AI giants "must buy," manufacturers hold the greatest pricing power! Morgan Stanley: This round of memory "super cycle" will far exceed historical peaks

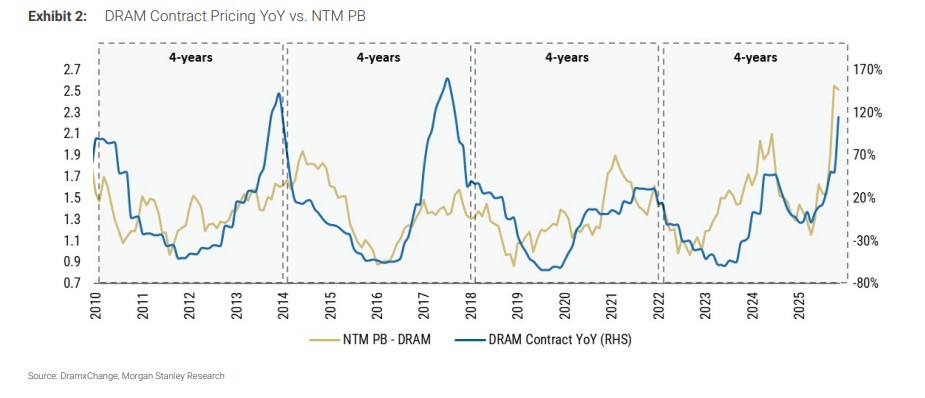

Morgan Stanley stated that this cycle is dominated by AI data centers and cloud service providers, whose customers are less sensitive to price. Inference workloads have become the main driver of demand for general memory, while on the other hand, suppliers have unprecedented pricing power. Morgan Stanley believes that the peak pricing in this cycle is expected to surpass the previous high point, and memory cycles typically last 4-6 quarters, with profit growth being the ultimate decisive factor, rather than historical valuations

Morgan Stanley believes that a new AI-driven "super cycle" in memory has already arrived, and its intensity and logic are distinctly different from any previous cycle.

According to the Wind Trading Desk, Morgan Stanley pointed out in its latest report that DRAM prices are breaking historical highs, initiating an unprecedented "super cycle."

Morgan Stanley noted that unlike previous cycles, this round is led by AI data centers and cloud service providers, whose sensitivity to prices is relatively low, and inference workloads have become the main driving force behind general memory demand. On the other hand, the latest channel survey shows that server DRAM contract prices soared nearly 70% in the fourth quarter, while NAND contract prices increased by 20-30%, giving suppliers unprecedented pricing power.

The firm maintains an overweight rating on SK Hynix and Samsung Electronics, expecting that the rise in memory prices will drive stock prices to new highs, and memory manufacturers' profits will significantly exceed expectations.

AI Demand Changes the Game, Customers "Must Buy"

Morgan Stanley pointed out that the core driving force of this cycle has undergone a qualitative change. The demand side is no longer traditional price-sensitive customers, but AI data centers and cloud service giants engaged in an arms race to build computing infrastructure.

For them, acquiring memory is a strategic "necessity," and price sensitivity has been minimized. At the same time, the production of HBM (High Bandwidth Memory) continues to structurally squeeze traditional DRAM capacity. As Morgan Stanley emphasized in the report:

The difference is that today's memory demand has evolved into a competition led by AI data centers (compute-intensive platforms) and cloud service providers, whose sensitivity to prices is far less than that of traditional customers... The exponential growth trend in inference demand provides a solid foundation, making this cycle fundamentally different from any previous time.

Unprecedented Price Surge, Suppliers Hold Absolute Initiative

On the other hand, Morgan Stanley stated that as DRAM contract prices soar, suppliers have gained unprecedented pricing power.

Morgan Stanley's latest channel survey shows that the outlook for DRAM prices has strengthened sharply in just two weeks. The fourth-quarter server RDIMM contract prices surged nearly 70%, far exceeding the previous forecast of 30%. The spot price of DDR5 (16Gb) skyrocketed by 336%, rising from $7.50 in September to the current $20.90. DDR4 prices also saw a 50% increase in quotes. Although most contract transactions will be completed later this month, customer acceptance seems inevitable—they are concerned about further price increases and limited supply.

