Nicolet Bankshares (NYSE:NIC) Director Purchases $12,759.60 in Stock

Nicolet Bankshares Inc. (NYSE:NIC) Director Christopher Ghidorzi purchased 105 shares at $121.52 each, totaling $12,759.60, increasing his ownership by 1.26%. Post-transaction, he holds 8,456 shares valued at $1,027,573.12. The stock traded down 0.1% to $124.27. The company reported $2.66 EPS for the last quarter, exceeding estimates, and declared a quarterly dividend of $0.32 per share. Analysts maintain a "Moderate Buy" consensus rating with a target price of $153.67.

Nicolet Bankshares Inc. (NYSE:NIC - Get Free Report) Director Christopher Ghidorzi bought 105 shares of the company's stock in a transaction dated Tuesday, November 4th. The shares were purchased at an average price of $121.52 per share, with a total value of $12,759.60. Following the transaction, the director owned 8,456 shares of the company's stock, valued at $1,027,573.12. The trade was a 1.26% increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this link.

Nicolet Bankshares Inc. (NYSE:NIC - Get Free Report) Director Christopher Ghidorzi bought 105 shares of the company's stock in a transaction dated Tuesday, November 4th. The shares were purchased at an average price of $121.52 per share, with a total value of $12,759.60. Following the transaction, the director owned 8,456 shares of the company's stock, valued at $1,027,573.12. The trade was a 1.26% increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this link.

Nicolet Bankshares Trading Down 0.1%

Shares of Nicolet Bankshares stock traded down $0.10 during trading on Friday, hitting $124.27. 2,215 shares of the company were exchanged, compared to its average volume of 78,223. The firm's fifty day moving average price is $130.37 and its 200 day moving average price is $127.12. The company has a debt-to-equity ratio of 0.11, a current ratio of 0.96 and a quick ratio of 0.96. The firm has a market capitalization of $1.84 billion, a P/E ratio of 13.29 and a beta of 0.76. Nicolet Bankshares Inc. has a 1-year low of $97.90 and a 1-year high of $141.92.

Nicolet Bankshares (NYSE:NIC - Get Free Report) last issued its quarterly earnings data on Thursday, October 23rd. The company reported $2.66 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.34 by $0.32. The company had revenue of $102.88 million during the quarter, compared to the consensus estimate of $76.83 million. Nicolet Bankshares had a net margin of 26.39% and a return on equity of 12.08%. As a group, sell-side analysts expect that Nicolet Bankshares Inc. will post 8.18 earnings per share for the current fiscal year.

Nicolet Bankshares Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Monday, September 15th. Shareholders of record on Tuesday, September 2nd were given a dividend of $0.32 per share. This represents a $1.28 annualized dividend and a yield of 1.0%. The ex-dividend date of this dividend was Tuesday, September 2nd. Nicolet Bankshares's dividend payout ratio is 13.70%.

Analyst Upgrades and Downgrades

A number of equities analysts have commented on the stock. Piper Sandler reaffirmed a "neutral" rating and set a $140.00 price objective (up from $122.50) on shares of Nicolet Bankshares in a research report on Wednesday, July 16th. Weiss Ratings reiterated a "buy (b)" rating on shares of Nicolet Bankshares in a research report on Wednesday, October 8th. Maxim Group lifted their price objective on shares of Nicolet Bankshares from $131.00 to $161.00 and gave the company a "buy" rating in a research note on Thursday, July 17th. Wall Street Zen raised shares of Nicolet Bankshares from a "sell" rating to a "hold" rating in a report on Friday, July 18th. Finally, Keefe, Bruyette & Woods upgraded Nicolet Bankshares from a "market perform" rating to an "outperform" rating and set a $160.00 target price for the company in a research report on Monday, October 27th. Three research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to data from MarketBeat, Nicolet Bankshares has a consensus rating of "Moderate Buy" and a consensus target price of $153.67.

