A large number of bulls in the US stock market are "speaking contrary to their hearts": they claim to fear an AI bubble, yet they are aggressively buying stocks!

Citigroup's report indicates that there is a significant disconnect between investors' words and actions. They are "worried" about valuations, credit, and the labor market, yet remain "steadfast" in their allocation to U.S. large-cap stocks, with sentiment indices reaching "euphoric" levels. Currently, U.S. stock valuations are at historical extremes, but strong earnings are a key pillar. Citigroup believes that there is no bubble in AI at present, making it suitable for buying on dips

A contradictory emotion of "saying one thing and meaning another" is dominating the U.S. stock market. According to Wind Trading Desk, Citigroup's latest report points out that investors are worried about high valuations and a potential AI bubble, yet their actual investment portfolios show an extremely bullish "euphoric" state, forming a group of "reluctant bulls."

Recently, the U.S. stock market has seen a pullback, with the S&P 500 index falling 3% from its late October peak, and the tech-heavy Nasdaq 100 index dropping 4.5%.

Currently, there is a significant disconnect between investors' words and actions; they are "worried sick" about valuations, credit, and the labor market, yet remain "steadfast" in their allocation to U.S. large-cap stocks. Citigroup strategist Scott T Chronert wrote in the report:

"Recent client communications indicate that there is a large number of reluctant bulls in the market."

This split mindset brings uncertainty to the market. Strong corporate earnings support the stock market, but extreme valuations and overly optimistic positions make the market exceptionally fragile. Once the narrative of earnings growth shows cracks, the current delicate balance may be disrupted.

The Huge Gap Between Sentiment and Positioning

The Citigroup report reveals the significant difference between investor sentiment and actual positioning. The report states that despite clients verbally expressing "ongoing concerns" about "valuations, bubbles, credit, and labor," their market positioning readings appear "euphoric."

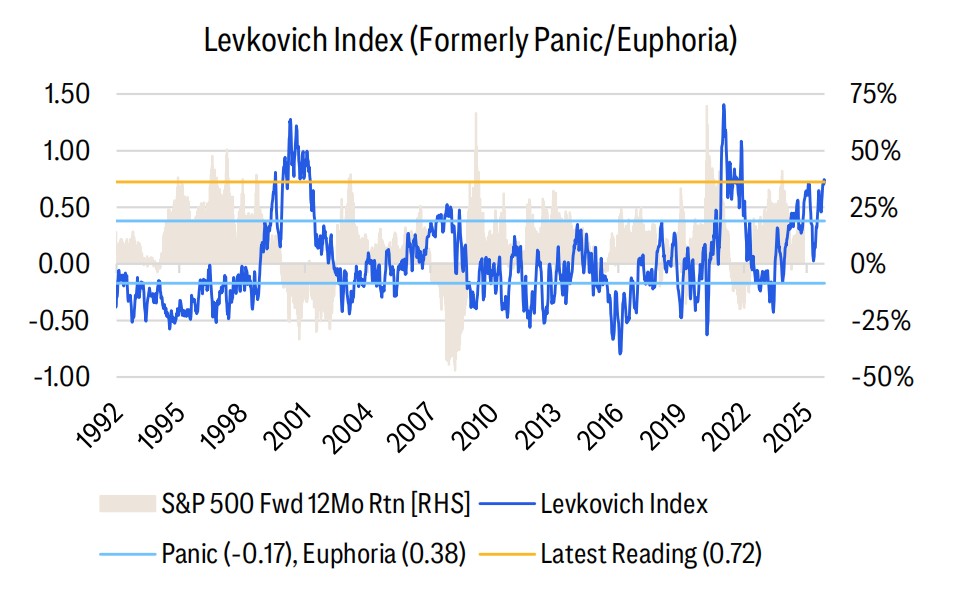

The Citigroup Levkovich Index, which measures market sentiment, currently reads 0.72, significantly above the "euphoric" threshold of 0.38. Historical backtesting data from the report shows that when this index enters the euphoric zone, the median return of the S&P 500 index over the next year is typically negative (-9.4%).

