily active user growth in September and October has stabilized at about 30% year-on-year growth.

Second, the U.S. market seems to be recovering from its low point, with improved brand sentiment and increased social media reach recently, which should translate into growth after some time.

In addition, long-term growth drivers remain intact, with impressive progress in the largest expansion market, China, as well as in key courses such as Advanced English and Chess