Morgan Stanley: Robots are the next underestimated growth engine for Apple, expected to contribute up to 25% of its stock price value

Morgan Stanley believes that embodied intelligence may become Apple's next key growth engine. If Apple holds a neutral 9% market share by 2040, the humanoid robot business could generate annual revenue of $133 billion, and in the best-case scenario, nearly $300 billion, potentially contributing up to $65 to the current stock price. Apple is accelerating the development of related products, supply chains, and team arrangements, with robots possibly taking over the iPhone as the new narrative

As Apple seeks the next wave of growth, Morgan Stanley believes the answer may lie in a field that most investors have not yet fully focused on: robotics. In a recent report, the firm pointed out that robotic technology, particularly embodied intelligence, represents Apple's undervalued next growth engine, with this opportunity ultimately expected to contribute up to 25% of its current stock price.

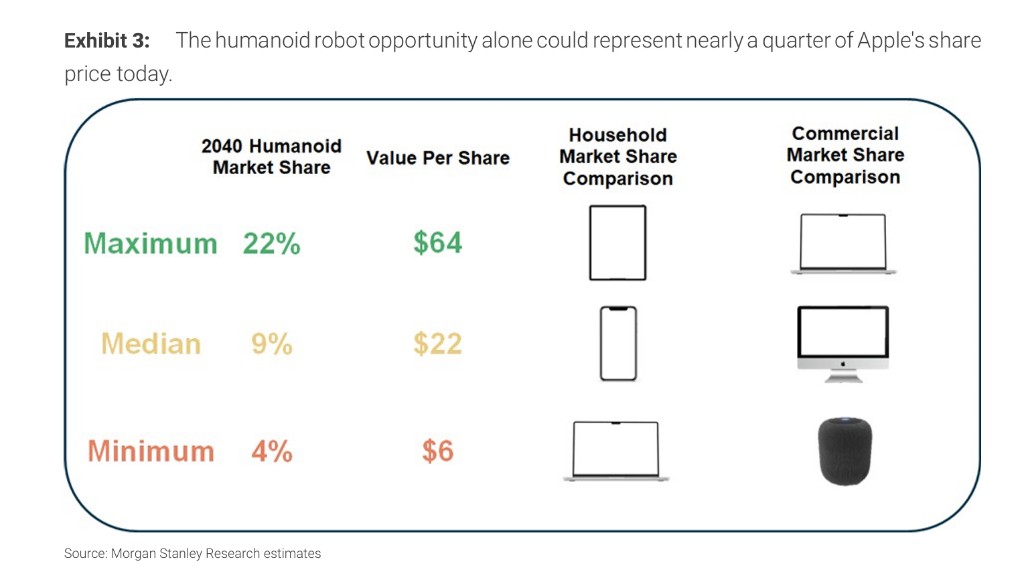

According to reports from the trading desk, based on predictions from Morgan Stanley analyst Erik W. Woodring's team, the humanoid robot category alone could potentially bring Apple $133 billion in annual revenue by 2040, which is nearly one-third of Apple's current revenue base. This forecast is based on a "neutral scenario" where Apple holds a 9% share of the market, and analysts believe this segment of the business translates to an approximate per-share value of $22 today.

In a more optimistic "maximum scenario," if Apple can replicate its success in the global smartphone market and capture a 22% share of the robotics market, then the related revenue by 2040 could approach $300 billion, contributing about $65 in value to the current stock price. This assessment comes at a time when the market is generally concerned about slowing growth in Apple's iPhone business and the urgent need for a new narrative, while the potential of the robotics business paints a new imaginative space for investors.

A series of signs indicate that it is accelerating its layout. According to media reports, Apple plans to launch a desktop robot in 2027, and its organizational restructuring has moved the robotics department from the AI team to the hardware engineering department, which is seen as a key signal of shifting from R&D experimentation to product execution. Morgan Stanley believes that Apple is quietly laying the groundwork for entering this trillion-dollar market, leveraging its vertical integration, large user base, and data collection capabilities.

Potential for Billion-Dollar Revenue, Up to $65 Contribution to Stock Price

For a company with daily revenues exceeding $1 billion, any new business must be large enough to "change the game," and the robotics market is just that. Morgan Stanley conducted a quantitative analysis of the long-term financial impact of Apple's robotics business in its report, with the core view being that this is a segment significant enough to drive Apple's future valuation.

The report estimates that the potential of Apple's robotics business is enormous, but the specific value depends on its market penetration capabilities. In three scenario assumptions:

- Neutral Scenario: By 2040, Apple holds a 9% share of the global humanoid robot market (with 45% in the consumer market and 7% in the commercial market), generating $133 billion in revenue. Discounted to today, this segment corresponds to a per-share value of $22. Morgan Stanley has included this valuation in its new bull market target price of $403 for Apple.

- Maximum Scenario: If Apple can achieve a 22% market share (similar to its current position in the global smartphone market), it could create nearly $300 billion in revenue, corresponding to a per-share value of up to $64.

- Minimum Scenario: Even with just a 4% market share, it could still bring in about $58 billion in revenue, corresponding to a per-share value of $6

Behind these predictions is Morgan Stanley's optimistic assessment of the global humanoid robot market, which is expected to reach an annual revenue of $1.2 trillion by 2040 and exceed $4.7 trillion by 2050, far surpassing the current global smartphone market.