Furthermore, NAND is in a severe shortage situation:

NAND has become a key component of AI computing infrastructure and video storage. Prices for 3D NAND wafers (TLC and QLC) are expected to rise by 65-70% quarter-on-quarter to cope with limited capacity. Nearline storage specifications are shifting from 128TB to 256TB QLC solid-state drives. TrendForce predicts that server demand for enterprise SSD bit capacity will grow nearly 50% year-on-year by 2026 Samsung's bit output in the first half of 2025 is constrained by the transition from V6 176-layer to 321-layer V8-NAND, with only a gradual increase in the second half of the year, resulting in a mere 10% growth in bit shipments this year.

There is still significant room for price increases; the cycle is far from peaking

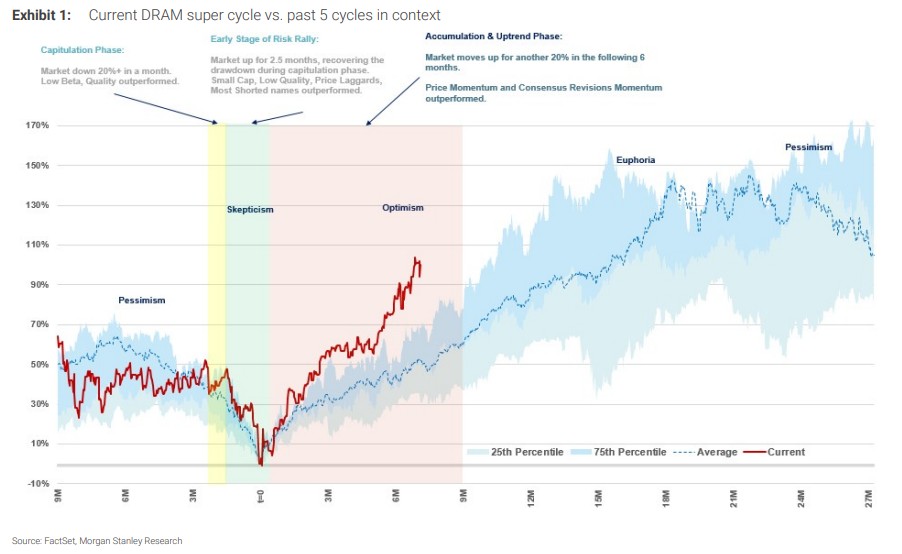

The market is often constrained by "fear of heights," believing that a new high in stock prices means a reversal is imminent. However, Morgan Stanley emphasizes that in this AI-driven market cycle, profit growth is the ultimate decisive factor, not historical valuations:

The current pricing for server DRAM is $1/Gb, while the peak during the cloud supercycle in Q1 2018 was $1.25/Gb. Considering the scale of AI infrastructure investment and the dynamic characteristics of hyperscale customers, this round of peak pricing is expected to surpass the previous high. Memory cycles typically last 4-6 quarters, and profits are being realized, but the key issue is the comparison with market expectations—there is clearly greater enthusiasm in the market for general memory pricing. Valuation is not a predictive indicator of future returns; it reflects supply and demand dynamics rather than historical precedents.

Currently, driven by strong long-term AI momentum, the rise in memory pricing has entered "uncharted territory," with profit prospects significantly exceeding general market expectations, indicating that stock prices still have substantial upside potential.

"As AI-related capital expenditures continue to expand, the share of memory in total expenditures may continue to grow—this will support the price-to-book ratio (P/B) far exceeding historical peaks. In our view, this is a story of valuation multiple expansion layered on top of cyclical profit recovery...

We believe that analysts' adjustments to data are always lagging—our earnings forecasts for Hynix and Samsung for 2026 and 2027 are 31-48% and 38-51% higher than market consensus, respectively."

Overall, the driving force behind this round of memory "supercycle" is more enduring, with price increases exceeding historical records, and profit prospects clearly higher, combined with strong cyclical momentum, creating a rare investment opportunity for memory manufacturers that hold pricing power