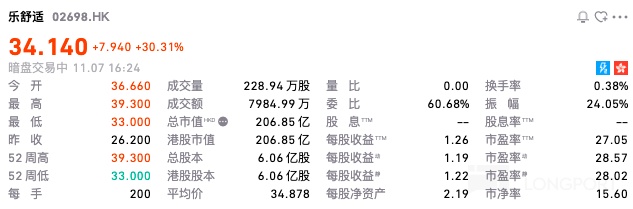

The Hong Kong stock of SOFTCARE rose over 30% in the dark market, with a total market value exceeding HKD 20.6 billion, earning over HKD 1,500 per lot

On November 7th (Thursday), shares of SOFTCARE surged over 30% in the Hong Kong dark market, with a total market capitalization exceeding HKD 20.6 billion. Excluding transaction fees, one lot earned over HKD 1,500; the company priced its shares at HKD 26.2, with each lot consisting of 200 shares, and will officially list for trading on November 10th (next Monday). SOFTCARE is a multinational hygiene products company focused on rapidly developing emerging markets in Africa, Latin America, and Central Asia, primarily engaged in the development, manufacturing, and sales of baby diapers, baby pull-ups, sanitary napkins, and wet wipes for infants and women. During the track record period, the majority of the company's revenue came from sales to African customers. According to Frost & Sullivan, based on 2024 sales volume, the company ranks first in both the African baby diaper and sanitary napkin markets, with market shares of 20.3% and 15.6%, respectively; and based on 2024 revenue, the company ranks second in both the African baby diaper market and sanitary napkin market, with market shares of 17.2% and 11.9%, respectively. In terms of financial performance, SOFTCARE's revenue increased by 28.6% from USD 320 million in 2022 to USD 411.4 million in 2023, and further increased by 10.5% from USD 411.4 million in 2023 to USD 454.4 million in 2024. Additionally, revenue for the four months ending April 30, 2024, rose by 15.5% from USD 139.6 million to USD 161.3 million for the four months ending April 30, 2025

On November 7th (Thursday), shares of SOFTCARE rose over 30% in the Hong Kong dark market, with a total market capitalization exceeding HKD 20.6 billion. Excluding transaction fees, one lot earns over HKD 1,500; the company priced its shares at HKD 26.2 each, with a lot size of 200 shares, and will officially list on November 10th (next Monday).

SOFTCARE is a multinational hygiene products company focused on rapidly developing emerging markets in Africa, Latin America, and Central Asia, primarily engaged in the development, manufacturing, and sales of baby diapers, baby pull-ups, sanitary napkins, and wet wipes for infants and women. During the track record period, most of the company's revenue came from sales to African customers. According to Frost & Sullivan, based on 2024 sales volume, the company ranks first in the African baby diaper and sanitary napkin markets, with market shares of 20.3% and 15.6%, respectively; and based on 2024 revenue, the company ranks second in the African baby diaper and sanitary napkin markets, with market shares of 17.2% and 11.9%, respectively.

In terms of financial performance, SOFTCARE's revenue increased by 28.6% from USD 320 million in 2022 to USD 411.4 million in 2023, and further increased by 10.5% from USD 411.4 million in 2023 to USD 454.4 million in 2024. Additionally, revenue for the four months ending April 30, 2024, increased by 15.5% from USD 139.6 million to USD 161.3 million for the four months ending April 30, 2025. Net profit increased by 251.7% from USD 18.4 million in 2022 to USD 64.7 million in 2023, and further increased by 47.0% from USD 64.7 million in 2023 to USD 95.1 million in 2024. Additionally, net profit for the four months ending April 30, 2024, increased by 12.5% from USD 27.7 million to USD 31.1 million for the four months ending April 30, 2025.

Cornerstone investors include: BA Sprout Limited and BA HM Limited, Arc Avenue, Arcane Nexus, Beijing Shunao, CDH Emerging Markets, HCEP, NewTrails Capital and NewTrails Forest, Southern Fund, Franklin Templeton and Franklin Templeton Hong Kong, E Fund Management and E Fund Hong Kong, Charisma Mega, TruMed Healthcare Master Fund and TruMed Health Innovation Fund LP, Qihui Runjin, Huaxia Fund (Hong Kong), Jane Street.

According to the prospectus, SOFTCARE plans to use the funds raised from the global offering for the following purposes: approximately 71.4% is expected to be used for expanding overall production capacity and upgrading production lines; approximately 11.6% is expected to be used for marketing and promotional activities in Africa, Latin America, and Central Asia; approximately 4.7% is expected to be used for strategic acquisitions in the hygiene products industry;Approximately 0.4% is expected to be used for upgrading the CRM system and gradually implementing it in business operations across multiple countries; approximately 2.6% is expected to be used for hiring management consulting firms to analyze new markets and new products, and to provide advice on strategy execution and corporate management; and approximately 9.3% is expected to be used for working capital and general corporate purposes