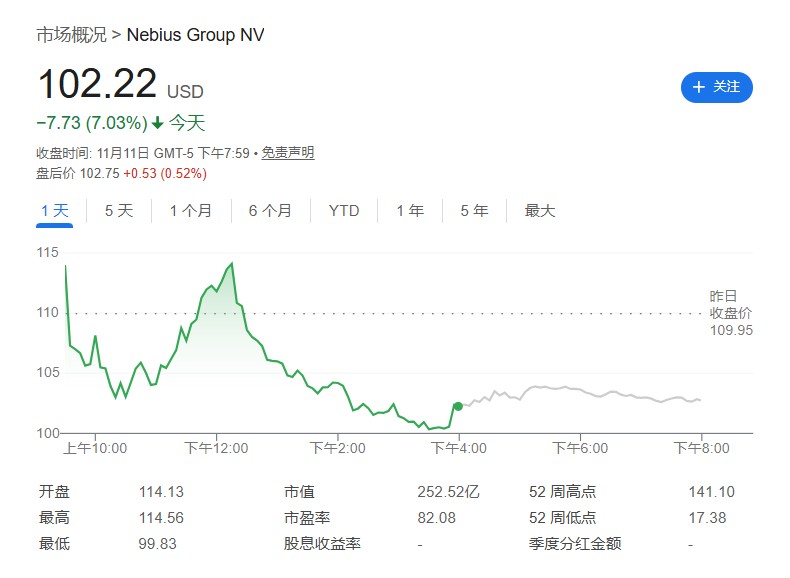

Cloud service provider Nebius reported quarterly losses that exceeded expectations. Despite announcing a partnership with Meta, the stock price still fell by more than 7%

Despite Nebius announcing a significant AI cooperation agreement with Meta worth approximately $3 billion, its net loss for the third quarter was about $120 million, exceeding market expectations of $97 million, leading to a sharp decline of 7% in its stock price. Nebius also announced the issuance of an additional 25 million Class A shares to raise funds for the expansion of its data centers

On November 11th, Nebius, a cloud computing service provider focused on artificial intelligence (AI) infrastructure, announced its third-quarter financial report before the market opened. The report showed that the company's performance fell short of Wall Street expectations, leading to significant pressure on its stock price.

Specifically, Nebius recorded a net loss of nearly $120 million in the third quarter ending in September, a significant increase from a loss of $43.6 million in the same period last year, and higher than the analyst forecast of $97 million.

In terms of revenue, after excluding the business of the divested AI data company Toloka, Nebius' quarterly revenue grew 355% year-on-year to $146.1 million. Despite the rapid growth, this figure still did not meet the analyst expectation of $155 million. The company noted that the revenue shortfall was related to an accounting change. Following the earnings announcement, Nebius' stock price fell more than 7% during the day's trading, closing at $102.18.

Alongside the earnings disclosure, Nebius also announced a series of significant business developments. The company has reached an agreement with Meta to provide approximately $3 billion worth of AI computing infrastructure over the next five years. Notably, Nebius has also reportedly signed a cooperation agreement with Microsoft worth up to $19 billion.

To support its business expansion, Nebius announced plans to issue 25 million Class A common shares, aiming to raise funds for the construction of data centers.

As a company that rents out NVIDIA AI chip servers to AI model builders and application developers, Nebius is in a rapidly growing sector. However, the market is not entirely optimistic about its prospects. Some analysts pointed out that the company's customer concentration and high debt levels pose potential risks.

Before the earnings report, Nebius' stock price had soared 264% within 2025, and the high market expectations mean that any performance flaws could trigger significant volatility. Its competitor CoreWeave recently also saw a sharp decline in stock price due to a downward revision of its full-year revenue guidance, reflecting the fierce competition and challenges in the AI infrastructure sector