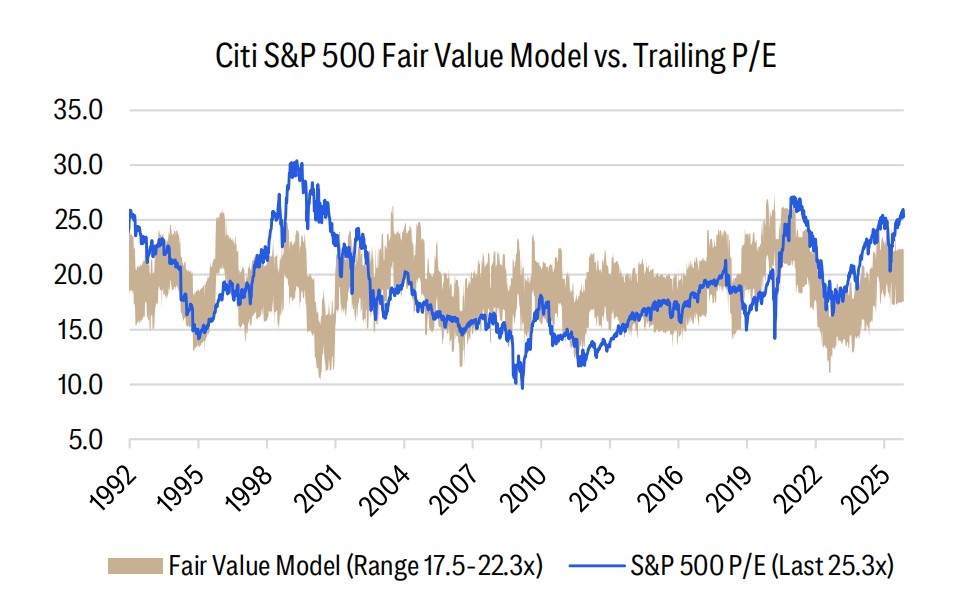

High valuations are another key factor causing concern. Citigroup's PULSE model rates the "price" indicator as "negative," with several valuation metrics nearing historical extremes. The report indicates that current U.S. stock valuations are at historical highs. The price-to-earnings ratio (TTM P/E) of the S&P 500 index has reached 25.3 times, placing it in the 95th percentile of historical data over the past 40 years, meaning this valuation is higher than 95% of the time in the past 40 years.

Additionally, metrics such as price-to-book (P/B), price-to-sales (P/S), and enterprise value/EBITDA (EV/EBITDA) are at the 99th, 100th, and 100th percentiles, respectively The report points out that historically, such a high level of price-to-earnings ratio often results in a median market return of negative (-11.2%) in the following year.

Earnings Growth Becomes a Key Pillar for the Market

Despite frequent alarms, the market is not without its foundations. Strong corporate earnings have become a key force supporting the market. Citigroup has rated the "earnings" indicator in its PULSE model as "positive."

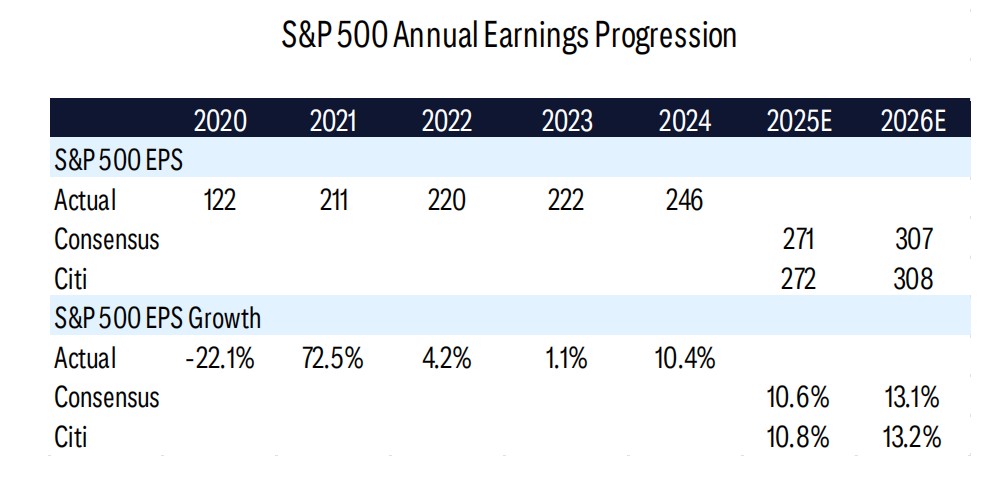

Data shows that the earnings season for the third quarter of 2025 performed robustly, with the number of companies exceeding earnings expectations being six times that of those falling short. At the same time, analysts continue to raise their earnings expectations for the future, with the market generally anticipating that the S&P 500 index's earnings per share (EPS) will reach $271 in 2025 and further grow to $307 in 2026.

Citigroup's own forecasts ($272 and $308) are also in line with this, demonstrating confidence in corporate fundamentals. However, the report also emphasizes that the market needs an annualized compound growth of about 10% in EPS to justify the current valuation.

No Bubble in AI, Suggests Buying on Dips

Regarding the highly discussed field of artificial intelligence (AI), Citigroup believes that "no bubble has been seen yet," and investors can adopt a "Growth at a Reasonable Price" (GARP) strategy, as about 50% of the companies within its selected AI investment range remain attractive.

Overall, Citigroup advises investors to view further market pullbacks as "opportunistic" buying opportunities, as structural trends seem to persist. In terms of sector allocation, the report recommends increasing holdings in financials, technology, and utilities, while reducing positions in consumer staples and industrials