Check Out Our Latest Research Report on Nicolet Bankshares

Institutional Trading of Nicolet Bankshares

A number of large investors have recently bought and sold shares of the business. Victory Capital Management Inc. purchased a new position in shares of Nicolet Bankshares in the 1st quarter worth approximately $288,000. Vanguard Group Inc. lifted its stake in shares of Nicolet Bankshares by 1.1% during the 1st quarter. Vanguard Group Inc. now owns 745,270 shares of the company's stock valued at $81,205,000 after buying an additional 8,147 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. raised its holdings in Nicolet Bankshares by 24.8% during the 1st quarter. Connor Clark & Lunn Investment Management Ltd. now owns 9,256 shares of the company's stock valued at $1,009,000 after acquiring an additional 1,838 shares during the period. Nuveen LLC purchased a new stake in shares of Nicolet Bankshares during the first quarter worth $3,754,000. Finally, HighTower Advisors LLC bought a new position in shares of Nicolet Bankshares in the first quarter worth $432,000. 43.06% of the stock is currently owned by institutional investors and hedge funds.

Nicolet Bankshares Company Profile

(Get Free Report)

Nicolet Bankshares, Inc operates as the bank holding company for Nicolet National Bank that provides banking products and services for businesses and individuals in Wisconsin and Michigan. The company accepts checking, savings, and money market accounts; various certificates of deposit; and individual retirement accounts.

Read More

- Five stocks we like better than Nicolet Bankshares

- What does consumer price index measure?

- Getting Defensive: 3 Dividend Payers Reporting Strong Q3 Earnings

- Trading Halts Explained

- Why Investors Shouldn’t Fear the Dip in Microsoft Stock

- How to Calculate Stock Profit

- DigitalOcean’s Tide Has Turned: Get Ready to Ride the Wave

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. Please send any questions or comments about this story to [email protected].

Insider Buying or Selling at Nicolet Bankshares?

Sign-up to receive InsiderTrades.com's daily insider buying and selling report for Nicolet Bankshares and related companies.

From Our Partners

Protect Your Bank Account with THESE 4 Simple Steps

Starting as soon as a few months from now, the United States government will make a sweeping change to bank ac...

Weiss Ratings

Jerome Powell just made me a fortune (and my enemies)

The Fed rate cut truth they don't want you to know The Fed's 25 basis point cut isn't just monetary policy…...

Crypto 101 Media

Capital Gains Tax Strategies for Seniors

Capital gains taxes can take a bite out of your retirement income—unless you have a smart strategy. From holdi...

SmartAsset

Nvidia CEO Issues Bold Tesla Call

While headlines focus on Tesla’s car sales, tech analyst Jeff Brown says the real story is Tesla’s role in a $...

Brownstone Research

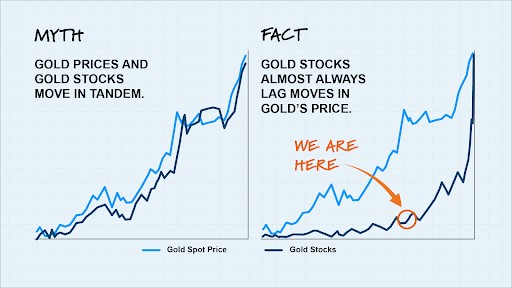

This gold stock is STILL undervalued by 80%...

“Like buying gold for $1,000/oz” If you could go back in time to 10+ years ago and buy gold for $1,000 an o...

Golden Portfolio

Nvidia x 1,000,000

Nvidia’s latest AI chip is a $25,000 powerhouse — with 80 billion transistors and the ability to perform 60 tr...

Paradigm Press

AI’s timebomb

What No One's Saying About Amazon's 30k Layoff First they cut jobs at Meta... now 30,000 at Amazon – its la...

Stansberry Research

Nvidia Chief: Where The Next AI Fortune Could Land

This Feels Like Collecting ‘Toll Money’ From AI… Every time AI ‘thinks,’ data has to move, and that moveme...

Stocks To Trade