Valuation has reached its limit? A perspective on gold prices from five dimensions

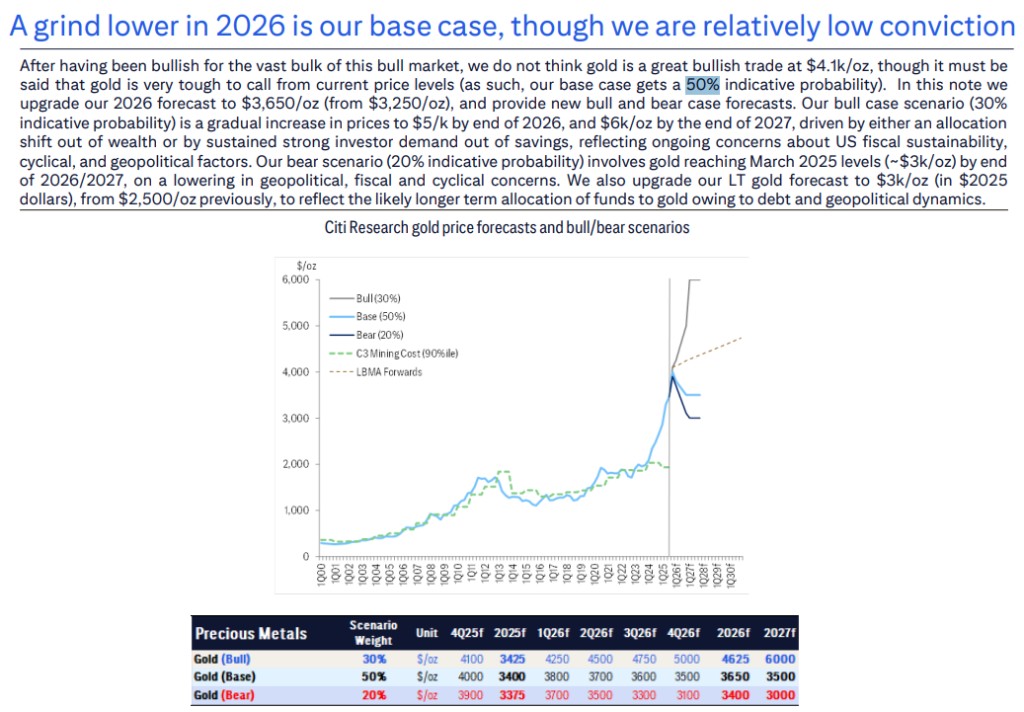

Citigroup stated that gold has reached historically "expensive" levels across five dimensions, including its share of GDP and household wealth. Nevertheless, the future trend of gold remains full of uncertainty. The bank believes that under the base case scenario (50% probability), gold prices will fall to $3,650 by 2026, but if structural risks materialize, in the bull market scenario (30% probability), gold prices could surge to $5,000

Against the backdrop of record-high gold prices this year, a recent gold outlook report from Citigroup provides a calm perspective for the frenzied market. The core conclusion of the report is that, despite the ongoing structural demand in the long term, gold's valuation has become "expensive" from multiple dimensions, and investors should prepare for future price fluctuations.

According to the news from the Wind Trading Desk, this research report released on November 10 analyzes that gold's valuation has reached or is close to historical extremes across five key dimensions, sending a clear warning signal to the market.

- Share of GDP reaches a 55-year high: The annual expenditure on gold as a percentage of global GDP has risen to about 0.55%, the highest level in the past 55 years.

