Trending | RGTI Plummets 5% on Tuesday, Some Put options Increases 41%

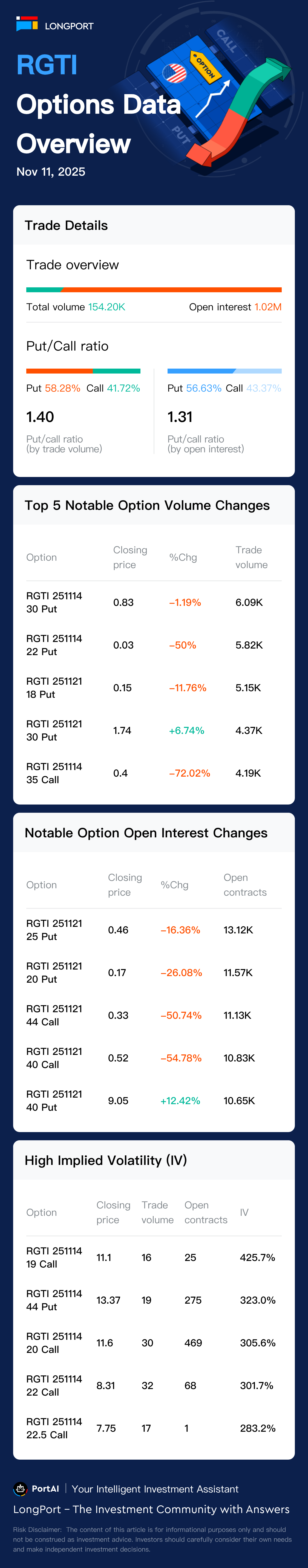

On November 11, Eastern Time, Rigetti Computing options saw a total of 154198 contracts traded, with calls accounting for 41% and puts making up 58%.

On November 11, Eastern Time, Rigetti Computing options saw a total of 154198 contracts traded, with calls accounting for 41% and puts making up 58%.

Rigetti Computing has 1021495 contracts outstanding, with calls accounting for 43% and puts making up 56%.

The top volume gainer was the 30 dollars Put option expiring on November 14, 2025, with 6092 contracts traded.

On the news front, Recent key news:

1. Nov 11, Rigetti's Q3 earnings showed a mixed performance with a smaller-than-expected loss of $0.03 per share but revenue of $1.94 million, missing estimates of $2.17 million. This led to a decline in stock value. Source: Benzinga

2. Nov 10, Analysts maintained a Moderate Buy rating for Rigetti with a price target of $32, implying a 5.2% downside. This reflects cautious optimism despite recent earnings. Source: TipRanks

3. Nov 12, Benchmark Co. analyst David Williams maintained a Buy rating with a $40 price target, indicating confidence in Rigetti's long-term potential despite short-term volatility. Source: TipRanksQuantum computing sector remains speculative.

Please note: The chart below does not include options expiring within five days.