The AI boom suddenly cools down, Goldman Sachs summarizes three main reasons behind it!

Goldman Sachs TMT expert Bartlett stated that the sudden cooling of the AI sector is due to three main reasons: first, the market's skepticism about the prospects of AI has intensified, especially after OpenAI's comments regarding "guaranteed" financing from the federal government sparked panic; second, the stock prices of giants like Meta and Netflix plummeted after releasing their earnings reports, leading to an imbalance in risk-return ratios; third, the deterioration of the job market, with 153,000 layoffs in October reaching a 20-year high, raising concerns about job displacement caused by AI

U.S. tech stocks have recently experienced severe fluctuations, and the AI sector's upward momentum has come to a halt.

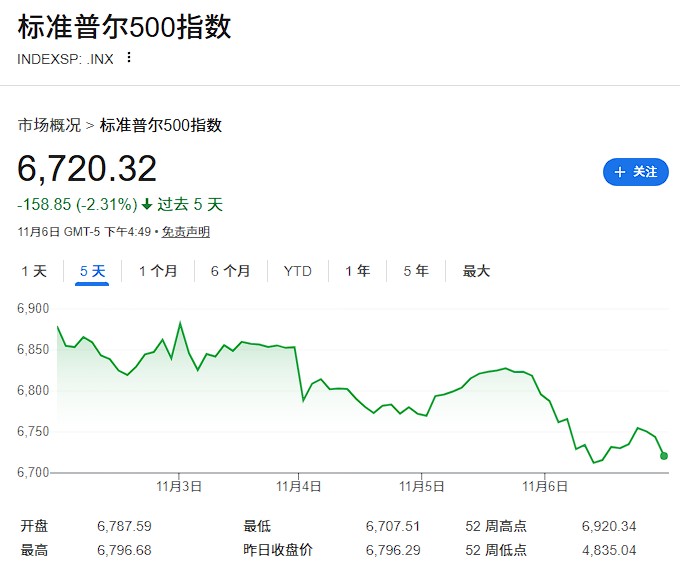

In this regard, Goldman Sachs' technology, media, and telecommunications (TMT) industry expert Peter Bartlett pointed out that the market is undergoing its toughest period since April, with the S&P 500 index dropping more than 2% twice within three days, making the market trend increasingly unsettling.

Bartlett believes that the three main factors contributing to the increased market volatility include: growing skepticism about the prospects of AI, negative asymmetry in tech earnings season, and concerns over the deterioration of the U.S. job market. Among these, OpenAI's comments regarding the federal government's "guarantee" of AI infrastructure spending have particularly shaken the market.

Goldman Sachs believes that, given the current levels of holdings and the rapid recent gains in certain sectors, the asymmetry in earnings reports is prompting investors to reassess the risk-reward ratio before the end of the year.

Skepticism about AI Rises, OpenAI's Financing Comments Trigger Market Panic

Goldman Sachs TMT expert Bartlett stated in a report that an increasing number of investors are expressing more bearish or skeptical views on AI trades, even though the levels of holdings have not changed much from their highs—shorting or underweighting this strong momentum trade remains too difficult.

The driving factors behind the market's skepticism include: the cyclical nature of cloud computing trades, the news flow reaching a "peak feeling," and general concerns about investment returns. However, OpenAI's two recent statements have particularly unsettled the market.

First, earlier this week, OpenAI CEO Sam Altman provided a defensive response on the g2Pod podcast to Brad Gerstner's question about "how a company with $13 billion in revenue can make a $1.4 trillion spending commitment."

Second, yesterday, OpenAI CFO Sarah Friar mentioned in a media interview that the federal government might provide "guarantees" for AI financing.

Bartlett noted that although Trump's AI affairs head David Sachs responded to the "federal bailout" comments, many market participants pointed out that discussing any "bailout" at this stage of the AI cycle seems rather odd.

