Is Quantum Computing the "Next AI"? Analysis: Timing of Entry is Crucial

Although quantum computing shows great potential and has seen concept stocks rise due to government attention, the industry is still in its early stages. Bottlenecks such as insufficient qubit scale, high error rates, and uncertain technological pathways restrict its commercialization, with scalability breakthroughs expected to take another 5-10 years. Despite analysts predicting that the market size could reach USD 4.25 billion by 2030, investors currently face risks related to technological path uncertainty and long return cycles. The core issue is not "whether quantum computing is worth investing in," but rather "when to invest."

Quantum computing is becoming a new focus for investors, but the commercialization process of this emerging technology still faces significant challenges. Despite recent technological breakthroughs and reports that the U.S. government is considering investing in related companies, industry insiders warn that the risks investors face far outweigh the potential returns before quantum computing truly matures.

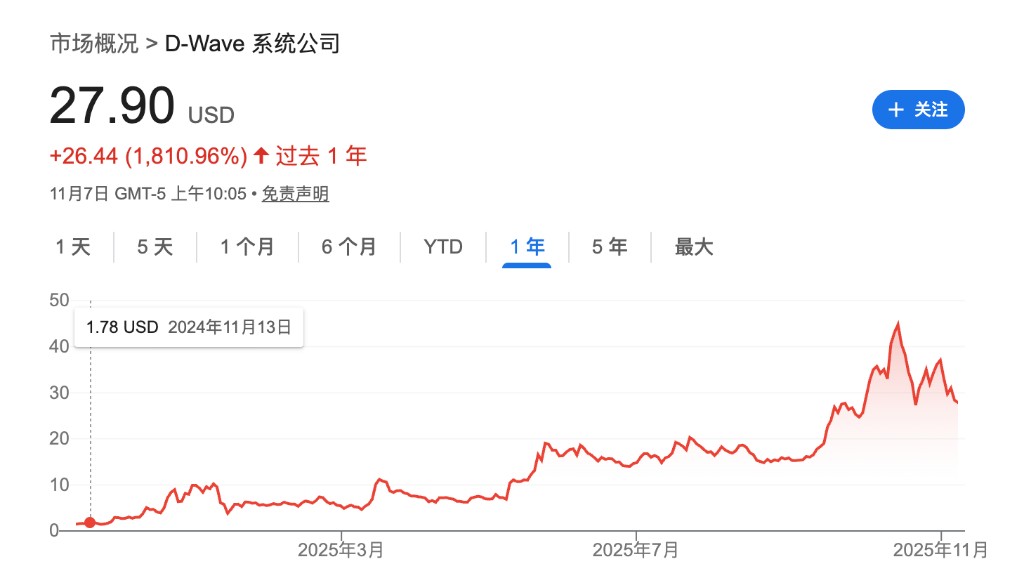

Recently, Google announced that its quantum chip is 13,000 times faster than traditional computers in specific computations, showcasing the potential of quantum computing. Earlier media reports indicated that the Trump administration was considering acquiring shares in companies like IonQ and D-Wave Quantum; although the government denied this, such news still drove significant increases in quantum computing concept stocks. Over the past year, D-Wave Quantum surged 1,811%.

However, the industry is still in its early stages. Currently, the most advanced quantum computers cannot surpass traditional computers in most application scenarios, primarily due to the insufficient scale of the electronic "brain," which cannot reliably correct computational errors. Bank of America analyst Wamsi Mohan pointed out that scalability is a key issue for the next five to ten years.

Technological Bottlenecks Need Time to Break Through

The fundamental reason for the instability of current quantum computer performance lies in the insufficient number of quantum bits (qubits) and high error rates. Unlike traditional computers that use bits that can only be 0 or 1, quantum computers utilize the quantum mechanical properties of so-called quantum bits, allowing them to simultaneously exist in both 0 and 1 states. This enables them to process more possibilities at once, solving problems that traditional computers would take nearly infinite time to complete.

However, building large-scale, error-free quantum computers is extremely challenging. Many quantum components need to be cooled to near absolute zero to function, and the equipment is typically large and requires precision. IBM has been deeply involved in quantum computing for about a decade and has produced some of the most powerful quantum computers, but its most advanced system has only 156 qubits.

Analysts state that quantum computers need orders of magnitude more qubits to solve many problems that ordinary computers cannot handle. IBM's roadmap released this year shows plans to reach 2,000 qubits by 2033. Google currently has a chip with 105 qubits, aiming for 1,000 qubits, but the timeline is still unclear.

The Battle of Technological Routes is Still Unresolved

Who will win the race for the expansion of quantum computing is far from clear. IBM and Google are investing heavily, and tech giants like Amazon and Microsoft are also entering the fray. Smaller publicly listed quantum computing companies may also break through and capture market share. Additionally, startups like PsiQuantum are building large-scale quantum computers in Australia and Chicago, with the company breaking ground in Chicago in September.

The quantum computing industry is still in its early stages, and it is not yet clear which basic technological path is the most scalable. Some companies like IBM and Google use materials cooled to near absolute zero, while companies like IonQ use charged particles suspended in space, and PsiQuantum utilizes the quantum properties of light For investors, any avenue for investing in quantum computing carries significant risks. Any technological path today could fail, just as Betamax lost to VHS in the videotape format war decades ago. Early government support for a particular solution could also have counterproductive effects; if the wrong bet is placed, it could hinder the development of the entire industry.

The timeline for commercialization remains uncertain

It is still uncertain how long industry consolidation will take. BNP Paribas analyst David O'Connor pointed out in a recent report that quantum computing is now more of an engineering problem than a scientific experiment, involving how to manufacture larger-scale computers. He estimates this could take three to four years.

Bank of America analyst Wamsi Mohan predicts that quantum computing revenue could reach $4.25 billion by 2030. This figure is not astonishing, but it should not be underestimated: it is roughly equivalent to NVIDIA's revenue level a decade ago.

If these challenges are addressed, quantum computing seems poised for rapid growth and could provide substantial returns for investors. Scientists have already used quantum computers to identify materials that can improve solar cell efficiency, simulate the performance of Airbus aircraft, and optimize power grids. Powerful quantum computers can quickly test complex molecular combinations, potentially accelerating the discovery of new drugs.

The current question is less about whether quantum computing will become a technology worth investing in, and more about when it will become a technology worth investing in, which may still take some time.