Ecology, Data, and Manufacturing Capabilities Build a Moat

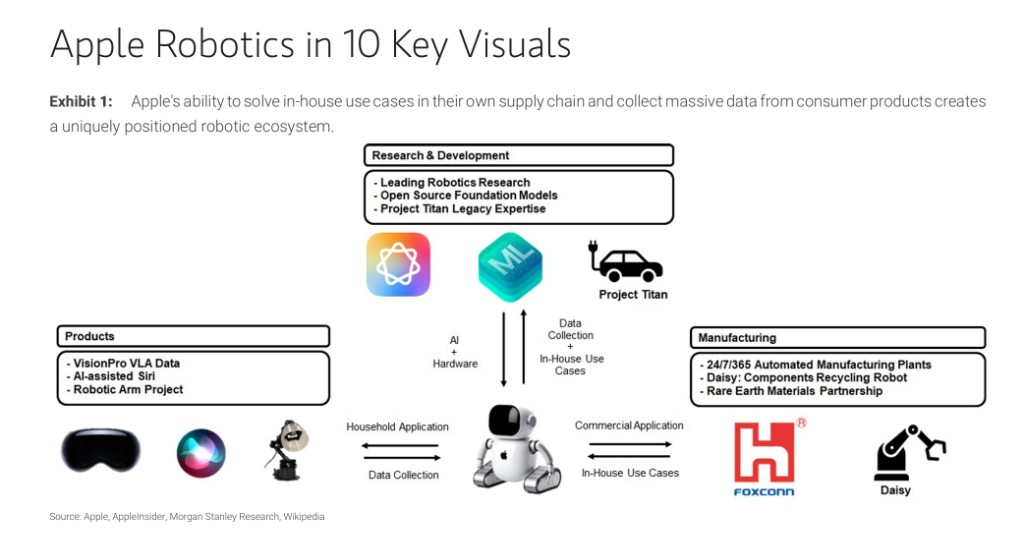

In the fiercely competitive robotics market, Apple is not a pioneer; tech giants and startups have already entered the fray. However, Morgan Stanley believes that Apple possesses unique competitive advantages that form a solid barrier for winning the market.

First, Apple has a globally leading vertically integrated ecosystem that encompasses hardware, software, services, and self-developed chips. This capability allows it to create a seamless user experience that is difficult for competitors to replicate. Secondly, its vast device installation base (over 2.3 billion active devices) and more than 1.4 billion iPhone users not only provide a huge potential market but also an unparalleled data collection network.

Especially in terms of visual data, Apple Vision Pro and the recently released EgoDex dataset (the largest dexterous manipulation first-person perspective video dataset to date) highlight Apple's unique advantages in training robot models. The report also points out that Apple's accumulated experience in supply chain management and large-scale automated production, such as its recycling robot Daisy and its partnership with Foxconn, lays the foundation for the mass production of its future robots. Furthermore, even the discontinued "Project Titan" autonomous vehicle project has left a valuable technological legacy in computer vision and machine learning that benefits Apple's robotics endeavors.

From Organizational Structure to Patent Recruitment, the Robotics Project is Transitioning from R&D to Implementation

Although Apple has remained tight-lipped about its robotics plans in public, a series of behind-the-scenes actions indicate that the project is accelerating from "talking on paper" to actual implementation. Morgan Stanley has listed several key "milestones" that investors should pay attention to:

- Organizational Restructuring: Reports indicate that Apple has moved its robotics department from AI head John Giannandrea's team to hardware engineering head John Ternus's team. This move is interpreted as an important signal that Apple's robotics strategy is shifting from early exploration to productization and commercialization execution.

- Media Reports and Product Roadmap: Reports reveal that Apple is developing a desktop robotic arm, expected to be released in 2027. At the same time, Apple is also exploring commercial robotic arms for manufacturing and mobile robots similar to Amazon Astro, and is expected to collaborate with BYD for assembly

- Patent and Recruitment Activity Growth: Data shows that the number of patent applications related to robots by Apple is steadily increasing, while the recruitment of machine learning and robotics engineers is also on the rise. This indicates that Apple is actively reserving technology and talent for new product development.

- Accelerated Academic Research: Since 2025, Apple has intensively published multiple research papers related to robotics, covering areas such as motion planning and augmented reality data collection, reflecting that its R&D activities are accelerating.

How to Monetize Robotics and Explore Growth Potential through Multiple Paths

Morgan Stanley believes that Apple will adopt its mature "hardware + services" model to drive the commercialization of its robotics business, initially focusing on smart home applications and gradually expanding into broader fields.

At the product level, the most direct entry point is non-humanoid home robots that deeply integrate with the existing ecosystem, such as the desktop robot mentioned in reports. These devices can become the hub of the home, integrating entertainment, security, and communication functions. In the long run, Apple may develop more comprehensive humanoid robots for home and even commercial use, entering the larger global labor market.

At the service level, the launch of new hardware will create new growth points for Apple's service business. The report envisions several possibilities:

- AI Subscription Services: A physical robot will become the best platform to showcase the upgraded capabilities of Siri and may give rise to independent AI functionality subscription fees.

- iCloud Storage: The vast amount of data generated by smart homes and robots will drive user demand for iCloud storage services.

- AppleCare+: Mobile robotic devices inherently have wear and maintenance needs, which will open a new product category for AppleCare+ services.

- Software Licensing: With advantages in visual data collection through devices like Vision Pro, Apple has the opportunity to create a leading visual-language-action (VLA) model and offer it to other robot manufacturers through software licensing or subscription models