Negative Asymmetry in Earnings Season Highlights Imbalance in Risk and Return

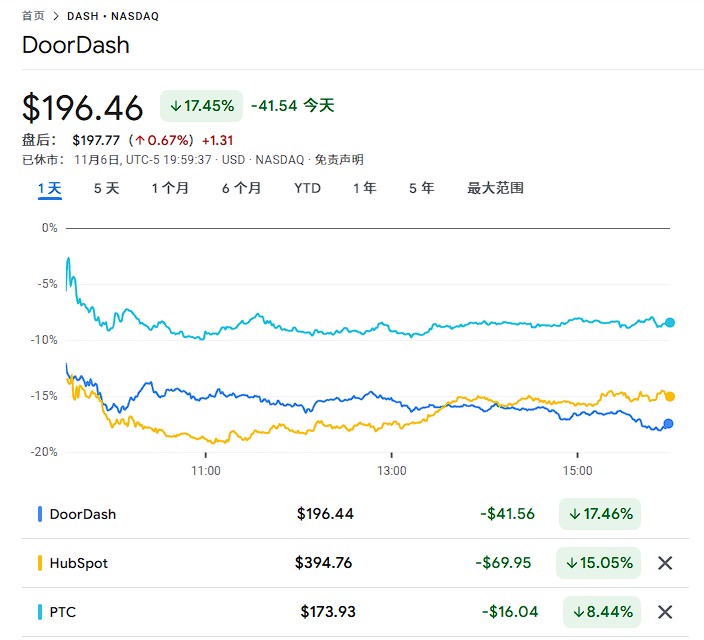

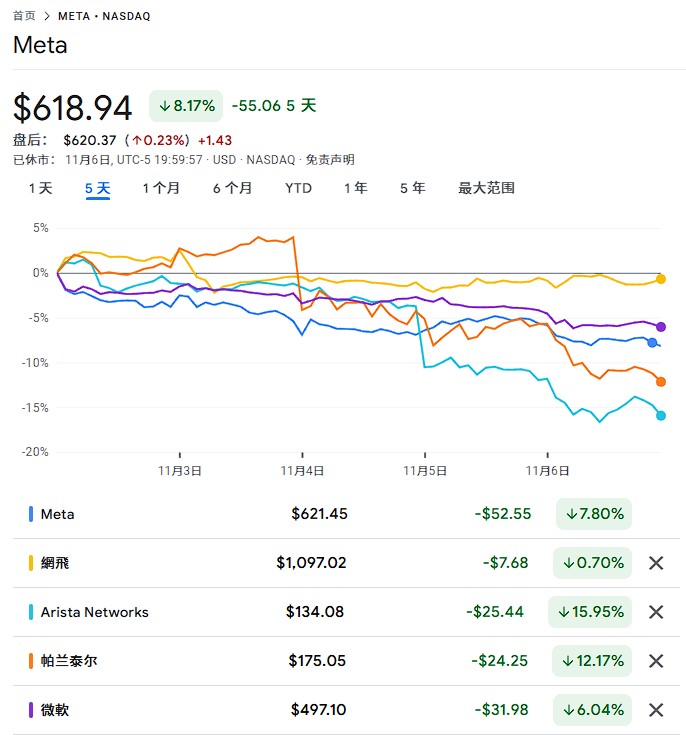

Tech stocks have continued to struggle to achieve positive returns following earnings releases.

From the performance of individual stocks, DoorDash fell 15%, HubSpot dropped 17%, and PTC decreased by 10%. Previously, Meta fell 12%, Netflix dropped 10%, Arista Network declined by 9%, PLTR decreased by 7%, and MSFT continued to weaken

Goldman Sachs' Bartlett believes that the asymmetry reflected in financial reports is prompting investors to reconsider the risk-reward ratio before the end of the year, especially considering the current position levels and the rapid and strong rise of certain market sectors in recent months. This negative deviation highlights that the risks investors face at the current valuation levels are significantly greater than the potential rewards.

Deterioration of the Job Market Intensifies Market Concerns

According to an article from Wallstreetcn, U.S. companies announced layoffs of 153,000 last month, three times that of the same period last year, setting a record for any October since 2003. Data from Challenger, Gray & Christmas shows that the main reasons for companies tightening spending and freezing hiring are the application of AI, weak consumer and business spending, and rising costs.

Bartlett concludes that how the market responds to the potential unemployment issues brought about by AI remains an open question, and the current market trend may indicate that there is a threshold where "overemployment substitution" becomes a problem.

This means that the market is beginning to weigh the balance between advancements in AI technology and the potential employment shocks it may trigger. When job losses exceed a certain critical point, even if AI brings productivity improvements, it may negatively impact the market