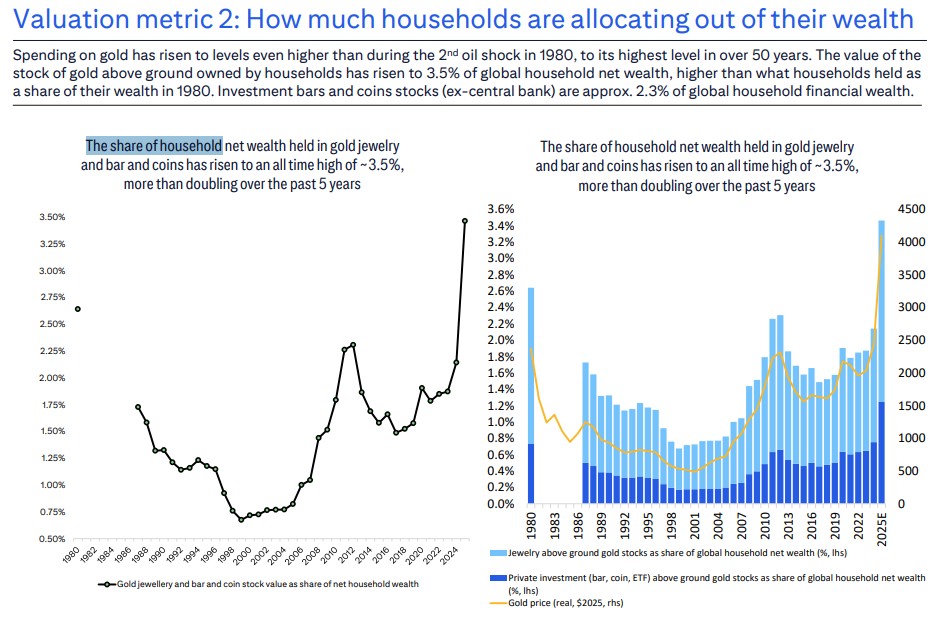

- Share of household wealth reaches an all-time high: The value of gold held by the private sector (including gold jewelry, bars, and coins) now accounts for about 3.5% of global household net wealth, setting a historical record.

- Share of foreign exchange reserves reaches a 30-year high: Gold's share in global central bank foreign exchange reserves is nearing 35%, the highest point since the mid-1990s.

- Ratio to broad money close to historical peak: The ratio of the total value of gold to global broad money (M2) is approaching the historical peak seen during the second oil crisis in 1980.

- Mining profits reach a 50-year high: Benefiting from soaring gold prices, gold miners' profit margins have reached their highest level in 50 years.

These data points collectively point to one conclusion: whether from a macroeconomic perspective, household asset allocation, central bank behavior, or industry profits, gold's relative price is at an extreme position. The report emphasizes that such a level of allocation is rare in history.

“We estimate that... the global expenditure on gold as a percentage of GDP has exceeded 0.55%... this is the highest operating rate in 55 years of data... the value of above-ground gold held by households has risen to 3.5% of global household net wealth, higher than the proportion in 1980.”

2026 Outlook: Cautious Base Scenario with Potential for Huge Volatility

Despite the high valuation, Citigroup believes that the future path of gold is far from one-directional, but rather depends on the interplay between cyclical concerns and structural risks.

The base scenario of the report (50% probability) predicts that gold prices will fall to $3,650 by 2026. The core logic is that as the U.S. economic environment improves, investor concerns about a recession will diminish, which will weaken gold's appeal as a safe-haven asset. A robustly growing economy with controlled inflation, often referred to as a "Goldilocks" economy, is typically more favorable for industrial metals and the stock market rather than gold. The report explains:

“In this ‘Goldilocks’ type of U.S. economic environment, interest rate cuts... are more likely to benefit industrial metals and the stock market rather than gold. A key trigger point for a softening gold market will be a shift (upward) in U.S. growth sentiment and a decrease in real interest rates However, Citigroup has also outlined two distinctly different possibilities for investors. In a bull market scenario with a 30% probability, ongoing structural issues, such as the U.S. fiscal sustainability crisis or escalating geopolitical tensions, will drive investors to continue flocking to gold, potentially pushing gold prices to $5,000 by the end of 2026 and further up to $6,000 by the end of 2027.

-

Bull Market Scenario (30% Probability): Hitting $5,000. If market concerns about the U.S. fiscal crisis and escalating geopolitical conflicts become a reality, the safe-haven properties of gold will be fully ignited. In this case, the report predicts that gold prices could rise to $5,000 by the end of 2026 and further reach $6,000 by the end of 2027.

-

Bear Market Scenario (20% Probability): Falling Back to $3,000. Conversely, if global risks significantly decrease and market sentiment improves broadly, the currently overvalued gold prices will face immense pressure, potentially falling back to the level of $3,000.

It is worth noting that even under a cautious baseline forecast, Citigroup has still raised its long-term gold price forecast. The report acknowledges that concerns surrounding sovereign debt and geopolitical issues may lead to persistent structural demand, thus raising the long-term price forecast for gold from the previous $2,500 to $3,000 (calculated in 2025 dollar value). This indicates that, in Citigroup's view, gold's position as a long-term store of value has been solidified, providing a higher bottom support for its price than ever before.